ETF Stream’sCrypto Tomorrow 2023 event came following a period of extreme market stress and wavering sentiment for the crypto industry.

Aiming to cut through the noise of the past few months, ETF industry participants explained how digital assets can recover from the collapse of FTX, how crypto exchange-traded products (ETPs) fit in an investor’s portfolio and the regulatory outlook for 2023 and beyond.

Bitcoin and other cryptocurrencies enjoyed a strong start to the year, buoyed by risk on market sentiment, however, the fragile nature of the industry is still apparent while a regulatory clampdown looks set to hit the market soon.

The impact of FTX

Opening the conference with a deep dive into the aftermath of Sam Bankman-Fried’s (SBF’s) dramatic fall from grace last year, Andrew Robinson, head of institutional core sales for EMEA at Coinbase, said institutional demand for crypto has been shaped by but not swayed by the events of 2022.

“Following the conversations that we have with institutional investors regularly, my view is that institutional adoption of crypto as an asset class is building momentum,” he said.

“The events of 2022 rightfully changed how some institutions approached the digital asset space and how they analyse opportunities and choose partners, but it did not sway them away from continuing to build and invest in the industry.”

Helping to guide investors through the FTX debacle, Tom Wan, research analyst at 21Shares, gave a demo of how their self-built dashboards improved transparency for the industry at a time when it was most needed.

Noting the importance of transparency moving forward, Wan said: “On-chain analytics allows you to analyse the fundamentals of crypto assets, for example the number of users and trades in real-time. This allows you to spot signals ahead of time and identify potential risks.”

Regulation, ‘the only good answer’

Delivering a keynote on regulation, Sean Tuffy, industry expert and former head of market intelligence at Citi Securities Services, said the collapse of FTX will lead to tighter regulation but added it will also likely be delayed due to SFB’s lobbying of both Republicans and Democrats.

“It will be a while before we get a sense of formal direction on regulatory regimes,” he said. “In the meantime, the Securities and Exchange Commission (SEC) will start using enforcement mechanisms to push the crypto into a better regulatory light.”

Tuffy added markets such as the UK and Europe are further down the regulatory path.

“If crypto wants to make the jump from where it is today to more institutional adoption the only path forward is regulation,” he said.

In a session exploring how crypto ETPs are traded, Daniel Izzo, CEO of GHCO, said FTX had a profound impact on market makers as well as stating that “regulation is the only good answer”.

“We had exposure to FTX but we managed it to a low amount by assessing our counterparty risk,” he said. “We were not the only ones as was evident after the collapse. We went back into the crypto ETP market the next day and only a few of our competitors showed up, and some never came back.”

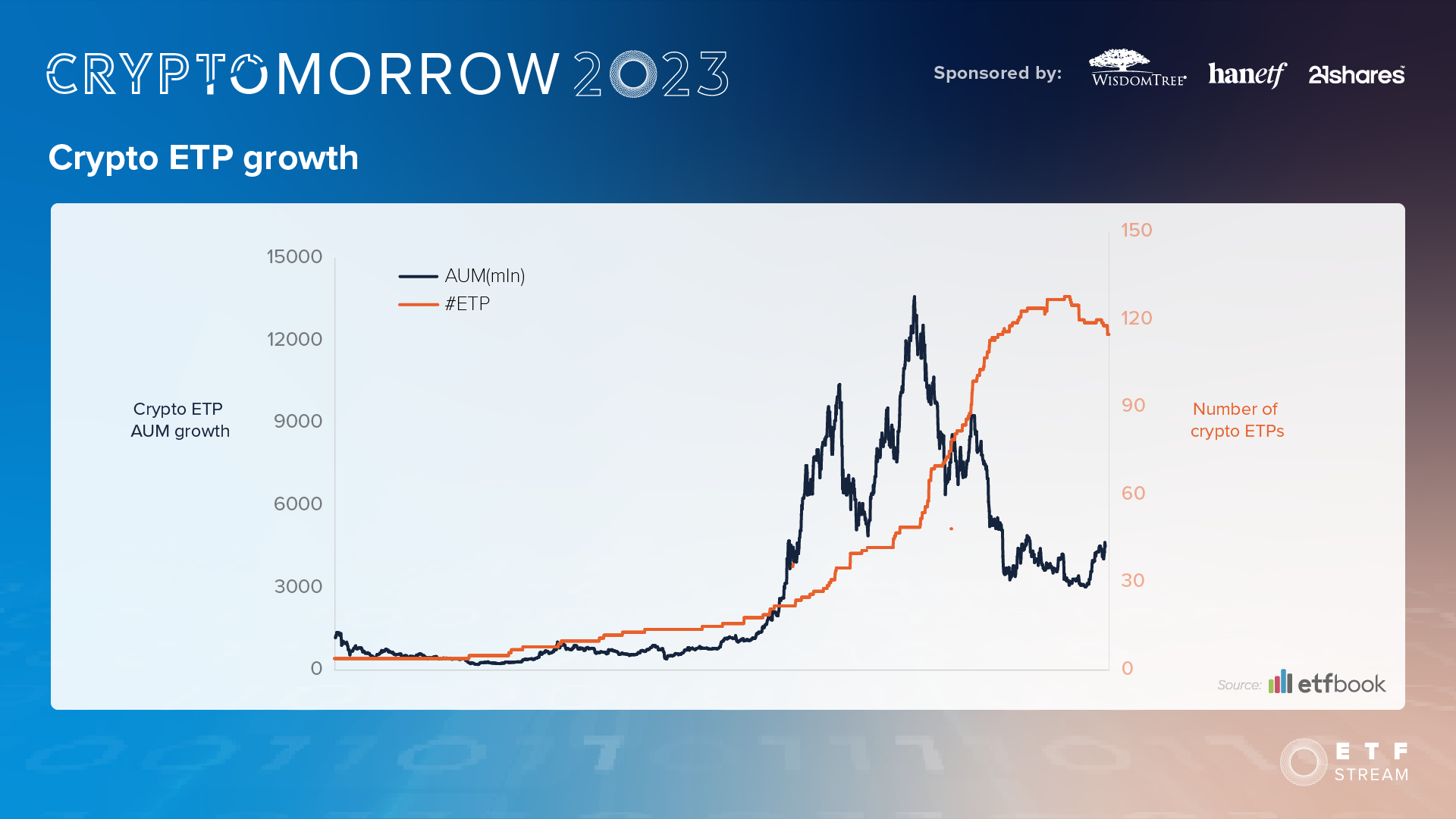

The crypto ETP investment case

Looking at how investors can use crypto ETPs within their multi-asset portfolio, Bradley Duke, co-founder and CEO of ETC Group, said investors must ask themselves several key questions before investing.

“For investors coming into the space who have a secular belief in the growth of cryptocurrencies to do their homework before selecting crypto ETPs,” he said. “Going through the checklist is important to make sure they are going through the right process in the selection process.”

Speaking on the only panel of the day, Mirva Anttila, director of digital asset research for WisdomTree Europe, said crypto ETPs have many advantages over investing in crypto directly.

“You have a one-stop solution where the ETP issuers will deal with the market makers, so you typically get a better price through transacting on your own,” she said. “They can also trade at a discount to their NAV while the user does not have to remember their private key and are secured by an institutional grade computer system.”

She added crypto baskets such as multi-asset crypto ETP are a great way to get total exposure across crypto assets.

Charlie Morris, CIO of ByteTree Asset Management, suggested allocating 2.5% of an investor’s equity portfolio to bitcoin and a further 1.5% into a crypto basket.

2023 and beyond

Looking ahead, Anttila said there were three areas of innovation to look out for in the crypto space.

Firstly, the scalability of the blockchain networks via a layer two solution. Secondly, user interface improvements for investors’ crypto wallets, and thirdly, the progression of digital identity and privacy on the blockchain.

Néstor Palao, head of DLT and corporate clients at Sygnum Bank, added the space is ready to become a more mature market, with the digital asset bank “slowly closing the bridge between decentralised finance and crypto”.

Rounding off his earlier keynote, Robinson said he expects the volatility in crypto to continue in 2023 but is bullish over the long term. “The crypto economy is poised to strengthen and ultimately win,” he said.