German investment technology platform BITA has launched a series of thematic indices that are expected to be impacted by the coronavirus outbreak.

The BITA Coronavirus Covid-19 Impacted series consists of companies expected to see the strongest negative impact as the coronavirus continues to spread.

While the BITA Coronavirus Covid-19 Immune series is for stocks that are expected to outperform relative to the wider market as coronavirus fears reach their peak.

The indices cover two major geographic universes through US and EU versions.

The firm said the indices will offer investors the tools to tactically address the current market volatility and uncertainty.

The coronavirus outbreak has sent shockwaves through global markets with the S&P 500 suffering its largest one-day fall since the Global Financial Crisis last week.

The S&P 500 is down 12.2% from year-to-date highs after triggering a circuit breaker which temporarily pauses trading on the New York Stock Exchange (NYSE) if it falls more than 7%.

Meanwhile, amid the coronavirus uncertainty, OPEC and Russia failed to agree production cuts last Friday causing a 30% fall in Brent Crude on Monday.

This sent markets plummeting with the FTSE 100 suffering its largest one-day drop on record, falling 8.5%.

According to BITA, the coronavirus has accounted for more than 95,000 cases across 79 countries including around 14,000 cases outside of mainland China.

BITA commented: “Even when the full extent and severity of this outbreak still remains unclear, making it hard to understand the overall effects and real impact in the worldwide economy, there are some early indications of the negative, and in some cases positive, impact of this crisis over certain industry segments and companies.

“From the issuance of profit warnings to the presence of massive operative disruptions, some companies are already feeling the impact of this worldwide event.”

Factor performance during coronavirus sell-off

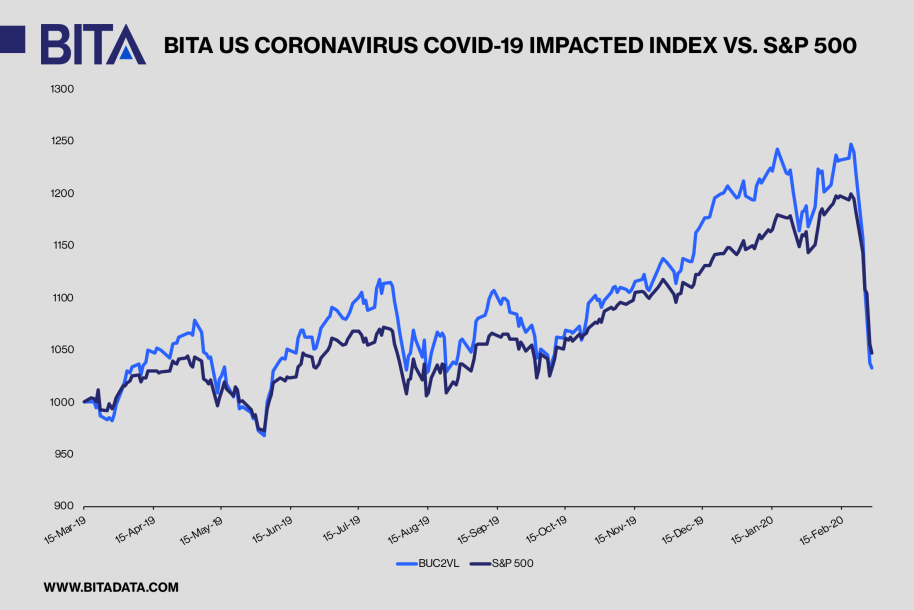

The first index BITA launched was the BITA US Coronavirus Covid-19 Impacted index (FIGI) which dropped 11.6% during February, according to backtests, versus 8.4% for the S&P 500.

BITA launched its self-indexing platform BITACORE in Q1 this year which aims to enable clients to design and construct their own indexing strategy.