Cryptocurrency exchange-traded products (ETPs) recorded their largest weekly inflows since July last year after BlackRock’s spot bitcoin filing in the US peaked investors’ interests.

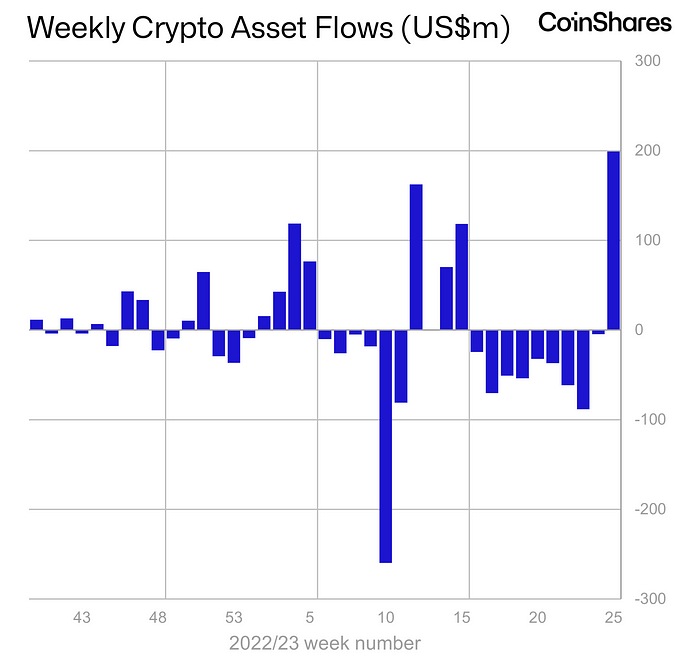

Digital asset ETPs recorded inflows of $199m last week – $187m of which flowed into bitcoin – correcting almost nine weeks of outflows, according to CoinShares weekly flows data.

Europe accounted for $87.2m of the inflows, with the $664m ETC Group Physical Bitcoin ETP (BTCE) recording $77m inflows.

Asset managers have started lining up behind BlackRock’s filing, with WisdomTree, Invesco and Valkyrie all reapplying for previously rejected filings.

Meanwhile, institutional-focused crypto exchange ETX Markets was launched, backed by Citadel Securities, Fidelity International and Charles Schwab.

As well as inflows, the news also boosted trading volumes, totalling $2.5bn for the week, 170% above the average so far this year.

Inflows elsewhere were limited, with Ethereum seeing inflows of $7.8m, while the renewed sentiment did not trickle down to altcoins with only minor flows for XRP and solana.

Source: CoinShares, Bloomberg

James Butterfill, head of research and investment strategy at CoinShares, said: “We believe this renewed positive sentiment is due to recent announcements from high-profile ETP issuers that have filed for physically backed ETFs with the US Securities and Exchange Commission (SEC).

“Total assets under management (AUM) are now at $37bn, their highest since before the collapse of 3 Arrows Capital.”

The SEC’s approval of a bitcoin ETF remains in the balance, but its approval of a Volatility Shares leverage bitcoin ETF last week has some anticipating a spot bitcoin ETF approval.

In a recent note on digital assets, Bank of America (BoA) said it expects the asset class to be supported by regulatory clarity “over the intermediate term”.

Digital assets are one of the best-performing asset classes this year, up 33% to 20 June, ahead of stocks (14%), gold (6%) and investment grade bonds (4%), according to BoA.

Bitcoin is up 85% year to date, edging towards $31,000 on institutional demand.