The Australian government has banned listed investment companies (LICs) from paying sales commissions to advisers and brokers, in what promises to give a second wind to the ETF industry.

Following a review, Treasurer Josh Frydenberg judged that commissions gave brokers an incentive to sell clients poorly performing LICs in order to cream off fees for themselves.

“[Banning] conflicted remuneration in LICs will address…the potential mis-selling of these products,” the Treasurer said.

LIC commissions were originally banned by the Labor government as part of its 2012 financial advice reforms known as FOFA.

However, the reforms were watered down in 2013 following a change of government. The new government, led by then-Prime Minister Tony Abbott, created an exemption to FOFA that allowed LICs – and LICs alone – to pay commissions.

The exemption caused an onslaught of LIC creation, as many unlisted funds recreated themselves as LICs, Adam Lawrance, a Canberra-based financial adviser, said.

“Every month there was a new LIC created. A lot of it was churn and burn: repackaging old unlisted funds as LICs,” he added.

“It did not really create a more efficient allocation of capital, as some argued at the time. Rather it just meant people moved over to the listed sphere where commissions were still available.”

The reintroduction of the ban has been cheered by the Australian ETF industry. The ETF industry only really got going in 2013, when FOFA came into effect. Pre-FOFA, Aussie ETF uptake was slow and lagged other English-speaking countries. Many in the industry believed the slow uptake owed to the fact ETFs did not pay commissions.

For this reason, many ETF providers thought that the Abbott government’s justifications for watering down FOFA were spurious and a step backward.

According to Arian Neiron, managing director of VanEck Australia, the ban was a long-time coming and enables ETFs to compete for advisers’ attention on a level playing field.

“We believe this is will further promote ETFs… as most ETFs offer the same exposures with better performance than the LICs and LITs currently listed on ASX,” he said.

How are advisers and brokers affected?

While ETF providers have rolled out the red carpet for bans on commissions, many have wondered how financial advisers and brokers are likely to fare.

Sales commissions provide a crucial source of revenue for brokers in particular. For some brokers, commissions can make over one-third of their revenue. On this basis, it is unlikely that brokers will be delighted with the ban.

For advisers however, the effects are less clear.

Most financial advisers had been moving away from commission-based business models over the past decade and moving towards a fee for service model instead. For many advisers, sales commissions on LICs were on borrowed time anyway.

Some advisers spoken to by ETF Stream were less welcoming of bans on commissions. They believed that banning commissions made financial advice a bit like private banking: elitist, and a service available almost only to the rich. This was because the fee for service model meant it was only really profitable to take on clients with over $600,000.

These advisers also suggested that sales commissions do not intrinsically create conflicts. Advisers have research processes vetting which LICs get purchased, and those who put their clients in duds risk reputation damage and loss of business, they stressed.

But according to Mr Lawrance, in the long run, the advice industry will be better off for the ban.

“Over the long-term I think this is a good thing. Advisers need to get better at showing the value they provide. There were also some ethical issues around the lack of disclosure on these sales commissions,” he said.

Can LICs survive against ETFs?

The final question raised by the ban is whether LICs can survive on a level playing field against ETFs.

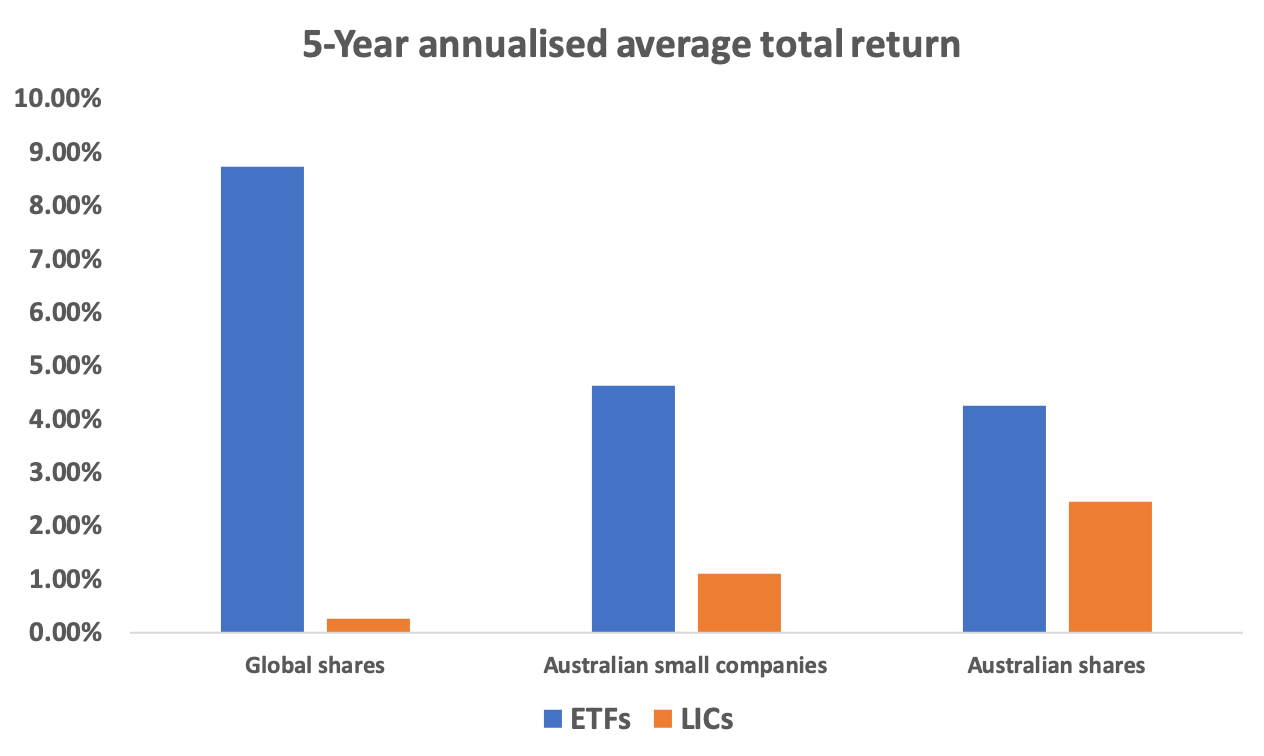

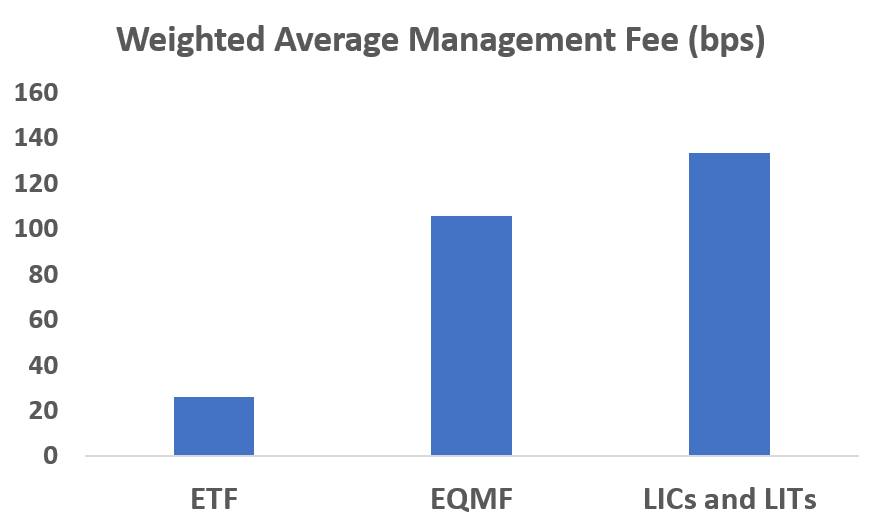

Research has repeatedly shown that LICs underperform index funds and ETFs. According to ASX data, LICs have strongly underperformed ETFs on a like-for-like basis over the past five years. The fees LICs charge are also significantly higher than ETFs, in some cases by an order of magnitude.

According to Harry Chemay, chairman of Clover, a Melbourne-based robo-adviser, LIC bosses must find another way to pay advisers and brokers if they hope to stay in the game.

“Now that LIC sales commissions are being stamped out, the question for financial product manufacturers is: How do I 'incentivise' advisers to recommend my product? Their heads will be down and they'll be looking for the next loophole already, no doubt.”

Sign up to ETF Stream’s weekly email here