The recent market turmoil has shone a spotlight on fixed income ETFs and the way they trade during periods of evaporating liquidity.

Coronavirus concerns sent markets tumbling last month with the CBOE/CBOT 10-year US Treasury Note Volatility index hitting its highest point since the collapse of Lehman Brothers.

It seems every ETF across the bond market spectrum has been impacted with over 80% of investment grade corporate bond ETF discounts widening to all-time highs, according to research from Citi.

As a result, ETF Stream took a deep dive into the five largest bond ETFs available on the European market to see how they behaved during the market turbulence.

The fixed income ETF market in Europe is still very concentrated. The five largest products, all owned by BlackRock, account for $39.5bn of the $236bn market, a 16.7% share, according to data from Morningstar.

As coronavirus fears spread, corporate bonds were impacted by the sell-off in risk assets with the iBoxx Euro Corporates index climbing to a six-year high at almost 2.20% in mid-March.

With liquidity drying up in the underlying holdings, the discount on Europe’s largest ETF, the $11.5bn iShares Core EUR Corp Bond UCITS ETF (IEAC), widened to highs of 6.5% on 18 March.

According to data from Bloomberg, IEAC traded at an average 1.6% discount in March versus a yearly average premium of 0.03%, up until the Federal Reserve announced its 'unlimited' quantitative easing programme on 23 March.

It was a similar story for the discount on the $7bn iShares USD Corp Bond UCITS ETF (LQDE) which widened to 7.5% on Black Thursday (12 March), one of the worst days for US stocks since the 1987 crash.

The Fed’s decision to enter the market and announce purchases of corporate bond ETFs led to a rally in credit while discounts jumped to premiums as market makers were caught short credit. For example, LQDE moved to a 2.1% premium on 24 March as investors piled into the ETF in a move to front-run the central bank's purchases.

Max discount (%)Average one-year premium/discount to 1 April (%)iShares Core EUR Corp Bond UCITS ETF (IEAC)6.50.03iShares USD Treasury Bond 1-3yr UCITS ETF (IDTB)0.60.02iShares USD Corp Bond UCITS ETF (LQDE)7.50.05iShares J.P. Morgan USD EM Bond UCITS ETF (IEMB)5.90.08iShares JP Morgan EM Local Government Bond UCITS ETF (IEML)3.80.08

Source: Bloomberg

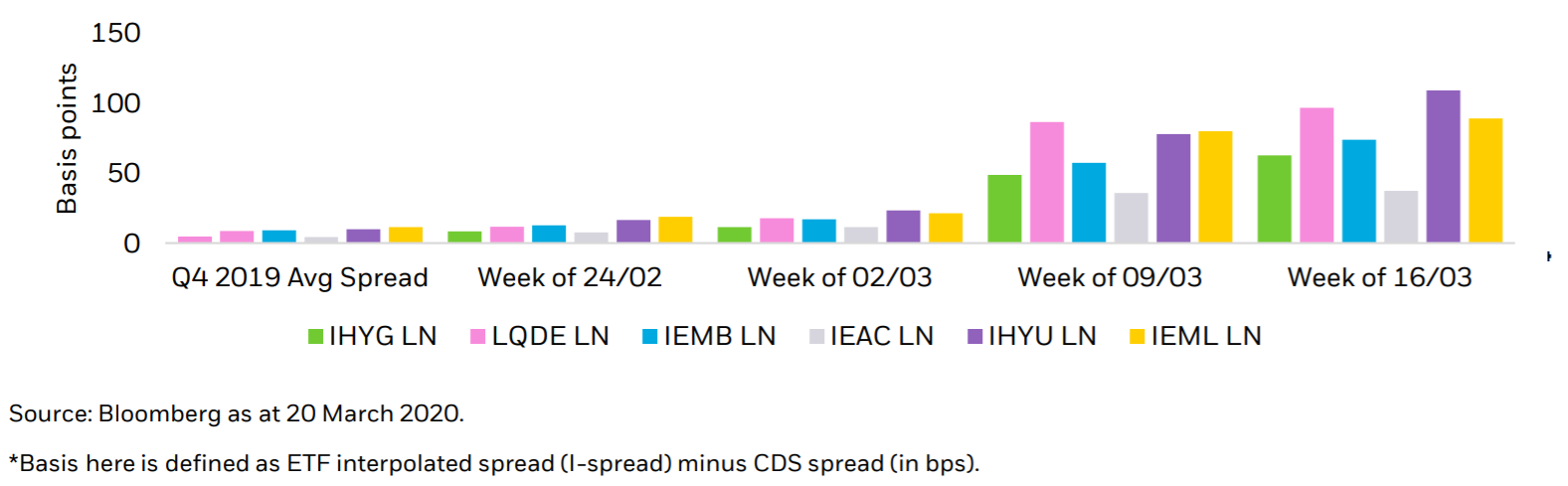

BlackRock in a research note, entitled Sending A Clear Signal, said this was driven by elevated trading costs for market makers looking to hedge coupled with the lack of liquidity in the underlying cash bond markets. As well as the discounts, market makers started to widen bid-ask spreads on fixed income ETFs as volatility began to increase.

Widening bid-ask spreads combined with the discounts did little to stop investors trading, however. According to BlackRock, turnover in IEAC hit a record $1.2bn on 6 March, 6.6x the 12-month average daily volume (ADV), while the $6.3bn iShares JP Morgan EM Local Government Bond UCITS ETF (IEML) saw record turnover of $851m in IEML on 19 March, 5.5x ADV.

The increasing trading volumes shows investors are turning to ETFs during periods of uncertainty in order to rebalance holdings, hedge portfolio sand manage risk.

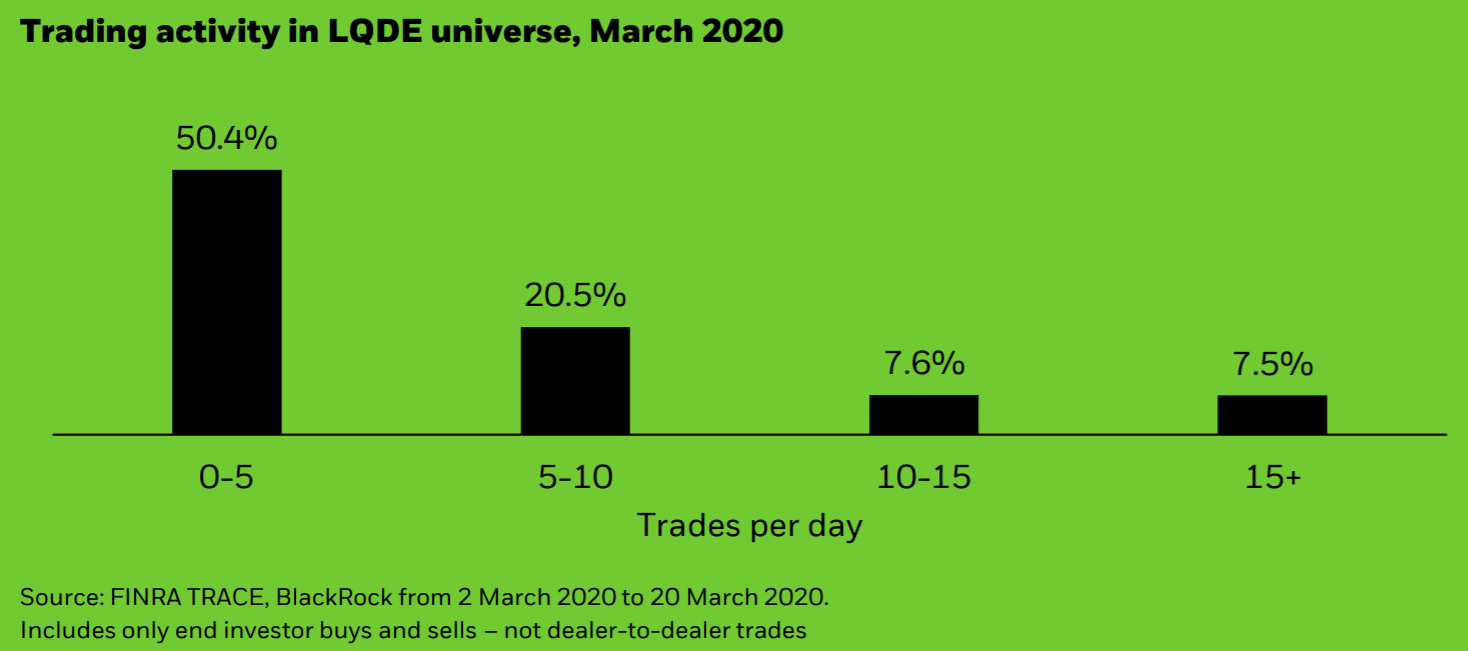

For example, LQDE traded more than 1,000 times on exchange and over-the-counter (OTC) on 12 March while its top five holdings traded an average of just 37 times each, according to BlackRock.

Real-time trading means ETFs can be priced at fair value compared to the NAV which is calculated at the end of the day through a pricing policy.

The note explained: “Fixed income ETFs trade frequently, allowing ETF prices to incorporate more real-time information than even the most heavily traded portfolio bonds.

“This is especially true during volatile markets as ETF trading activity increases.”

Furthermore, BlackRock said the lack of consolidated tape in Europe leaves fixed income ETFs in a unique position.

Without a consolidated tape, Europe still lags behind the US in terms of trading data meaning bond ETFs offer a post-trade view that would not be possible otherwise by capturing real-time shifts in investor sentiment.

"This dynamic of ETF prices being a more indicative source of real-time pricing for the underlying cash bonds is similar to the way other index-based derivatives and futures shed light on true market prices," BlackRock's research note concluded.