ARK, one of the most successful small ETF businesses, is listing an actively managed fintech ETF, which aims to invest in companies driving technological change in finance ("fintech" companies).

The ARK Fintech Innovation ETF (ARKF) defines fintech companies very broadly. It includes the more familiar, such as those in payments, point of sale providers, peer-to-peer lending, blockchain and intermediary exchanges. But also the very broad, including those in fraud detection and data analytics.

The prospectus says ARK can invest in fintech companies that generate no revenue from innovation, leaving it open to invest in almost any company that might benefit from fintech.

Stocks will be "conviction weighted", as is typical of actively managed funds. The fund's holdings will be made transparent on a daily basis.

The fund will invest in 40 - 55 companies and charge 0.75%.

Analysis - ARK: beating the index with innovation

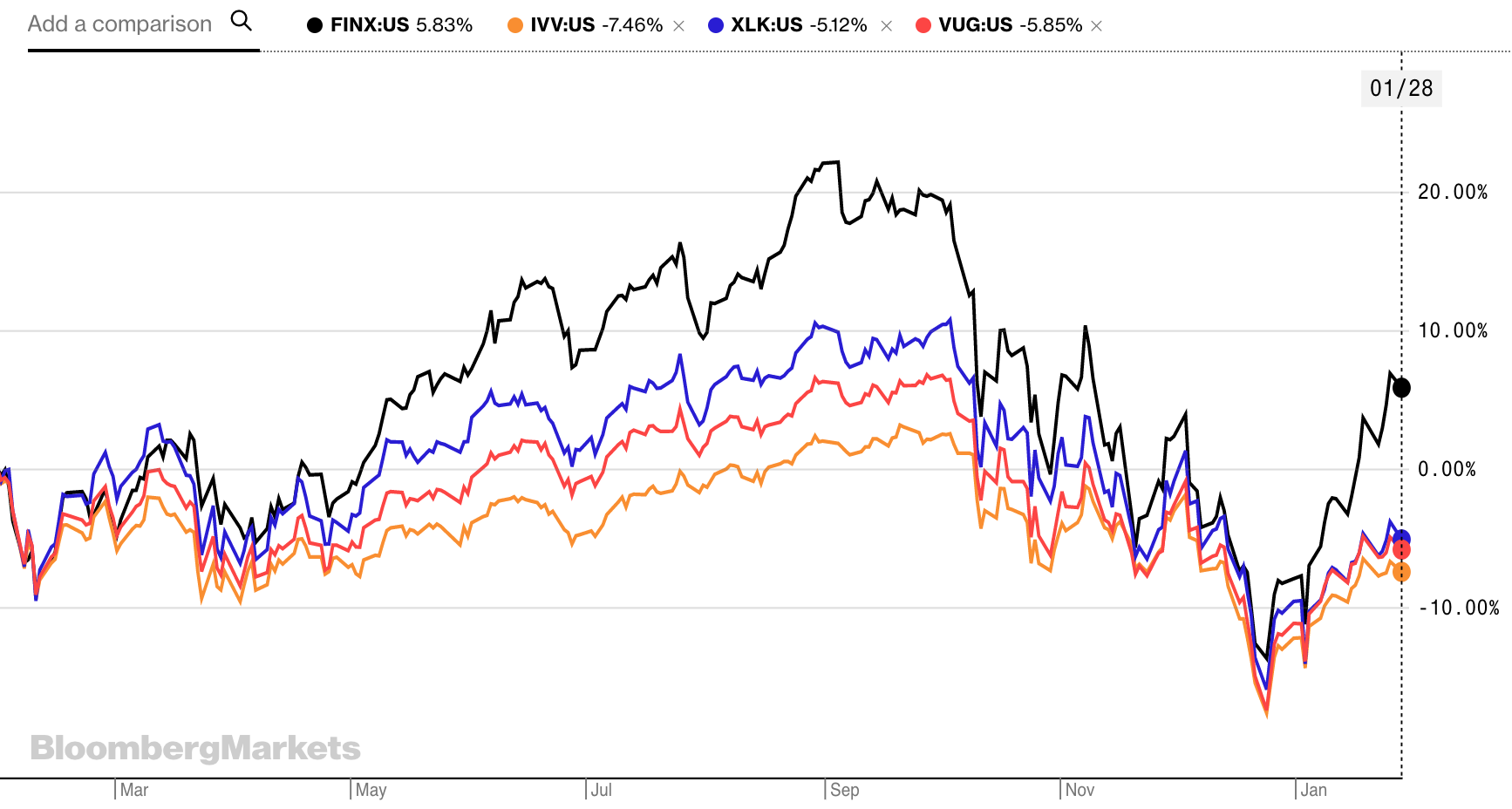

ARK has been one of the only ETF startups that has made major headways in the past few years. Assets have grown on the back of the ARK Innovation ETF (ARKK) and ARK Web x.O ETF (ARKW) which have smashed the index, the tech sector and the major growth ETFs all at once. The four-year-old ARKK now has $1.3B under management and has helped blaze the trail for thematic ETFs everywhere.

However, a fintech ETF raises new questions:

Is fintech a theme or just a buzzword?

If a theme, will ARKF's investment strategy successfully track it?

Will the fund perform?

How will this fund be different from other fintech ETFs (i.e. Global X's)?

The first two questions are thrown into starkest relief when one considers the US banking giants: JP Morgan, Goldman Sachs and Citi.

On the one hand, the fintech theme is largely built on their prospects of taking business from giant banks. Indeed, a major argument for alternative lending fintechs (i.e. P2P lenders like RateSetter) is that banks' capital requirements post-GFC prevent them from making certain types of loans. This then creates opportunities for non-bank lenders.

Yet on the other - contradictory - hand, some see value in fintech deriving from their capacity to get acquired by banks. In which case the future for banks is not so bad after all. Regardless, for the fintech theme, there doesn't seem to be a way around the banks.

On the second two questions, we'll have to wait and see. But for those wondering, Global X's $277M FINX performance has been impressive.