Amundi has overtaken UBS to become Europe's fourth largest ETF provider in March amid record-breaking monthly outflows for the European ETF market due to concerns about the long-term impact of coronavirus.

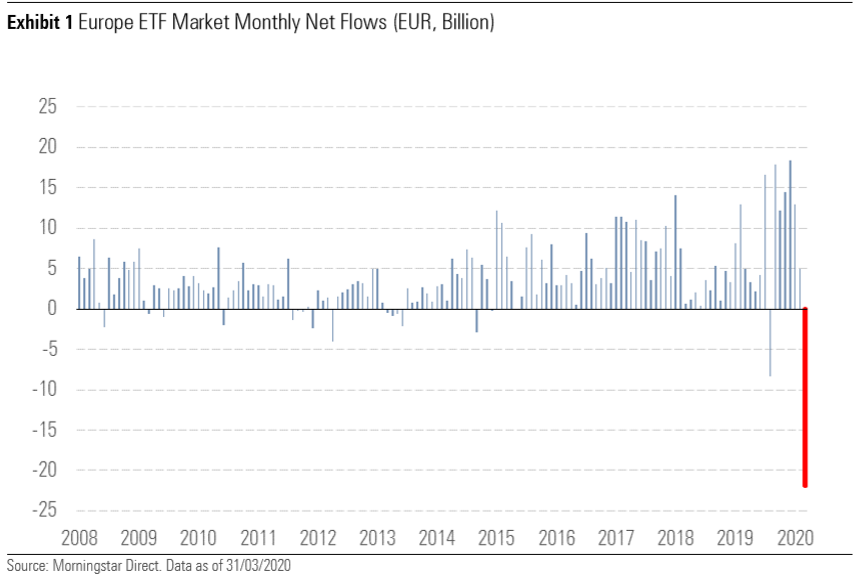

According to data from Morningstar, the European ETF market lost a record-high €21.9bn last month as total assets under management (AUM) dropped by 13% to levels last seen in June 2019.

UBS lost €7.3bn in net flows, bringing its AUM to €45.8bn by the end of last month while Amundi saw €2.7bn outflows taking its AUM to €46.5bn, leapfrogging the Swiss asset manager.

Amundi had previously overtaken UBS's AUM in July 2019 before UBS regathered its position by the year's end. Coming into 2020, UBS had nearly €60bn AUM, some €3.2bn more than Amundi.

Some of Europe’s other top ETF issuers were also hit particularly hard as the ETF businesses of BlackRock and DWS suffered heavy losses with outflows worth €6.6bn and €4.8bn, respectively.

Despite the turmoil, Lyxor saw positive net flows for the month with €100m. This will be welcome news for the French asset manager which suffered €5bn outflows in 2019.

BlackRock maintains its European dominance with €346.9bn AUM and a 44.4% market share.

How coronavirus impacted markets in Q1

Commenting on the record outflows, Jose Garcia-Zarate, associate director of passive strategies research at Morningstar, said: “This is a negative record high for an industry that has become used to seeing an almost uninterrupted string of monthly net inflows since establishment nearly two decades ago.”

Garcia-Zarate is not surprised by the decrease in AUM from nearly €900bn in February to €781bn in March given the sharp falls in equity and bond markets as whole economies come to a sudden standstill.

Weekly flows analysis suggests investors were gaining confidence once again in the latter stages of March and the first week of April. Morningstar believes this was a reaction to the barrage of supportive policy measures announced in the US and Europe by the Federal Reserve and European Central Bank, respectively.

While lockdowns are still in place for many countries around the world, it is still too early to tell the magnitude coronavirus has impacted economies.

So far in April, equity and bond markets have held up relatively well in comparison with previous weeks as there is likely a mixture of investors who are playing it safe and not rushing any investment decisions whereas others are too tempted by the flattering valuations.

Sign up to ETF Stream’s weekly email here