Even though decentralisation remains a core tenet of the crypto ecosystem, further adoption of the asset class hinges on its ability to integrate with existing financial services, according to Morningstar’s maiden analysis of the industry.

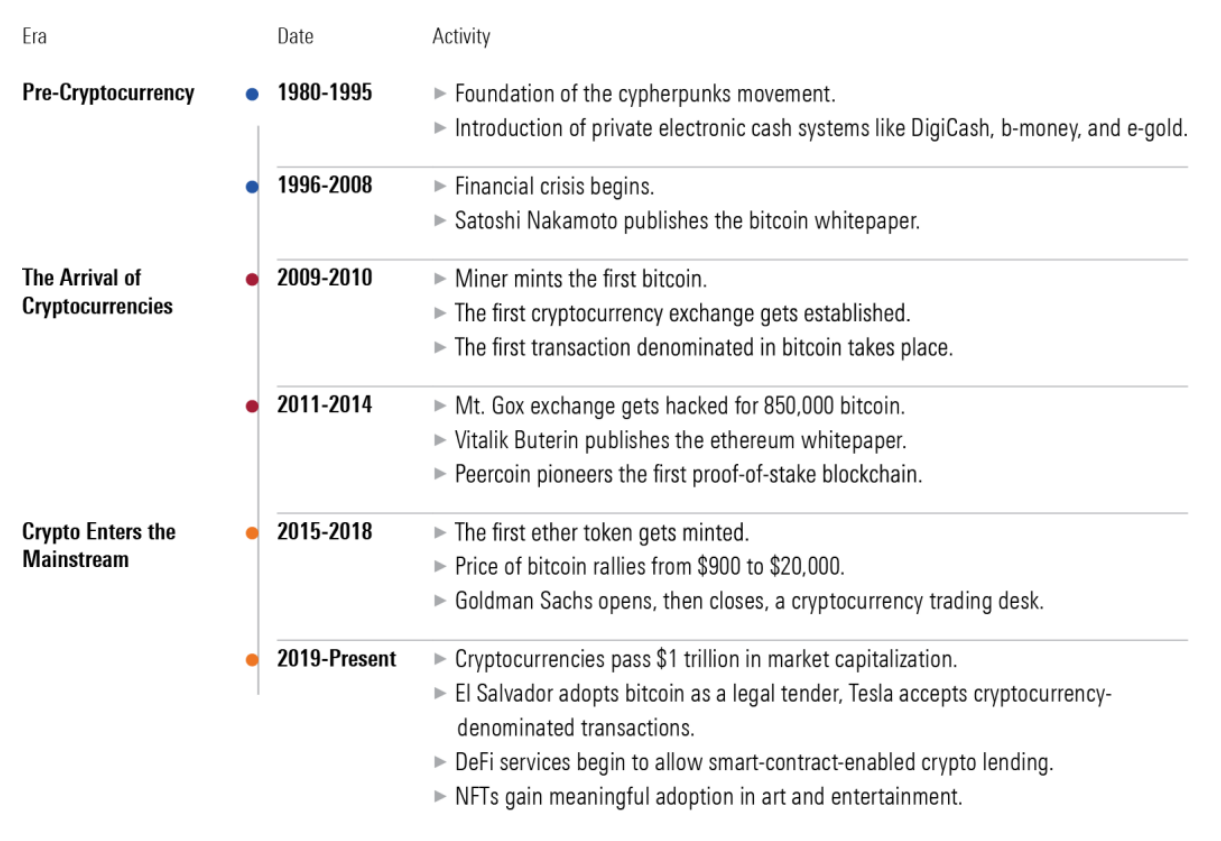

The report, titled the 2022 Cryptocurrency Landscape, said the pursuit of an unmediated electronic cash system goes back as far as the collapse of Bretton Woods and the financial crises and hyperinflation that defined the 1970s. Satoshi Nakamoto’s 2008 white paper on blockchains, bitcoin and peer-to-peer payments was merely the initial splash for the cryptocurrency wave we continue to ride.

Source: Morningstar

Since then, crypto assets have spawned “entire parallel economies” and potential applications, Morningstar said, but it also warned the industry’s reliance on decentralised infrastructure could set up “meaningful barriers against real-world use cases”.

The research argued while decentralisation can help users move digital assets around for the sake of interaction with the real world, practical road bumps exist.

In theory, applications such as smart contracts can automate on-chain transactions but when information from third parties is required – such as home inspections during property transactions – this requires an intermediary to upload data to a blockchain network, requiring trust.

While future iterations of smart contracts and other crypto innovations might iron out their kinks over time, Morningstar argued future adoption will be driven by convergence with existing players in finance, not in spite of them.

Offering a real-world example of where this has happened, the research pointed to Visa’s partnership with Coinbase to offer a debit card to the app’s customers, allowing them to make purchases using their Coinbase account.

“Service providers sacrifice the principles of decentralisation for convenience – during the transaction, Visa converts cryptocurrency into the consumer's home fiat currency for the merchant,” Morningstar explained. “Nevertheless, the partnership reached $2.5bn in transactions in the fiscal first quarter of 2022.

“We expect more partnerships between crypto native, centralised companies seeking credibility and incumbents that want to preserve their market share.”

The road to intrinsic value

Another challenge often levelled against crypto assets is the lack of justification for their valuations. This is a concern Morningstar shared, stating the asset class is driven by “speculative narratives” and “the absence of intrinsic valuations disqualifies cryptocurrency as a fundamental investment”.

However, the report suggested this does not have to be the case. While integration with established players might expand cryptos’ payments and transactions use cases, altcoins and their blockchain networks may offer several other avenues for real-world applications.

For instance, the terra blockchain creates stablecoin tokens, polkadot transports information and assets between other blockchains, SAND acts as an in-game currency facilitating metaverse applications and the cardano blockchain can embed smart contracts that are fulfilled using its native token.

“Specialisation has blunted investor interest in the past, but altcoins’ swelling market share has reshaped this grab bag into a force to be reckoned with,” Morningstar continued.“As the cryptocurrency market matures, we expect that altcoins will behave much more in line with the narrow subsegments of the market to which they belong.”

In such a scenario, the report said valuations could be based on the rate of adoption of the industries they are involved in.

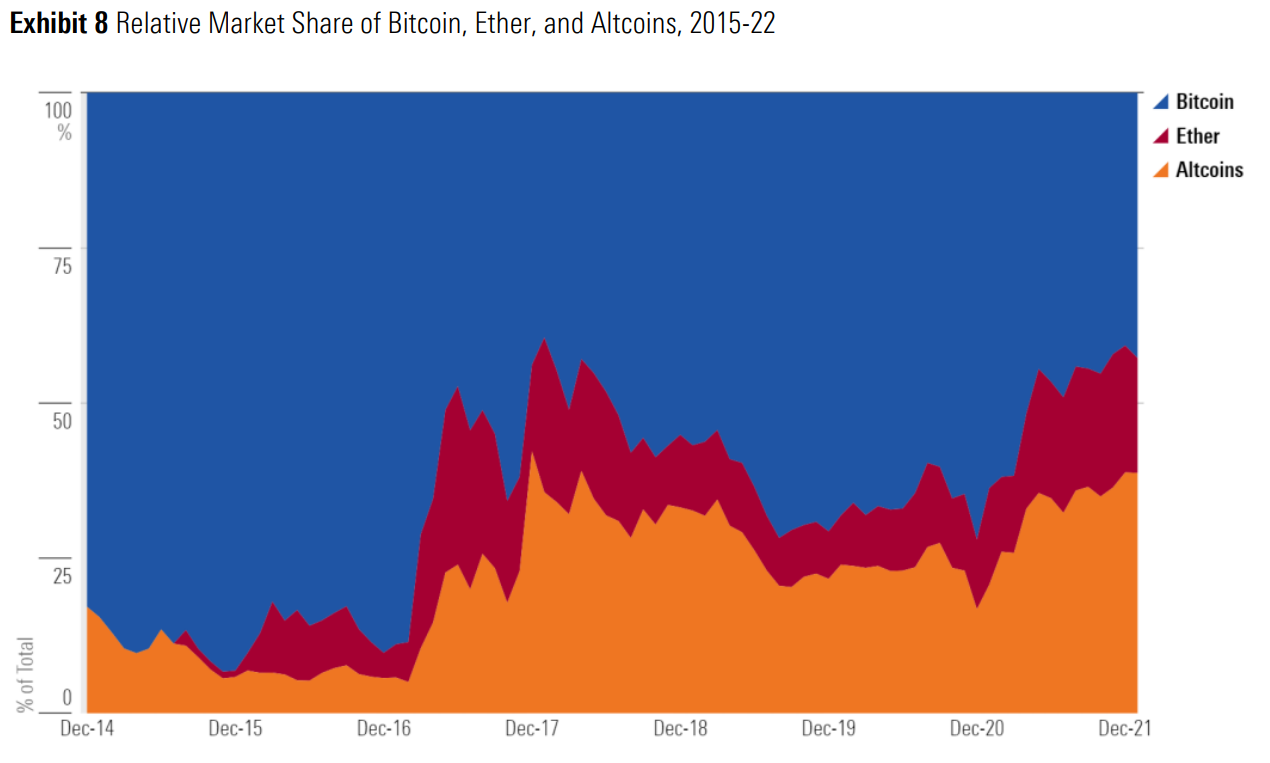

It is also worth noting the remarkable speed at which altcoins have captured investors’ imaginations with their potential use cases.

Bitcoin’s market share stood at 90% in December 2016, falling to 70% by January 2021 and then again to just 43% by January this year. Part of this owes to users flocking to the ethereum blockchain but subsequent cost hikes associated with trading on the network have made investors turn to previously unloved alternatives.

Altcoins now claim more than a third of crypto market share.

Source: Morningstar and CoinGecko

Crime and punishment

An uncomfortable talking point often raised against crypto assets – for good reason – is the asset class’s misfortune in being used by and targeted by criminals.

Morningstar highlighted a worrying 79% year-on-year surge in fraudulent crypto activity but said transactions linked to fraud have still fallen 1.3% in “recent years”, now accounting for 0.15% of all transactions.

Regardless, the report warned “a single scam can have devastating consequences” and rapid innovation has been exploited in hacks such as the Poly Network breach of August 2021 and the Wormhole hack of February 2022 – which cumulatively wiped out over $1bn in value.

Instances such as these and the lack of “smart, measured regulation” are key barriers to future crypto adoption argued Morningstar, a point agreed upon by 55% of US-based financial advisers and 39% of institutional investors globally.

The gold comparison

A popular game among crypto proponents has been to describe bitcoin as the new ‘digital gold’ and although crypto in general has “virtually zero sensitivity” to established risk factors, Morningstar said bitcoin behaves too much like a risk asset to deserve comparisons to the safe haven.

Between January 2015 and January 2022, MVIS CryptoCompare Digital Assets 100 index was five times as volatile as the MSCI ACWI index. Interestingly, this includes stablecoins pegged to fiat – excluding these, the picture for most crypto assets is likely even more extreme.

“Gold’s alternate use cases buffer the metal during periods of market stress so that it does not depend on market sentiment to create liquidity,” the research argued. “We believe that relative to gold, bitcoin lacks enough outside applications to outweigh the impact of market events on its price, limiting its usefulness as a store of value.”

Too big to ignore

Regardless of doubts and teething issues, Morningstar highlighted the simple fact crypto has gathered scale at a “staggering” pace over the past seven years.

The market cap of the top 100 coins in January 2015 came to around $5.2bn in January 2015. Seven years later, the top hundred assets had a market cap of almost $1.7trn – a more than three-hundred-fold increase.

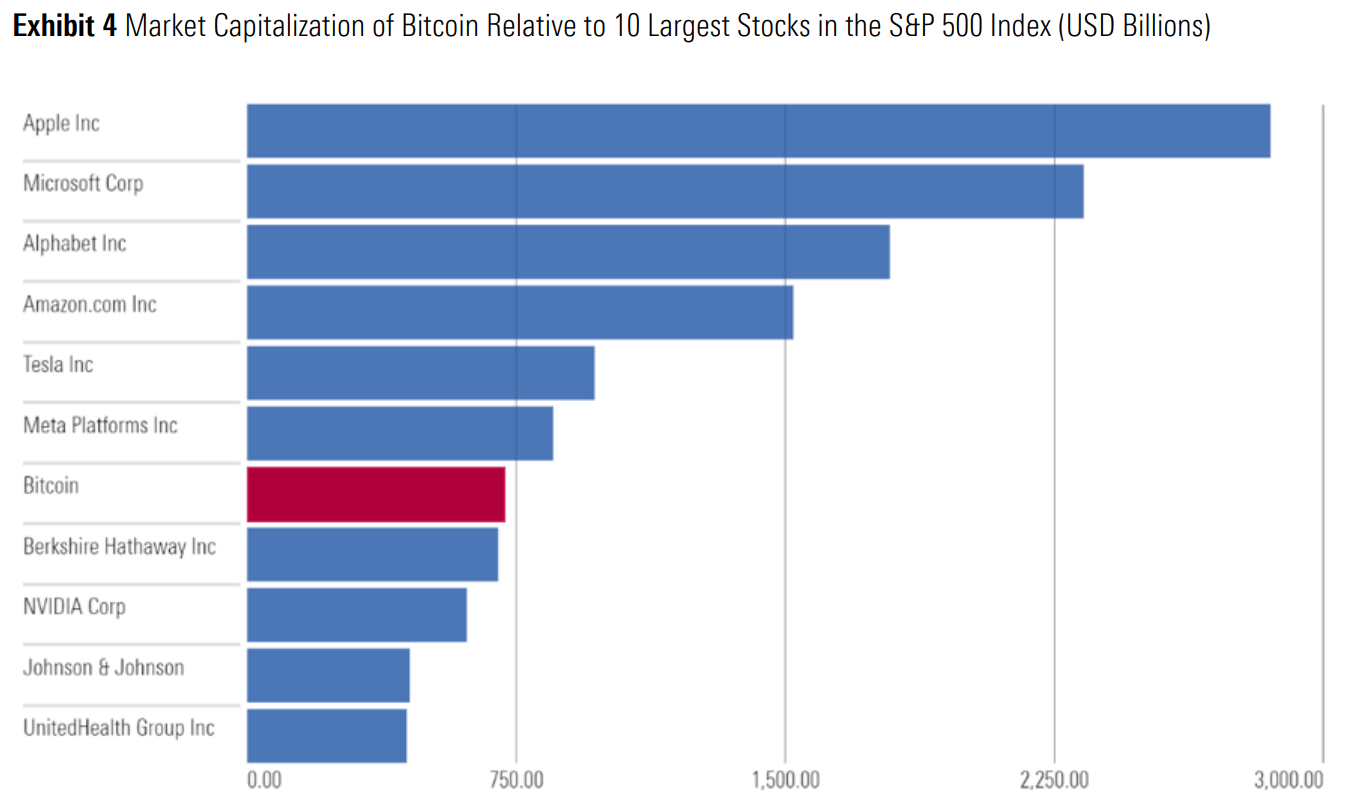

Morningstar said crypto assets now represent the fourth-most popular type of investment behind only stocks, mutual funds and bonds, with bitcoin’s market cap alone large enough to rank in the top 10 constituents of the S&P 500.

Source: Morningstar and CoinGecko

Interestingly, the research found most of this interest has been expressed via direct investment and derivatives, whereas digital asset funds claim assets under management (AUM) of just $47bn – equivalent to 0.2% of mutual fund and ETF assets.

Continued product innovation and evolution in regulator attitudes – such as the first spot crypto ETFs in the US and retail access to crypto exchange-traded products (ETPs) in the UK – will be key to further development on this front.

Related articles