Index funds have been one of the greatest inventions of the past fifty years creating billions of dollars of value for investors across the globe.

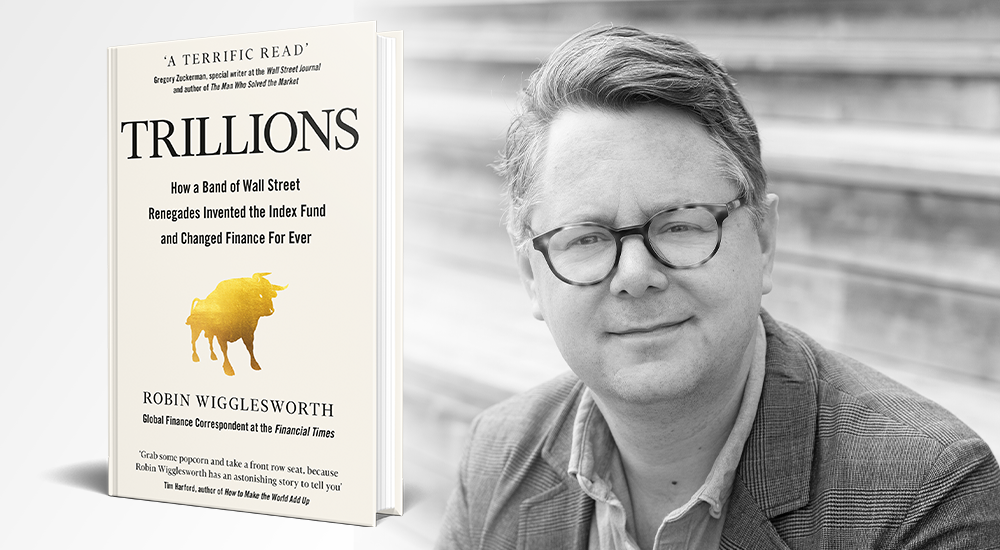

In his book, titled Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever, Robin Wigglesworth, global finance correspondent at the Financial Times, details the people behind the revolution on Wall Street.

From world-renowned academics such as Gene Fama and Burton Malkiel to the father of the index fund John McQuown and legendary Vanguard founder Jack Bogle, he assesses the role of these figures in shaping the industry into what it is today.

This includes a look at how the creation of the index fund came into being, what caused the indexing boom in the 1990s and what the future of passive investing beholds.

Following the release of the book earlier this year, Wigglesworth (pictured) spoke to ETF Stream about the background to the book, the most interesting people he spoke to along the way and the meteoric rise of index funds and ETFs.

What drove you to write the book?

The genesis for the book was during my time as the FT’s US markets editor in New York when I was reporting on passives and the ETF market. I wrote a piece for the FT in 2018 called ‘Passive Attack’ and that got the attention of an agent who suggested I turn this into a book proposal.

I wanted to write a book that would delight people in the ETF industry but was also could be consumed by a slightly more general audience. There are many books about hedge fund managers, banks and financial crises but nothing on this subject.

It is clear you spoke to a huge number of people from the industry. How difficult was it to reach everyone and out of the huge number of sources you reference, who was the most interesting person you spoke to?

It was tricky. Some people were easy to reach and were delighted to help with the book, however, several people had passed away when I was writing the book such as the late Jack Bogle who I had spoken to several times for the magazine piece but he died before I started writing the book. Much came down to asking people who were crucial in the growth of index funds or even peripheral people who had important roles that were perhaps not recognised publicly.

For every person quoted in the book, I spoke to around five or six people and several people such as John “Mac” McQuown – who I consider the father of the index fund – I spoke to many times over the course of two years. I feel I got to a place where the book is as close to the truth as is humanly possible as people have fading recollections of events.

The most interesting person I spoke to was Jack Bogle who oozed integrity and authority. I could listen to his stories for hours. As a journalist, he is the person you dream of interviewing. My favourite character is Louis Bachelier, the intellectual godfather of the index fund. I had a soft spot for him as he died in obscurity in France but his PhD thesis led to what became known as the random walk of stocks and efficient market of hypothesis. He is considered the father of financial economics and his story is compelling.

Jack Bogle is a titanic figure in the passive investing industry. What was his role and how did he come to prominence?

I would have loved to have spoken to Bogle about this. There is definitely a gap between the reality of Jack Bogle and the legend of ‘St. Jack’. In later years, he would reinvent himself as this indexing zealot but this was not the case at the start of his career when he was a fan of active management. At Princeton, he wrote his thesis on mutual funds and when someone suggested an index fund, he wrote a paper rubbishing the idea.

Bogle was an executive at Wellington and was best friends with John Naff so always had a soft spot for some active managers. He launched an index fund at Vanguard because of necessity. He was sacked at Wellington and precluded from active management but argued to the board the index fund was an unmanaged product and they agreed. At first, it was a failure and dubbed ‘Bogle’s folly'. It was only in the 1990s, he became the person we know him for now which was trumpeting the value of index investing, but he was certainly a convert to passives.

Another fascinating part of the book is the impact of BlackRock’s BGI acquisition which has been described as the ‘deal of the decade’ in some corners of the industry. What impact has BlackRock and CEO Larry Fink had on the ETF market?

Larry Fink is a very different character to Bogle, however, they share a similar hallmark which is they suffered an early professional blow that did not break them but made them. Fink founded BlackRock after losing money at First Boston where he was a mortgage bond trader.

For a long time, BlackRock was primarily a bond investment house. Fink has his detractors but, in my opinion, he is the most strategically brilliant person in the investment management industry. He has been able to spot trends and jump on them quicker than other people.

BlackRock had been sniffing around ETFs for a while in the early 2000s but during the Global Financial Crisis, Fink realised the potential of ETFs and saw the advantages of buying Barclays Global Investors (BGI) – the premier financial engineering factory in the world – rather than building an ETF arm from scratch. It is certainly by far the most successful deal in the history of investment management and arguably the most successful M&A deal in the history of business because it has transformed BlackRock.

What is the future of passive investing?

I am a huge fan of index funds. It is one of the most phenomenal inventions the finance industry has ever produced but we should not be blind to the fact that positive new technologies can have negative externalities.

ETF ownership is one of my biggest concerns. We all need to be concerned about the inevitable endpoint of the economics of indexing. The scale nature of the index industry means the big will naturally get bigger and barring any unforeseen regulatory intervention, BlackRock and Vanguard are going to become even more titanic than they are today. At some point, they will control the majority of the votes of every major company in the US and globally. This will be one of the defining battlegrounds for index funds and ETFs in the coming decade given the trend shaping the market today.

Related articles