Asset owners' increasing interest in the area of sustainable investing is driving strong growth in new products and innovation, according to the latest

from BlackRock.

The report explains what the future likely holds for sustainable investing, discussing the popularity in recent Environmental, Social and Governance (ESG) products. Drawing distinction between sustainable investing and ESG, BlackRock says: "We see sustainability investing as the umbrella and ESG as the data toolkit for identifying and informing our solutions".

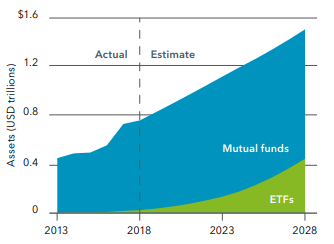

There is approximately $760bn invested in European and US sustainable ETFs and mutual funds. This figure is up from $453bn back in 2013. BlackRock predicts these figures to continue to swell over the next decade with expectations of over $400bn to be invested in sustainable ETFs by 2028. In excess of 100 sustainable ETFs and mutual funds were launched in the US between 2015 and 2017.

Source: BlackRock

When it comes to creating a sustainable investment product, BlackRock defines two methods of constructing it: avoid or advance. 'Avoid' is the process of eliminating companies or sectors which don't comply with the asset owner's values. 'Advance' is the process of aligning capital with companies because of their behaviours which include ESG scores.

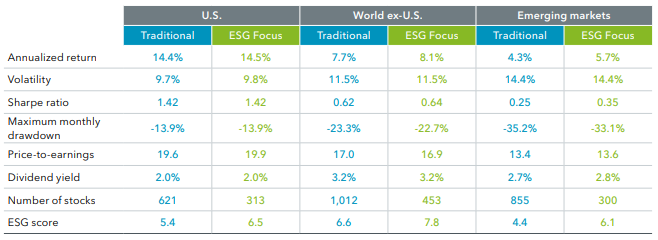

Source: BlackRock

As ESG integration is still a relatively new process for investing, therefore the products' performance history is predominately back-tested data. The data provided above by BlackRock shows general statistics for both traditional and ESG focused products in several regions. Despite the number of stocks which comprise the ESG focused funds being half (sometimes even less) than that of the traditional funds, the annualised returns are matched or are even higher.

What does the future hold?

There remains an issue when it comes to the ESG scoring of companies. There lacks a global standard for scoring a company, resulting in each company performing their own due diligence to comply with their respective ESG rating agency's process and methodology.

MSCI an ESG data provider has expanded the number of companies under its coverage fourfold over the last decade, according to the report. There remains a lack of historical data which is usually considered when calculating a company's ESG score. This is at fault of data providers who were not covering these areas previously. These areas include renewable energy use, corruption management and labour management. To rectify this, MSCI has nearly doubled its data points reported from 132,175 in 2009, to 229,294 in 2017.

A study by BlackRock late last year found that four out of five insurers have an ESG investment policy in place or set to have one in the next year. But BlackRock says the industry still faces the problem of defining ESG integration. To draw distinction, the firm enables its portfolio managers access to research, data and insights.

Rich Mejzak, Head of Global Portfolio Management for BlackRock, said: "Integrating ESG metrics into a cash portfolio can be additive over the long run, despite our highly restrictive investment universe and the relatively short maturities of cash investments. Companies that incorporate sustainable practices into their business tend to have lower capital costs and can be less susceptible to operational risks. This can ultimately help improve the return profile of an investment."