Asset managers are now almost twice as likely as they were last year to implement ESG considerations within fixed income, according to a survey conducted by the Index Industry Association (IIA).

The firm’s annual ESG survey of 300 asset managers found 76% of respondents now integrate ESG when running both passive and active fixed income mandates, up from 42% in 2021.

This increase was particularly notable in passive asset managers, with 87% of respondents integrating ESG into their bond allocations.

Increases have also played out but to lesser extents in equities which jumped from 53% to 74% while commodities rose from 37% to 47%.

Unsurprisingly, more than eight in 10 fund management companies expect ESG assets in all three asset classes to increase in the next year.

Respondents also anticipated ESG assets to make up 40% of their funds in a year, 57.4% in five years and up to 64.2% of asset manager portfolios by the early 2030s.

Source: IIA

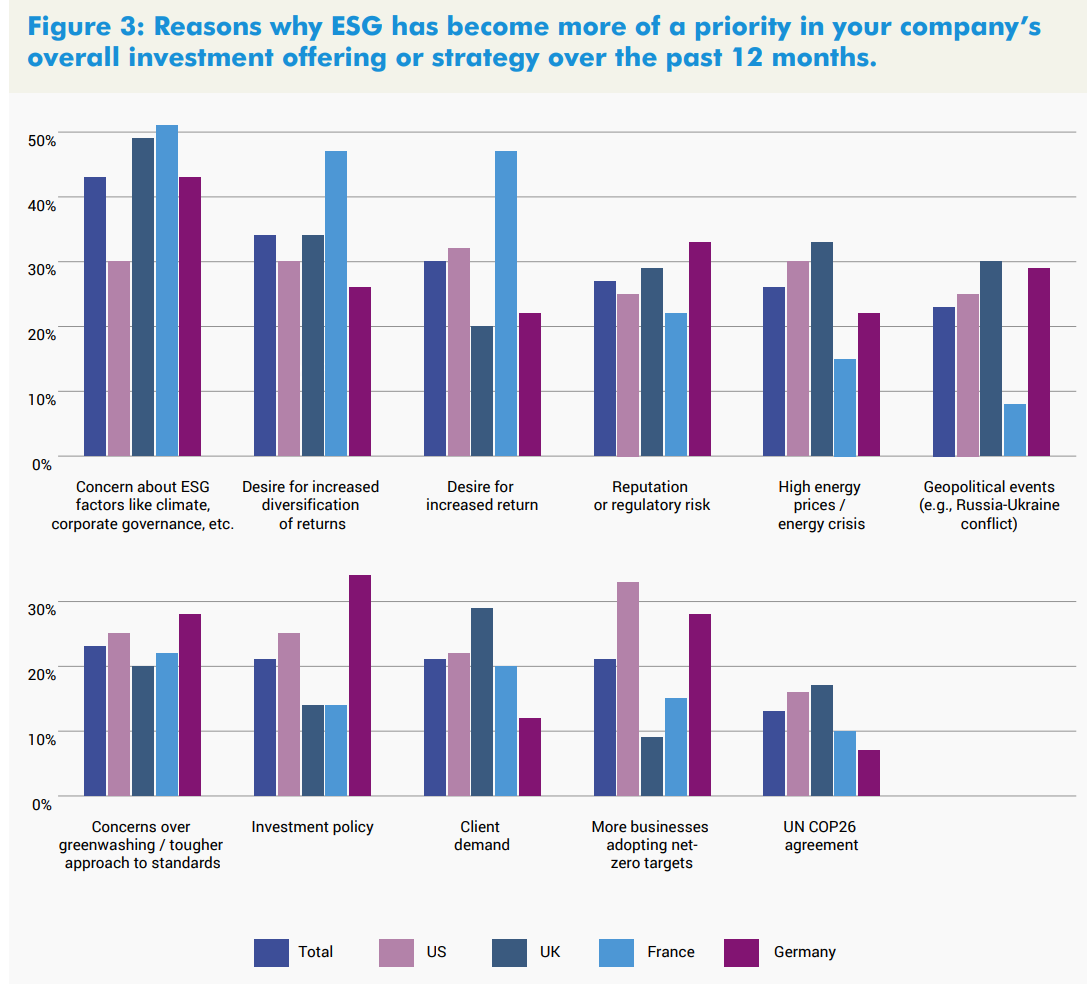

What might come as more of a surprise is despite ongoing volatility led by the invasion of Ukraine and fears surrounding inflation and recession, 85% of asset managers stated – at least publicly – that ESG has become more of a priority within their company’s investment offering over the past 12 months.

Of this number, 43% said the driving force has been a concern around ESG factors such as the climate and corporate governance while 34% declared a need for more diversified returns, 27% cited regulatory and reputation risk, 26% high energy prices and 23% geopolitical events.

Interestingly, 30% said a desire for increased return has driven their allocation to ESG, which will baffle some given there is little track record of ESG outperformance in the long-term and their tendency towards growth characteristics did not serve ESG strategies well in H1 this year.

Also, only 13% said the United Nations COP26 Agreement as a driver of ESG allocations, though the IIA said this was consistent with asset management’s focus on ESG as a driver of value.

Source: IIA

Another factor driving investment fund manager interest in ESG is their clients’ knowledge on the topic, with 53% saying they are very confident in their clients’ ESG knowledge versus 43% last year. Overall, 98% said they were either very or fairly confident in their clients’ understanding.

Breaking down the E, S and G

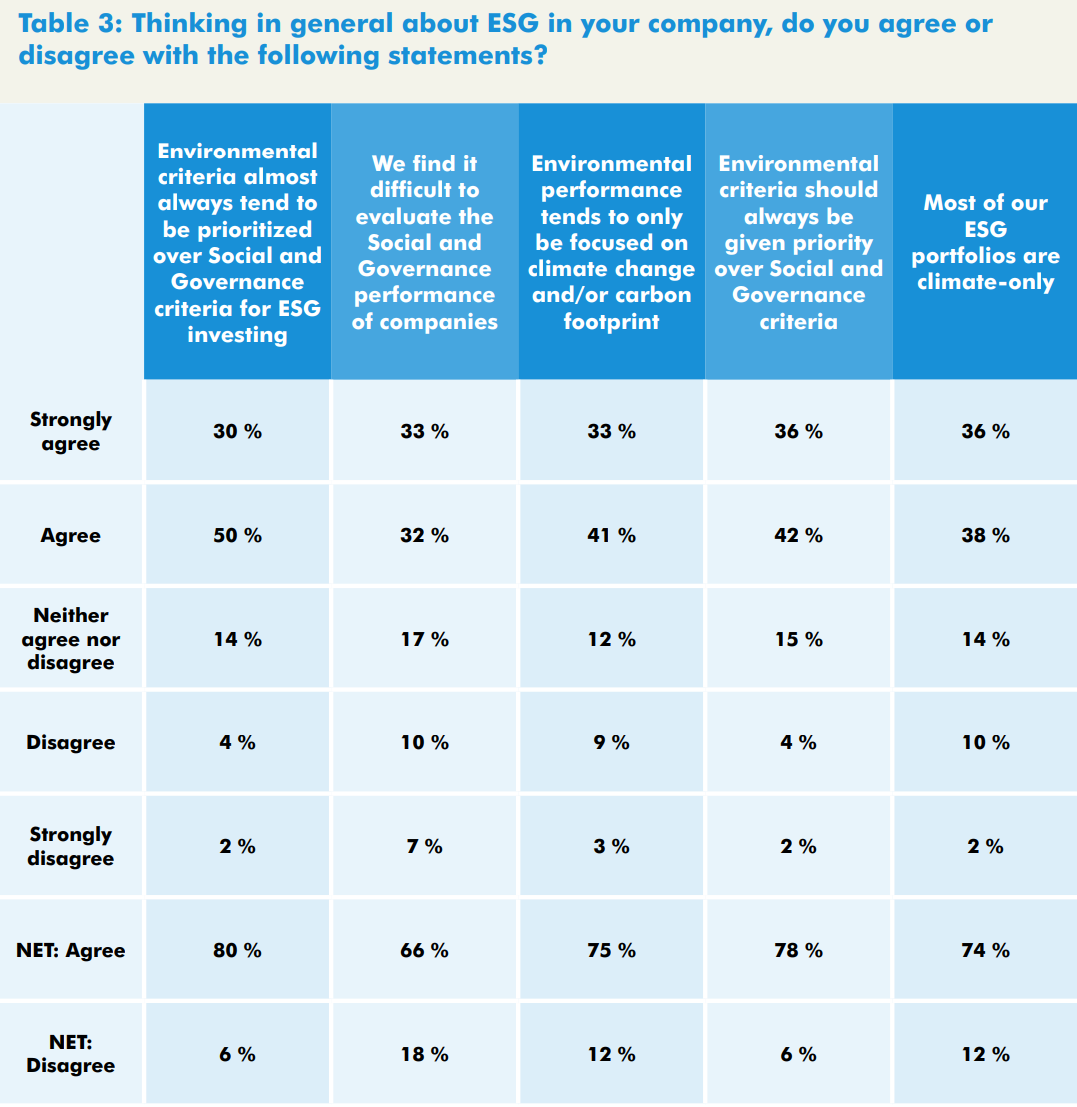

Returning to the exhausted conversation about which part of E, S and G acronym to prioritise, the IIA’s findings show environmental factors remain in focus.

Some 39% of respondents allocating to ESG said environmental criteria are a core part of their portfolio versus 31% for social and 36% for governance.

Interestingly, social elements are a core part of at least some of the portfolios of 75% of US, 73% of French, 64% of UK and 63% of German respondents.

However, climate remained king, with four out of five respondents stating “environmental criteria almost always tend to be prioritized over social and governance criteria” while 78% added “environmental criteria should always be given priority over social and governance criteria”.

Commenting on this, the IIA said: “To some extent this seeming backstage role could reflect the more diffuse, intangible and wide-ranging nature of social and governance issues, which makes performance on these factors harder to determine and measure accurately.”

Supporting this, 74% said that “most of our ESG portfolios are climate only” while two thirds of asset managers said they “find it difficult to evaluate the social and governance performance of companies”.

Source: IIA

Perhaps this will change as methodologies for assessing and reporting on ‘S’ and ‘G’ criteria mature and ESG providers find avenues to quantify qualitative inputs in a less contentious manner.

Room for improvement

Encouragingly, 34% said environmental impact tracking tools, metrics and services were highly effective while 59% deemed them fairly effective – a considerable increase from a collective 66% for high or fair effectiveness in 2021.

Meanwhile, 92% and 93% said social and governance tracking tools were fairly or highly effective, up from 66% and 69% the year before.

Despite this progress, the “data vacuum” highlighted in the IIA’s 2021 report remain a significant obstacle, the organisation said.

“Asked about the biggest challenges to ESG investing, fund managers highlighted the need for greater public corporate disclosure of companies’ ESG activities, as well as pointing to a lack of data standardisation across organisations and sectors,” the IIA noted.

When questioned on who should be responsible for developing ESG criteria and strategy, 43% of respondents said this should fall to asset managers themselves, 41% said third party data providers, 35% said policymakers and governments – but only 25% said corporate entities and 23% pointed to rating agencies.

In terms of how well ESG measures are responding to current affairs, 30% said ESG is responding very well to world events and 59% said the movement had responded fairly well.

Unsurprisingly, areas for improvement included better integration of geopolitical risk factors, with 51% asking for more high frequency data on macroeconomics and geopolitics while 45% want more detailed disclosure of geopolitical and area risk exposure relating to assets, location, investments or revenues.

Source: IIA

Looking ahead, 41% of asset managers want more specialised indices focused on specific aspects or components of ESG, 40% asked for better ESG metrics for individual users and markets and 39% underlined the need for more information about the underlying ESG data used in indices – as well as greater transparency in how indices are compiled.

Overall, though index providers were given a stellar review by respondents, with 45% stating they trust indexers “a lot” while 44% trust them “somewhat” to push ESG innovation and standards in financial services. In fact, they scored lower than regulators and the asset management industry itself – which both scored 91% on “a lot” or “somewhat” trustworthiness.

The IIA concluded: “The survey confirms that ESG investing has withstood the turbulence and uncertainty of the past 12 months, remains central to investment decision making, and if anything seems set to surge even further in the years ahead.

“It highlights the continued need to resolve some perennial issues—such as a lack of data standardisation across markets and sectors— as well as respond to emergent issues such as the role of world events and geopolitical risk in ESG measures.

“It also highlights the need for better understanding and measurement tools in relation to the ‘S’ and ‘G’ aspects of ESG.”

Related articles