Investors are calling for more transparency around the investment process of active ETFs as they look to up their usage of the ETF class, according to an ETF Stream survey of its ETF Buyers Club.

The survey, titled Quarterly Buyer Barometer, found that over 50% of fund selectors use active ETFs in their portfolios, while a further 8% plan to in the future.

Despite this, investors noted several challenges to up their exposure to the wrapper, including a limited range of products (25%) and tracking error (21%).

One ETF Stream Buyers Club member noted: “Active ETFs need to provide more transparency about their investment process.

“Not necessarily daily holdings, but as with many active ETFs in the US, there is not enough information on the investment process.”

Each quarter, ETF Stream surveys its ETF Buyers Club – a group of European professional investors with approximately $100bn ETF assets under management – to analyse their latest views on asset allocation.

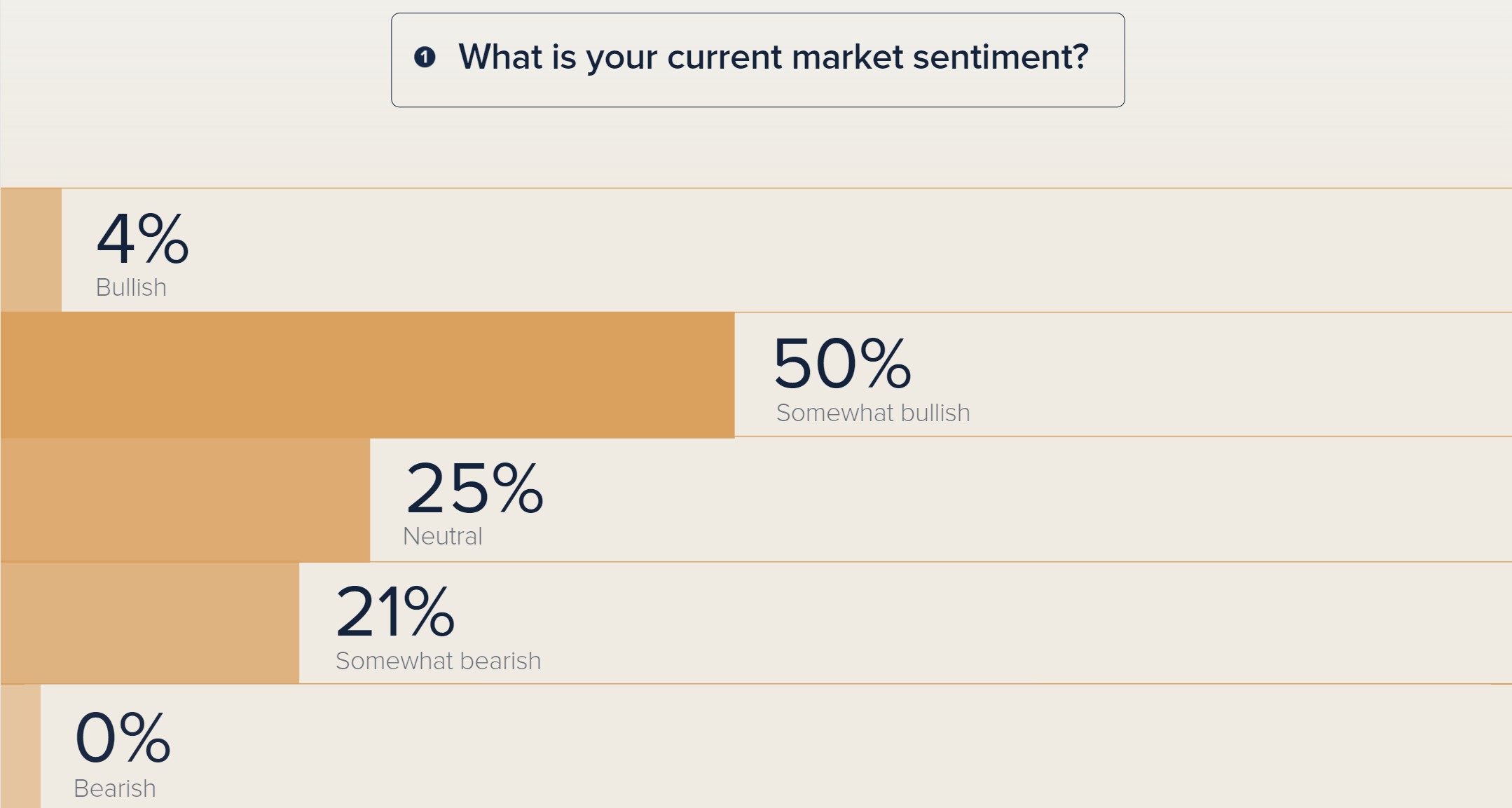

Overall, 75% said they were either ‘somewhat bullish’ or ‘neutral’ towards markets, slightly down on the 86% from the previous quarter.

Just over 4% said they were ‘bullish’, while 21% said they were ‘somewhat bearish’, compared to 5% and 9% for the previous quarter, respectively.

Chart 1: What is your current market sentiment?

Source: ETF Stream

Government bonds were once again the most popular play among investors, with 50% increasing their allocation to the asset class, followed by investment grade corporate bonds (35%) and core equities (30%).

Putting China in the spotlight, just 12% of respondents said they were bullish on the market as investors continue to question the economy.

High yield (28%) and emerging market equities (23%) were once again the areas where respondents have reduced their exposure over the past six months, as investors look to reduce their risk.

To view the full Quarterly Buyer Barometer Q2 2024 report, click here