Energy specialists at investment bank Goldman Sachs and asset management firm Guinness reckon that global energy markets are at a crucial juncture, with futures markets moving into backwardation and a temporary supply hit in the Middle East threatening to restrict output.

Goldman Sachs commodities analysts led by Damien Courvalin warned this week that geopolitical risk is likely to intensify in the short term with "Iraq's military seizing oil fields formerly controlled by the Kurdistan Regional Government (KRG) yesterday, Monday, October 16 and President Trump decertifying the Iranian deal on Friday, October 13. These occur as the decline in Venezuelan production appears to be accelerating and with potential downside risks to Libya/Nigeria production given their recent recovery but the continued local political instability. There remains high uncertainty on the potential impact of these new tensions on the oil market". In Kurdistan, the Goldman Sachs analysts reckon that the 0.5 mb/d Kirkuk oil field cluster is at risk with initial reports that c.350 kb/d has shut in. "From an oil price perspective" the report suggests, "the historical OECD inventory to Brent timespread relationship suggests that a 500 kb/d outage for 3 months (or 250 kb/d for 6 months) should increase Brent spot prices by $2.50/bbl." The Goldman's analysts reckon that these rising geopolitical risks introduce, alongside strong demand and a greater commitment to the cuts, more symmetrical risks to the banks year-end and 2018 $58/bbl Brent price forecast.

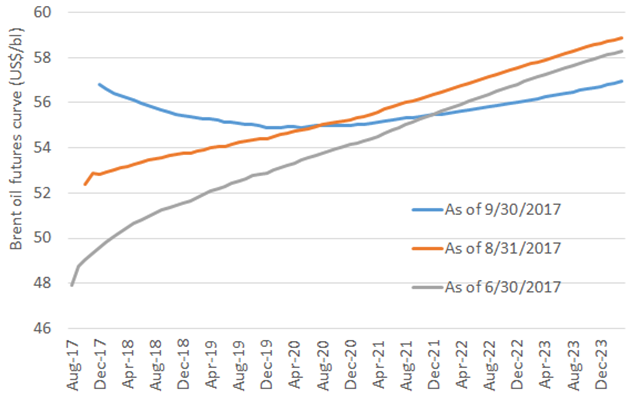

Increased geopolitical pressure coincide with the Brent oil forward curve moving from contango into backwardation late in this quarter. According to specialist energy investor Guinness Asset management the structure of the forward curve is as important as the level of the spot oil price. A backwardated curve (front month price being higher than 12 month forward price) indicates tight near term supply and demand fundamentals in the Brent oil market.

Graphic Brent oil forward curve has moved from contango into backwardation

Grey line = Brent futures curve as of end June 2017, Orange = end August 2017, Blue = end September 2017

Source: Bloomberg

According to Guinness, there are a number of reasons for this recovery in front month oil prices:

Global oil demand growth being revised higher. "The International Energy Agency (IEA) has steadily increased its estimates for 2017 demand throughout the year. Demand in 2Q was particularly strong and expectations are that demand growth will continue to be robust for the remainder of 2017."

Signs of lower US oil production growth potential. "A number of US E&Ps have indicated that either supply chain/logistics factors or subsurface issues (for example higher gas vs oil production ratios) have delayed their proposed ramp up of new oil supply and/or caused the E&Ps to suffer greater than expected cost inflation."

Increased confidence in OPEC's action. "Over the quarter, OPEC delivered sustained high levels of compliance on current production quotas and we saw evidence that OPEC oil exports are now falling as well".

The London based active fund manager believes that this move into backwardation is a positive signal for Energy sector equities - with most large cap oil businesses likely to see increased cash inflows. According to Goldman Sachs, European oil companies delivered a higher level of free cash flow generation in 1H 2017 (based on a $52 Brent oil price) than they delivered in 1H 2014 (based on a $109/bl Brent oil price). "The improved free cash generation comes as a result of both lower operating costs and lower capital expenditure and means that the same group of companies should be able to cover their full dividend commitments and capex from their operating cash flow at around $50-55/bl oil" says Guinness. " This is the first indication that scrip dividends could be removed and that the attractive dividend yields of the European oils would be sustained at current oil prices. "