Amid ongoing Brexit uncertainty and a deadline looming for the UK to leave the European Union, some ETFs offering exposure to the UK’s largest stocks have bounced back from what has been a disappointing start to October, although some have continued to slump.

The improvement in performance for some ETFs has been in tandem with the nation’s Prime Minister Boris Johnson actively trying to secure a Brexit deal.

On Thursday, Johnson settled on a deal with the EU however, Parliament voted against the deal on Saturday when markets were closed. The potential next steps include the PM preparing another bid to push the deal through parliament, asking the EU for a further extension or potentially offering another referendum to the public.

Despite many hopefuls believing late last week a Brexit deal might be imminent, it is still no clearer as to what is going to happen on 31 October when the divorce is scheduled for the UK and EU.

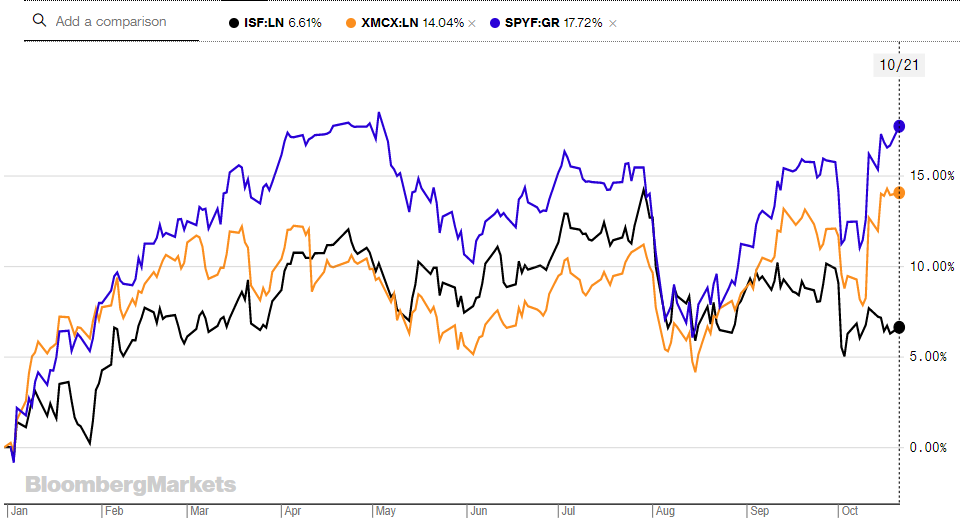

As a result, ETFs tracking the FTSE 100, FTSE 250 and FTSE UK All Share indexes have all been performing differently. This is undoubtedly going to make things more difficult for investors who are already divided on how to manage their portfolios during these difficult periods.

The FTSE 250 is comprised of the next 250 largest UK stocks after those which make up the FTSE 100 index and tend to perform well when sterling rallies as many of their earnings are tied to the UK economy. One ETF which tracks this index is the Xtrackers FTSE 250 UCITS ETF (XMCX).

XMCX’s net asset value (NAV) climbed 1.8% during the week commencing 14 October. Between the 9 and 18 October, the NAV change is even greater at 5.6% after falling 2.3% the week before (week of 30 September).

Year-to-date, XMCX has produced significantly positive returns of 18.5%.

Six ETFs to cushion against Brexit

The UK’s largest stocks, many of whose earnings are derived from overseas, are not performing so well as FTSE 100 ETFs struggle to make any significant gains.

The iShares Core FTSE 100 UCITS ETF (ISF) has been on a downward trend throughout October and has fallen 2.6% since the beginning of the month. Its three-month return remains negative at -3.1% however its YTD return holds modestly at 10.7%.

Likewise to XMCX, the SPDR FTSE UK All Share UCITS ETF (SPYF) has performed positively in the latter end of October.

The fund is the aggregation of the FTSE 100, FTSE 250 and the FTSE Small Cap indices.

SPYF’s NAV fell 4.1% between 30 September and 8 October but has since redeemed its losses and climbed a further 0.8% by last Friday. This has bolstered its YTD returns to rise to near 19%.

SPYF (Blue), XMCX (Yellow), ISF’s (Black) YTD Returns – Source: Bloomberg