Berkshire Hathaway business partners Charlie Munger and Warren Buffett both agreed passive investing is a growing and powerful phenomenon, however, Munger forever maintained a level of suspicion about a practice he described as “a massive transfer of power” to “di-worse-ification”.

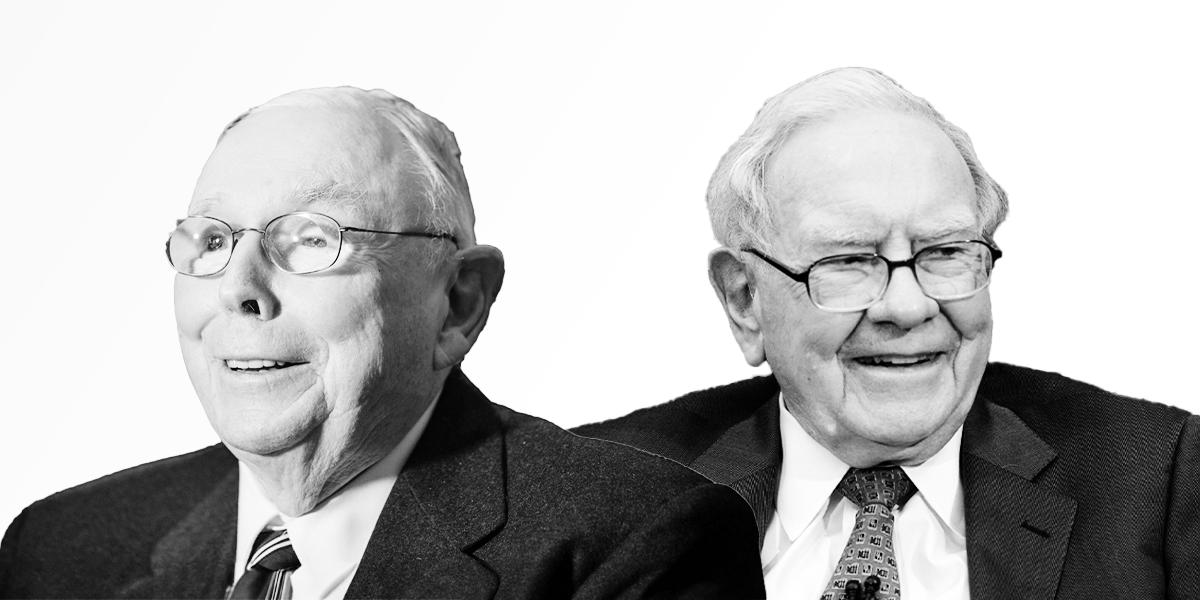

Munger (pictured left), who died on Tuesday at the age of 99 in California, is celebrated for the “architectural feat” of “the design of today’s Berkshire Hathaway”, Buffett (pictured right) said.

Over more than six decades, the pair took the company from being a textile manufacturer to a multinational conglomerate with large stakes in Apple and Coca Cola and full ownership of household names including Dairy Queen and Duracell.

In a statement on Tuesday, Buffett said the firm “could not have been built to its present status without Charlie’s inspiration, wisdom and participation”.

Central among this was Munger’s influence on Buffett’s investment philosophy, ending the ‘cigar butt’ investing strategy he had picked up from famous value investor Benjamin Graham, which involved buying companies at low prices in search of ‘free puffs’.

“The blueprint he gave me was simple: Forget what you know about buying fair businesses at wonderful prices; instead, buy wonderful businesses at fair prices,” Buffett said.

However, the pair never quite saw eye-to-eye when it came to the modern era’s most powerful investment movement: passive investing.

Munger vs Buffett on power of passive

On the one hand, Buffett has spent decades extolling the virtues of passive, arguing that yielding average results at far lower costs will put you in better stead than most active managers – and this represents a powerful proposition for the laymen of investing.

At a Berkshire shareholder meeting in 1993, he said: “By periodically investing in an index fund, for example, the know-nothing investor can actually out-perform most investment professionals. Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.”

At another shareholder meeting in 2002, he added: “The people who buy those index funds, on average, will get better results than the people that buy funds that have higher costs attached to them, because it is just a matter of math.”

So confident was his conviction in the merits of buying and holding index funds, that in 2008 he had a million-dollar bet with hedge fund Protégé Partners that an S&P 500 index tracker would outperform the hedge fund portfolio over the next decade.

By 2015, Protégé co-founder Ted Seides had departed his firm and said two years later, “for all intents and purposes, the game is over. I lost.”

Interestingly, Munger joined Buffett in betting big on passive. At the 2021 Daily Journal Corporation shareholder meeting, he said at a charitable institution where he had “some influence for a very long time”, its endowment accounts invested heavily in two vehicles, one of which was a Vanguard index fund.

“As a result of these two positions, we have way lower costs than anybody else and make more money than practically everybody else,” he said.

However, at the same meeting he issued a reminder that his approach to investing – selectively buying high quality businesses at low prices – will “never go out of style” and was in fact optimal to passively tracking an index.

“In wealth management, people think that if they have 100 stocks, they are investing more professionally than they are if they have four or five. I regard this as absolute insanity.

“People argue for diversification – by the way I call it ‘di-worse-ification’ – but I am way more comfortable owning two or three companies I think I know something about and where I think I have some sort of advantage.”

Two years earlier, at the 2017 Daily Journal meeting, he described it as “crazy in the extreme” to rely on the kindness of strangers in the financial world.

“It is just madness to pass up opportunities to do something intelligent with your spare money,” he said. “There is almost always something intelligent you can do instead of passively sitting in some index security.”

Forever wary of indexing

At other points, the straight-talking ‘abominable no-man’ did contradict himself and concede passive investing to be a movement gathering momentum. He also agreed with his business partner that the average individual investor – and active manager – would struggle to do better.

“People in the investment management industry ought to prepare for tougher times ahead,” he said at a 2020 shareholder meeting. “This indexing thing is going to run and run and run and the wretched excesses in a lot of the well-paid hedge funds and private equity businesses will in due time result in a lot of troubles.

“Everywhere, I see endowment managers with the same mantra: they want fewer and better investment managers. That is not going to be good for investment managers – and the rest of people are indexing.”

He issued a similar message a year earlier, stating it was “very peculiar” that the investment management profession works hard and is paid for “accomplishing nothing”.

“How are they dealing with this terrible situation as index investing gets more and more popular? The simple answer is they are handling it with denial.

“They have a horrible problem they cannot fix so they just treat it as non-existent, which is a very stupid way to handle a problem.”

He went on to deliver the same critique at his final Daily Journal meeting in February this year, stating managers “are used to charging big fees for stuff that is not doing their clients any good”, which he said represented “extreme denial” and “deep moral depravity”.

In fact, he said perhaps just 5% of investment professionals in the US are adept at finding ‘good businesses’ to invest in before everybody else does, which goes some way to explaining why the Daily Journal Corporation 401k plan for employees is exclusively comprised of index funds.

However, despite noting index investing will continue working better than active management “for a considerable period”, Munger always remained reticent about throwing unconditional support behind the movement.

Setting aside often-raised arguments about threats to market efficiency, he was concerned with what he described as the potentially “huge” power of index fund issuers to shape corporate governance - and wider society - as more people choose to own assets through tracker funds.

At the 2022 Daily Journal Corporation meeting, he warned: “We have a new bunch of emperors and they are the people who vote the shares in the index funds. Maybe we can make Larry Fink and the people at Vanguard Pope.

“All of a sudden, we have had this massive transfer of power to these index funds. That is going to change the world.

“I do not know what the consequences will be but I predict it will not be good. I think the world of Larry Fink, but I am not sure I want him to be my emperor.”