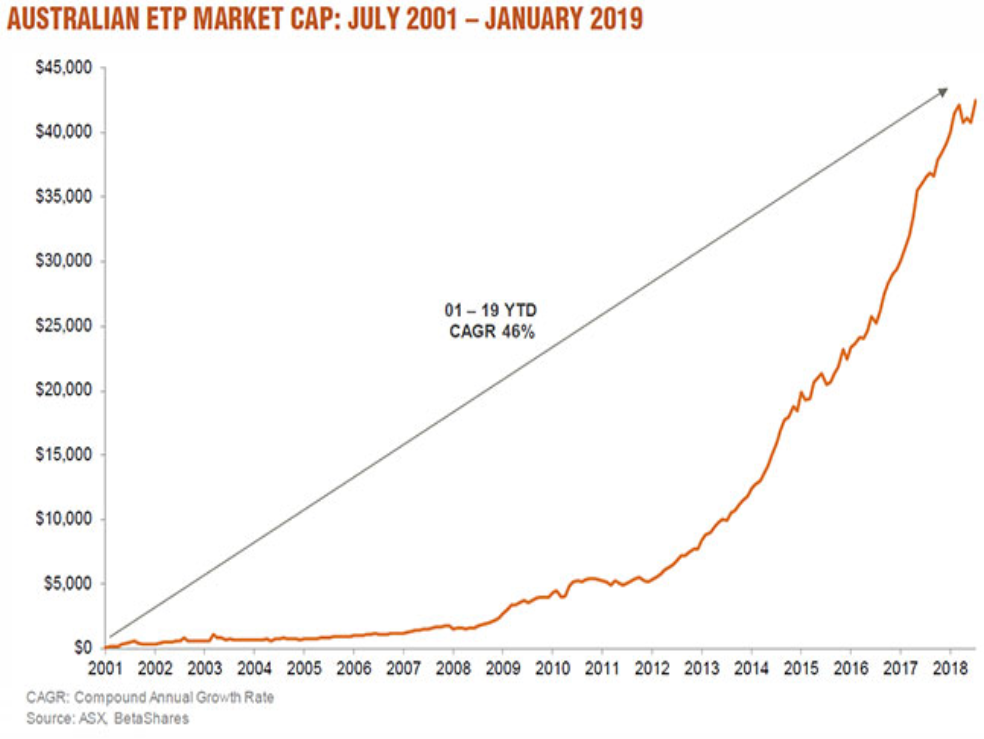

The Australian ETF market reached new highs in February following the largest increase of its market cap on record, according to the latest

from Sydney-based BetaShares. Increasing AU$2.3bn for the month, the Australian Stock Exchange (ASX) ETF market cap grew 5.4% to $44.8bn.

Despite no new listings for four weeks, the ASX still trades 242 ETPs. BetaShares says as asset prices rose in February, so did market sentiment, contributing to a 24% increase in trading value by ETF investors.

As the equity market bounced back in February, Australian investors flocked to international equities which saw inflows in excess of $210m, primarily in developed markets ($135m). Second to overseas equity ETFs was fixed income with $150m. Despite Palladium ETCs being the second-best performing product in February, investors sold off commodity ETFs as the category saw total outflows of $3.3m. Gold ETPs alone saw outflows of $3.6m which is to be expected as equity performances improve.

BetaShares predicts this momentum in ETFs to continue in Australia and forecasts funds under management to be in the range of $50-55bn by the end of 2019.