Vanguard has cut the fees on its core ETFs – again. The fee cuts come on some of its most popular products – including its $110+ billion Total Market (VTI) and S&P 500 trackers (VOO) – constitute a 25% discount.

The cuts have given Vanguard a slight price advantage over its top competitor, iShares, whose fees it had been following neck-and-neck the past several years.

They also raise an obvious question: can iShares keep up with Vanguard’s fee cuts?

Can iShares match Vanguard’s cuts?

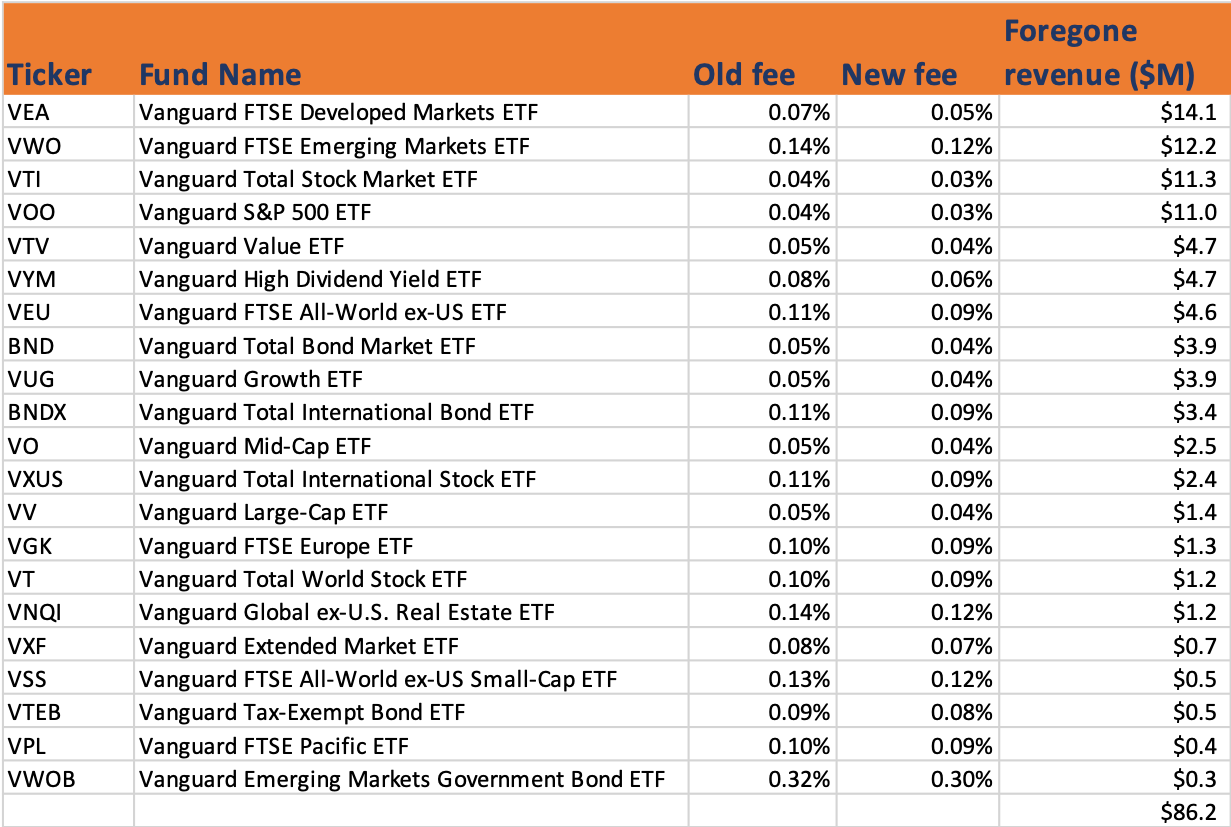

By cutting its fees, we calculate that Vanguard has forgone about $86 million per annum in revenue, which is a lot. (It’s easier for Vanguard to do this sort of thing because it’s a not for profit, with no analyst reports to sweat on.)

Source: ETF Stream

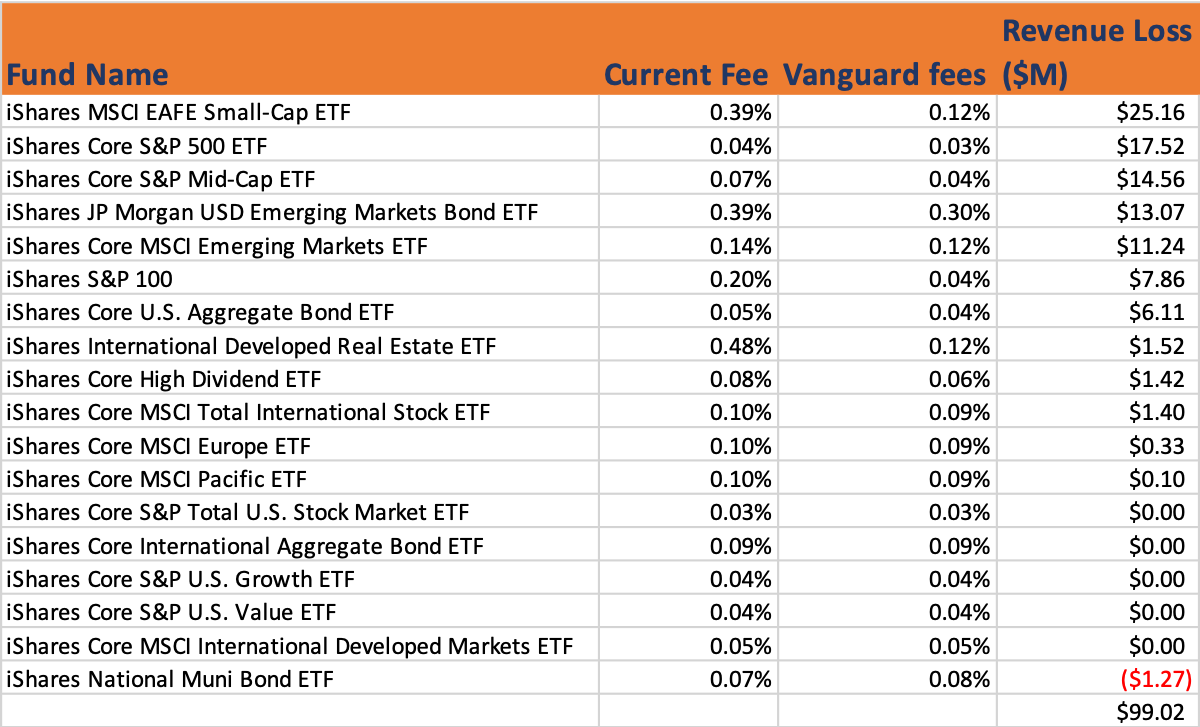

To match them on a product-for-product basis, iShares would have to forego about $100 million p.a. in revenue from its core range, we’ve calculated, using conservative product matches.

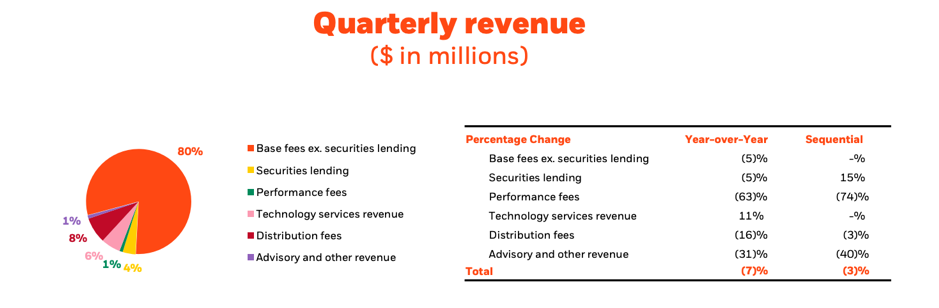

On the surface this might seem like a drop in the ocean: iShares took in $1.1 billion in total base fees in Q1 2019, BlackRock’s quarterly report indicates. Annualised this comes to $4.4B. On this basis, matching Vanguard’s fee cuts would cost iShares 2.3% of its annual base fees.

Given that BlackRock has cash to burn – the company has more than $4B in annual net income – there seems little doubt that BlackRock can afford to match Vanguard’s cuts.

What BlackRock must give up

Source: ETF Stream

…but will they? And if so, when?

The harder question is whether they will, and if so when?

BlackRock had a tough year in 2018. When Fidelity announced its zero fee index funds, markets took the air out of the tires of big index fund managers. BlackRock’s share price fell 40% from peak to trough in 2018. Its trailing PE ratio fell from the 20s, where it hovered in 2017 and 2018, down to 16 today (close to market and industry average).

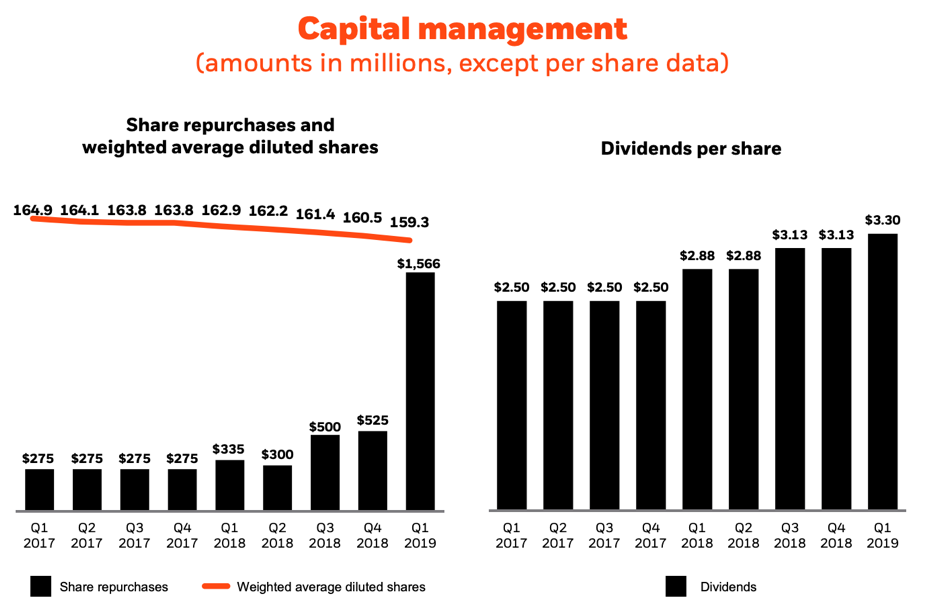

Buybacks and dividend binge

BlackRock responded by aggressively buying back its own stock and ramping up its dividend. The buyback binge in Q4 2018 and Q1 2019 has steadied the drop at 20% below peak.

With the market downgrading growth prospects for index investing, BlackRock has started trying positioning itself as an alternatives and private market specialist. Its executives are doing press to promote this position, while the company has made acquisitions to help it expand in this space.

Beyond strategy and valuations, the company’s revenue in 2018 was up only 4% from 2017, which was below analysts’ forecasts. The revenue miss owed to negative market movements but also to lower performance fee revenue, BlackRock said in its annual report. (Until very recently, BlackRock made more money on its actively managed funds than on its passive business).

Verdict – not sure

BlackRock can easily afford to match Vanguard’s fee cuts. And all data shows fee cuts boost asset growth for ETF providers.

However, a fee cut on IVV from 4 to 3 bps is a 25% discount. This would mean IVV would need 33% more assets ($58 billion) just to get back the fee revenue it lost. And that’s before a discount rate is added.

In years prior I would have guessed BlackRock would cut fees to match Vanguard - and on a short time frame to boot. But the market is no longer willing to pay BlackRock the same premium for AUM growth that it was in 2017. There may be other ways for BlackRock to spend the $100M p.a., like more buybacks or a bigger dividend.

There may be less incentive to aggressively cut fees in order to boost asset growth for BlackRock going forward. And Vanguard might – MIGHT – have just won the fee war.

******

Image Source: Wikipedia