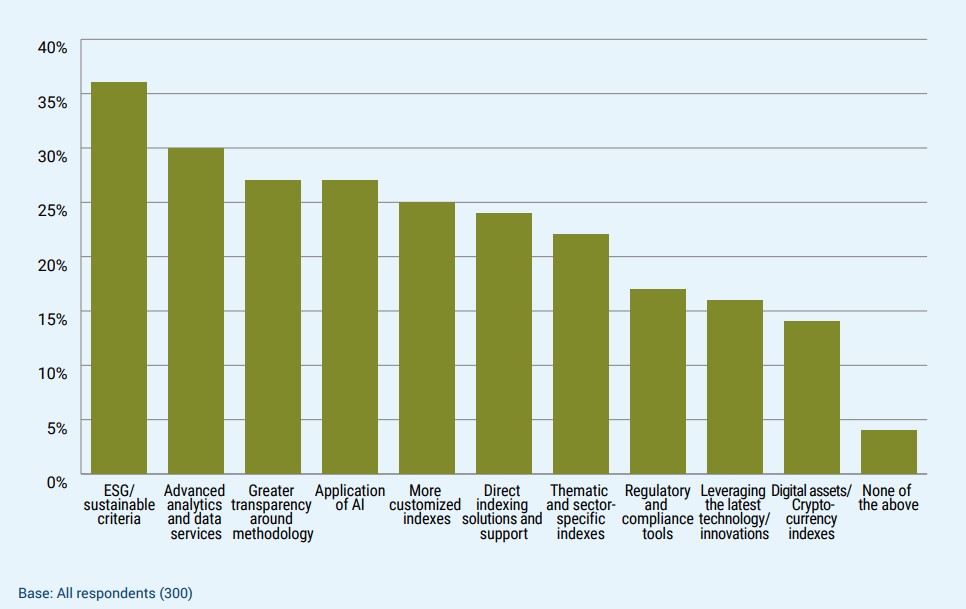

Asset managers would like to see more innovation in ESG, artificial intelligence and customisation from index providers over the next 12 months, according to a report by the Index Industry Association (IIA).

In its latest survey of US and European asset managers, over 35% said they wanted index providers to focus on ESG over the next year, with 30% noting they would like more advanced analytics and data services.

Meanwhile, roughly a quarter said they would like to see more applications of AI in indices and more customised indices.

It comes as more asset managers look to “create innovative products that offer a competitive edge while adhering to client values”.

Chart 1: What would you like to see index providers focus on over the next 12 months

Source: IIA

“Short-term economic uncertainty persists—and remains an ever-present danger—yet asset managers are resolutely focusing on the longer-term drivers of change affecting their industry,” the report said.

“The impact of disruptive innovations in the form of machine learning and AI, the adjustment of ESG expectations and priorities, and the emergence of new markets and assets.”

Over half (56%) of asset managers see customised investment products as an opportunity than a challenge.

According to the report, roughly nine out of 10 asset managers use index providers, with nearly 40% using five or more, while more than half (52%) say index providers will become more important to their firm’s success over the next year.