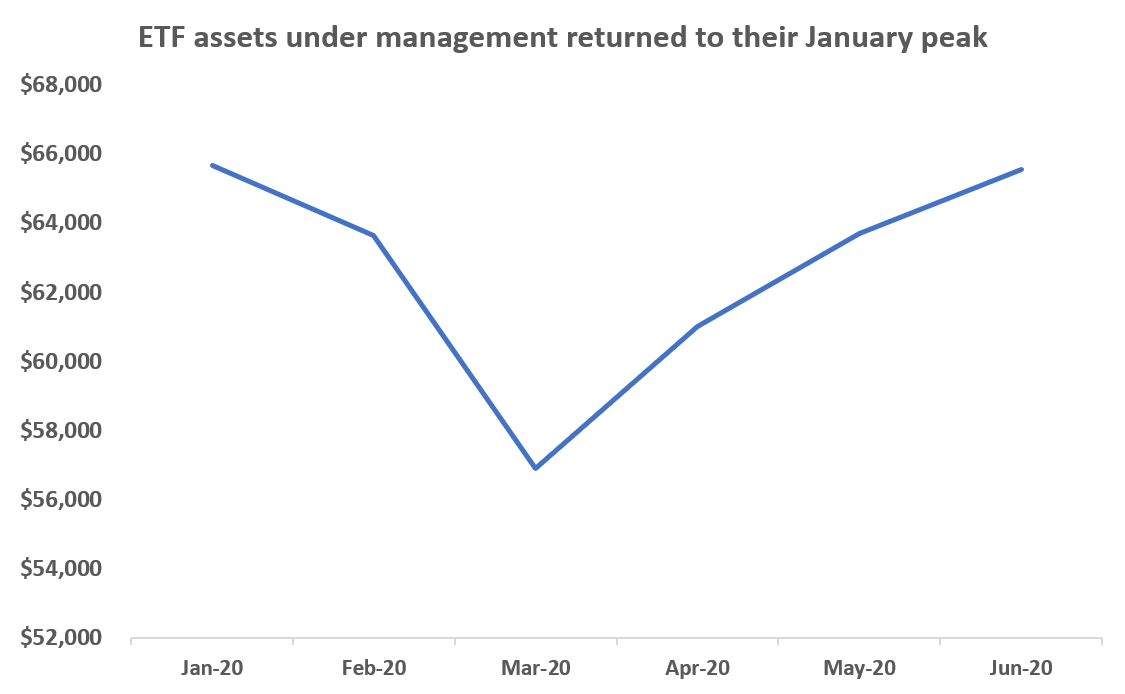

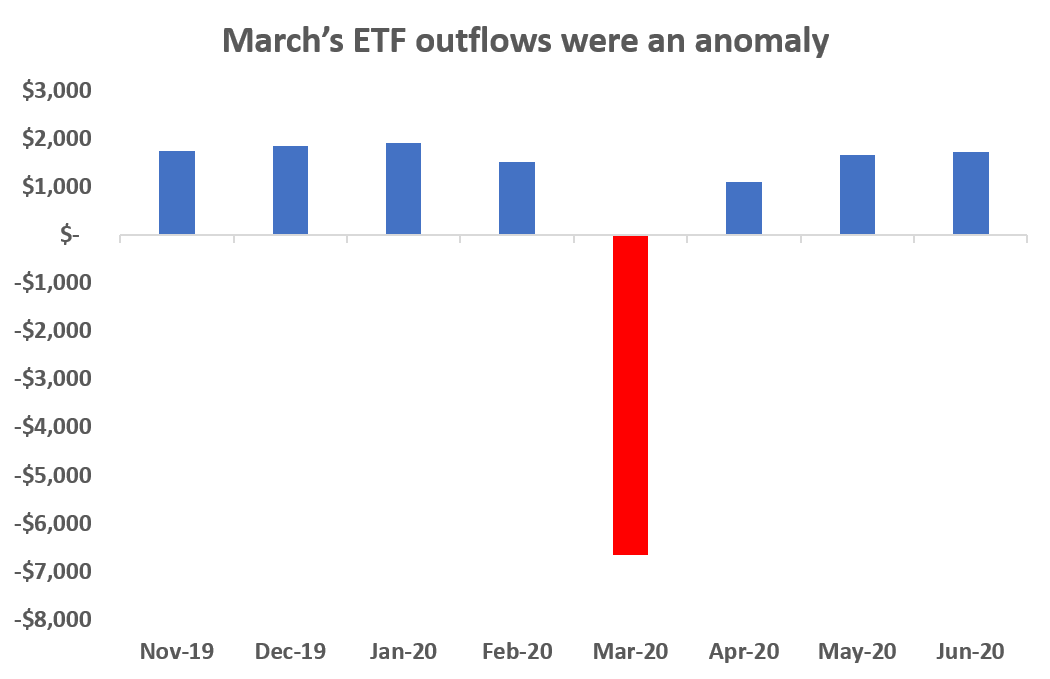

The second quarter was another strong period for the Australian ETF industry. By the end of June, assets under management had bounced back to where they were in January before coronavirus hit.

The asset growth was partly driven by rebounding global share markets. But also Australian investors reignited passion for ETFs. Inflows – which measure investors’ ETF uptake – have re-approached late-2019 averages as of 30 June.

Unpredictable winners

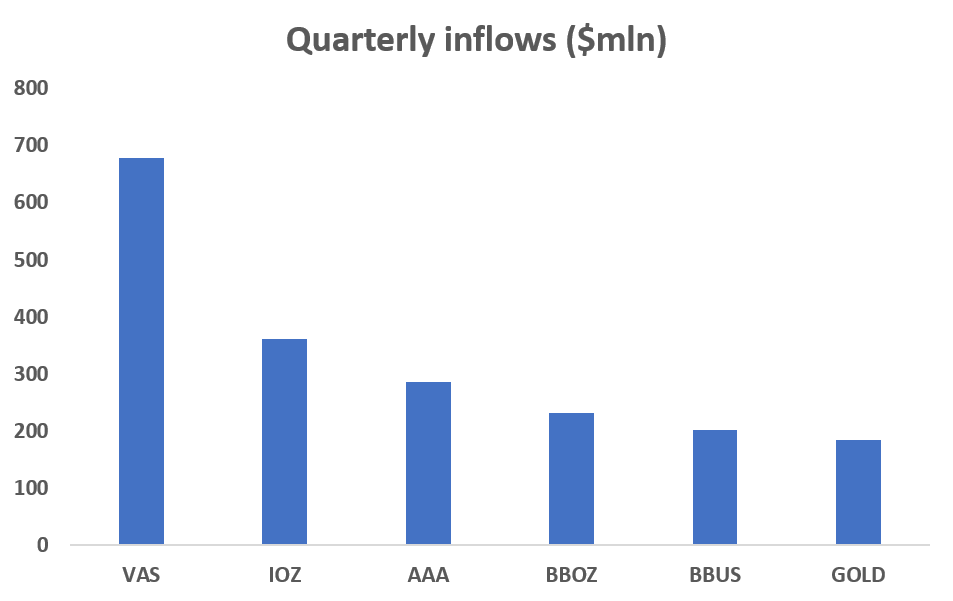

The big winners over the quarter included the familiar suspects such as the ASX 200 and ASX 300 from Vanguard and BlackRock, and gold ETF from ETF Securities. But they also included the bear ETFs from BetaShares which bet against the market.

It is highly unusual for two funds like BBUS and BBOZ to make the top inflows for a quarter. We understand this owes to both retail punters but also some institutions, that use the bear funds instead of derivatives.

In June, some of the most popular funds surprising and reminiscent of the board game Cloudburst, where losers are also winners. Perhaps the biggest surprise was the banking ETF, which is overwhelmingly made up of the big five banks.

Australia's big banks were market darlings in the 1990s and 2000s. But this decade their share prices have been clotheslined as declining interest rates and tougher regulations undermine their margins. Yet Aussie investors injected $52 million of it into their portfolios.

Ticker

Fund Name

June flows ($mln)

MVB

VanEck Vectors Australian Bank ETF

52.2

VAP

Vanguard Australian Property Securities Index ETF

38.8

FUEL

BetaShares Global Energy Companies ETF - Currency Hedged

33.1

The property ETF, which is made up of REITs, also saw a lot of love. Australian REITs are a very mixed bag but many of the biggest REITs in the index are shopping centres, which are fighting a losing battle against online shopping. The energy company ETF - made up primarily of oil majors - also had a night on the town, despite ever-more-dire warnings about global warming.

The inflows into these three ETFs may owe to retail investors, whose trading habits have inspired an almost anthropological interest from the business media and fund managers.

Revenue and market share

Market share can be measured in three main ways: by assets under management, by revenue and by inflow capture.

Market share by AUM

Apr-20

May-20

Jun-20

Q2 growth*

State Street

9.3%

9.5%

9.3%

-0.4%

Vanguard

31.2%

31.5%

31.3%

0.1%

Van Eck

6.7%

6.8%

6.9%

0.3%

Magellan

4.0%

4.0%

3.9%

0.0%

ETF Securities

4.0%

4.1%

4.0%

0.4%

BetaShares

16.4%

16.4%

17.1%

1.0%

BlackRock

24.2%

23.8%

23.4%

-1.2%

*Calculated as the difference between the Q2 and Q1 average

On an asset basis, the same trend that has defined the Australian ETF market for the past two years continued in Q2. That is, the smaller three index ETF providers continued to take more market share. On an assets basis, Vanguard and BlackRock remain the largest ETF providers in Australia by far. In this respect, Australia resembles other parts of the world.

Market share by revenue

April

May

June

Q2 growth

State Street

6.3%

6.4%

6.4%

-0.6%

Vanguard

15.8%

16.0%

15.9%

-0.4%

Van Eck

8.0%

8.2%

8.2%

0.3%

Magellan

15.3%

15.1%

15.2%

0.0%

ETF Securities

5.2%

5.3%

5.3%

0.4%

BetaShares

23.8%

24.3%

24.2%

2.6%

BlackRock

18.1%

17.6%

17.5%

-1.8%

However, on a revenue market share basis, the colosseum looks quite different. On this basis, BetaShares is the biggest ETF provider in Australia, having overtaken BlackRock at the start of 2020. BetaShares revenue has been given a leg up by its bear ETFs, which have surged while charging high fees.

Any discussion of revenue market share, however, should be caveated with the fact Vanguard is a not-for-profit and cuts its fees with an explicit intention of lowering its revenue market share.

BetaShares to reap $4 million profit windfall thanks to bear ETFs

The last piece of the market share puzzle is inflow capture. This measures how much new money is being collected by ETF providers. Inflow capture is also something of a canary in the coalmine, providing forward guidance about how big ETF providers will be in the future.

Inflow capture

April

May

June

State Street

7.7%

9.1%

2.0%

Vanguard

28.3%

29.8%

20.9%

Van Eck

6.8%

9.5%

9.5%

Magellan

5.2%

3.0%

3.8%

ETF Securities

3.8%

7.1%

5.4%

BetaShares

37.1%

19.5%

43.1%

BlackRock

7.8%

15.3%

10.5%

Inflows in Q2 suggest BetaShares is en route to becoming the biggest ETF provider in Australia. Vanguard – usually the final boss for inflow capture – fell into a deep dreamy sleep in June. This may owe to the coronavirus hitting Melbourne, where Vanguard is headquartered.

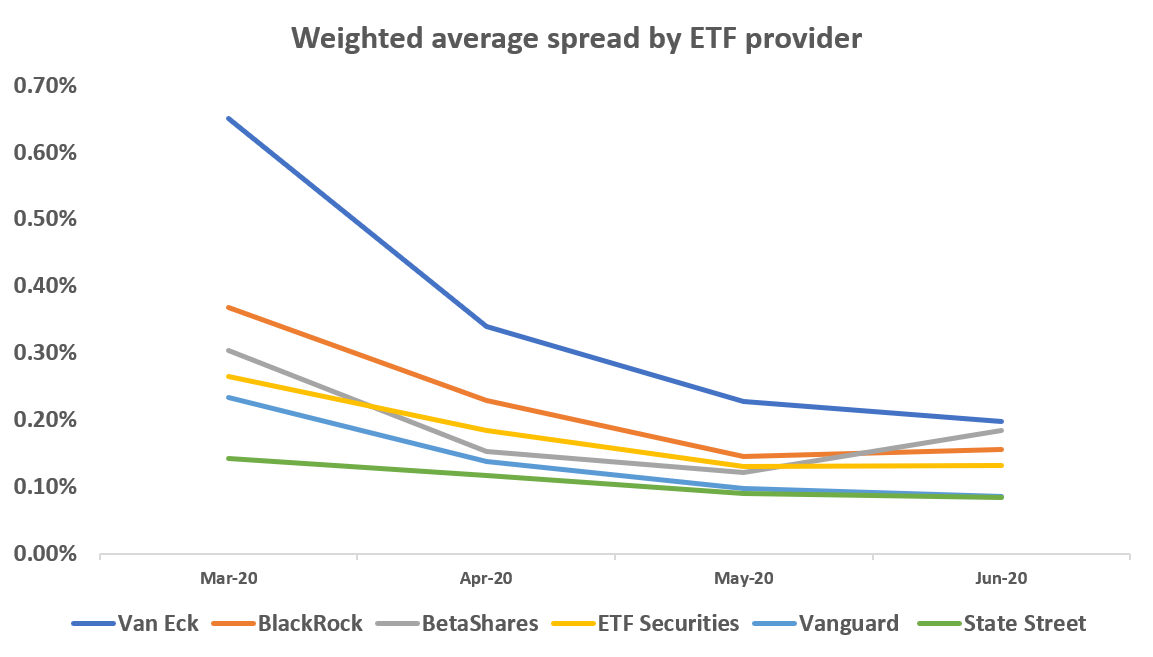

Spreads normalised

The final highlight of Q2 was that spreads normalised. Many ETFs became very expensive to trade in June, as markets discombobulated and flew through air pockets.

However, by end-June, spreads had normalised, with weighted average spreads returning to normal.

Sign up to ETF Stream’s weekly email here.