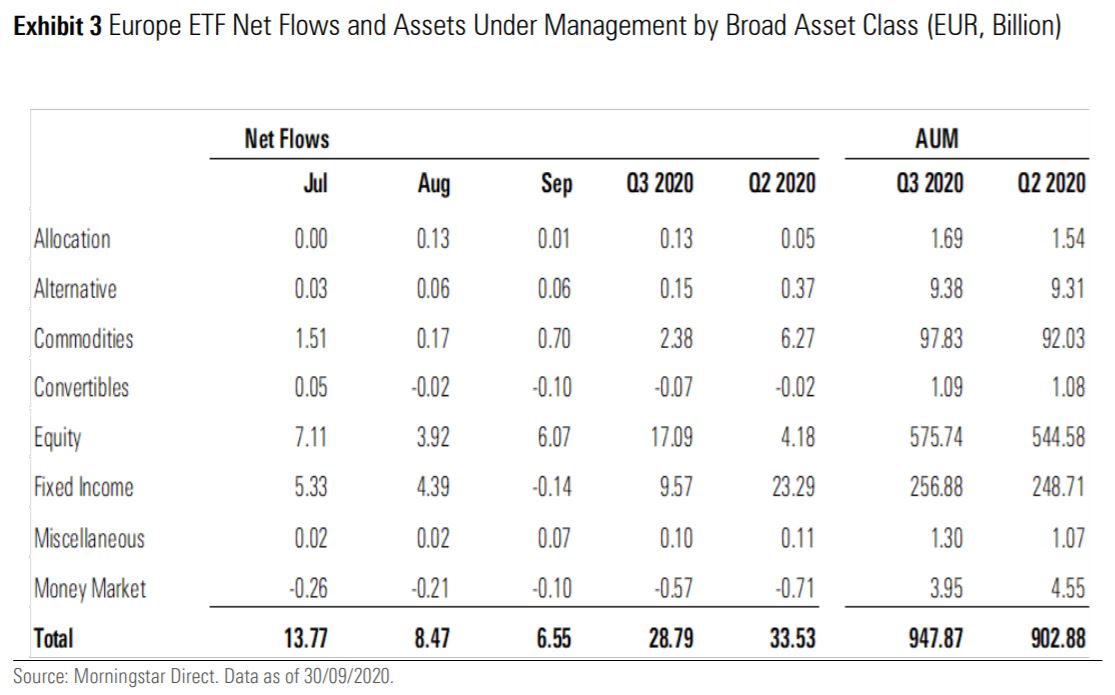

The European ETF market gathered €28.8bn of inflows in Q3, down from €33.5bn in the previous quarter, according to data from Morningstar.

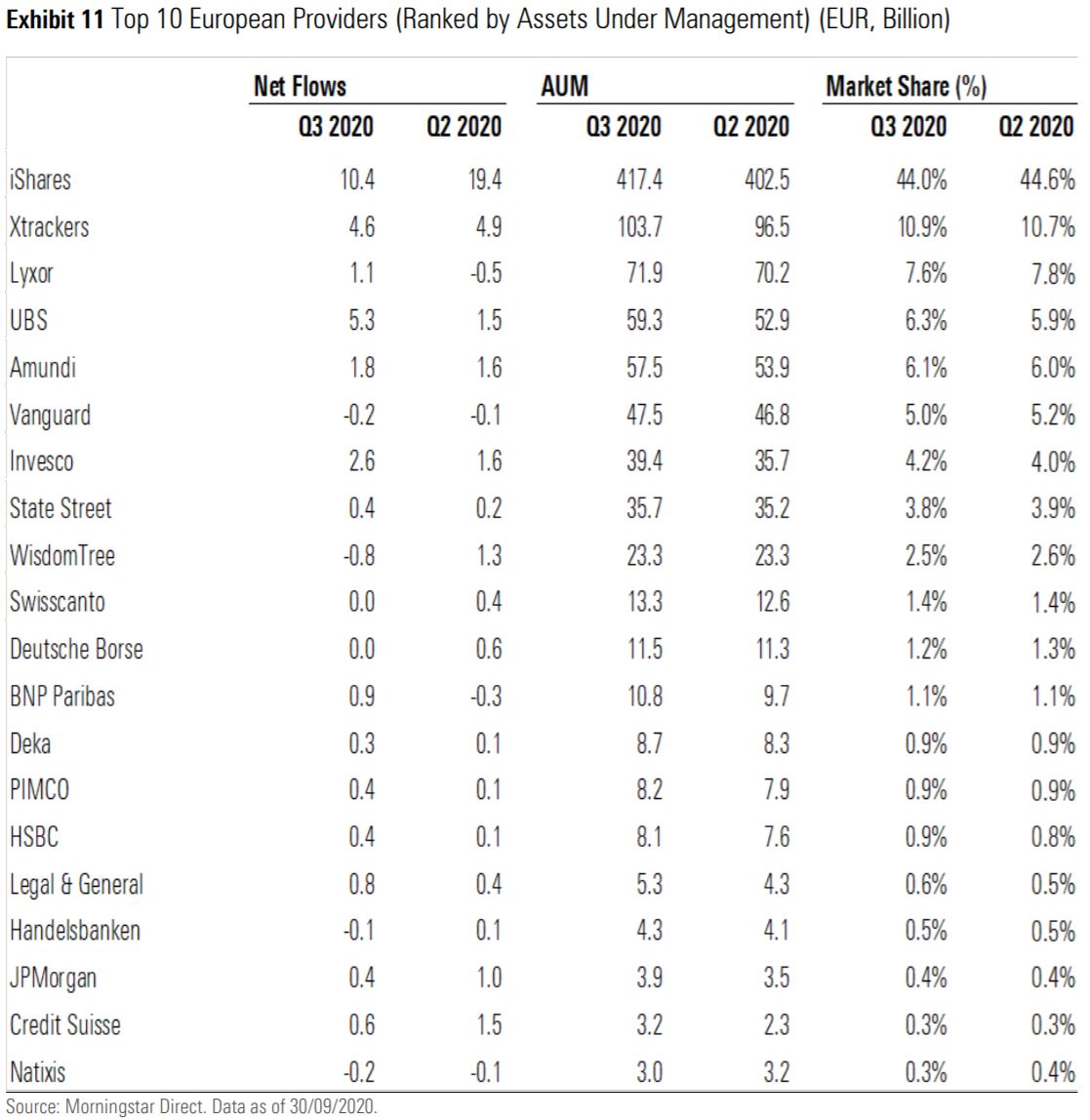

BlackRock’s iShares range accounted for over a third of the quarter’s inflows having attracted €10.4bn in new assets. However, these inflows were notably down from the €19.4bn received in the second quarter of this year.

DWS and UBS also had significantly positive quarters having attracted €4.6bn and €5.3bn for the period, respectively.

At the other end of the table, Vanguard saw €200m in outflows which marks the second consecutive quarter the ETF issuer has had negative net flows.

Surprisingly, BlackRock was the owner of the biggest losing ETF as the iShares Core S&P 500 UCITS ETF saw €1.1bn outflows.

Not too far behind were two of Vanguard’s products as the Vanguard FTSE All-World High Dividend Yield UCITS ETF and the Vanguard S&P 500 UCITS ETF saw outflows worth €930m and €560m, respectively.

WisdomTree saw the largest volume of outflows over the last three months having lost €800m in assets despite its robust commodity ETP offering. The asset class gathered €2.4bn in assets in Q3, meaning the asset class has attracted inflows every quarter in 2020.

WisdomTree changes indices on oil and gas ETPs following extreme market volatility

Despite energy commodity ETPs being the second largest category for outflows with €680.2m, precious metal ETPs was the second largest category in terms of inflows with €3.4bn, beating US large-cap products.

Nonetheless, equity ETFs have started attracting investor attention again having gathered €17.1bn in the last quarter, up from only €4.2bn in Q2.

A significant volume of these equity inflows is going into environmental, social and governance (ESG) strategies. Equity ESG ETFs received €6.6bn in assets while fixed income ESG ETFs attracted a further €1.9bn.

Despite its low AUM, ESG ETFs accounted for nearly 30% of the European ETF market highlighting the dramatic rise in the space.

Investors remain wary of the uncertainty surrounding the coronavirus as they increase their exposure to safe havens like precious metals, according to Jose Garcia-Zarate, associate director, passive strategies, manager research, Europe at Morningstar.

“The rise in equity markets in the summer months was hard to ignore, and it must be a reasonable assumption to make that many investors went into equities to profit from the rise,” he said.

“But underneath, there remains a great deal of uncertainty in the air about the economy, and so it’s not entirely surprising to see precious metals still gathering flows, in the same manner by the way than some bond categories also still are net recipients of investors’ money.”

Fixed income ETFs posted €9.6bn in new assets for Q3, but unlike equities, this figure is down from €23.3bn the previous quarter.

Fixed income ETFs continue to lure investors

Chinese onshore government bond ETFs were the most popular with €2.1bn inflows which is noticeably larger than assets received in the previous two quarters of 2020.

Euro government bond ETFs and global corporate bond hedged to sterling ETFs were the least popular among investors having lost €361.1m and €249m.

“In both cases of precious metals and fixed income, the flows in Q3 were lower than in the two previous quarters,” Garcia-Zarate added. “My guess is that uncertainty could play a more prominent role in investment decisions in Q4.”