Smart beta has emerged as one of the winners from a “rollercoaster” year to date in terms of investment according to the mid-year review from State Street Global Advisers.

Speaking earlier today, the head of research for SPDR ETFs in the EMEA region Antoine Lesné showed that fixed income has dominated flows in the first six months as investors have reacted to the backdrop of markets remining positive despite global instability.

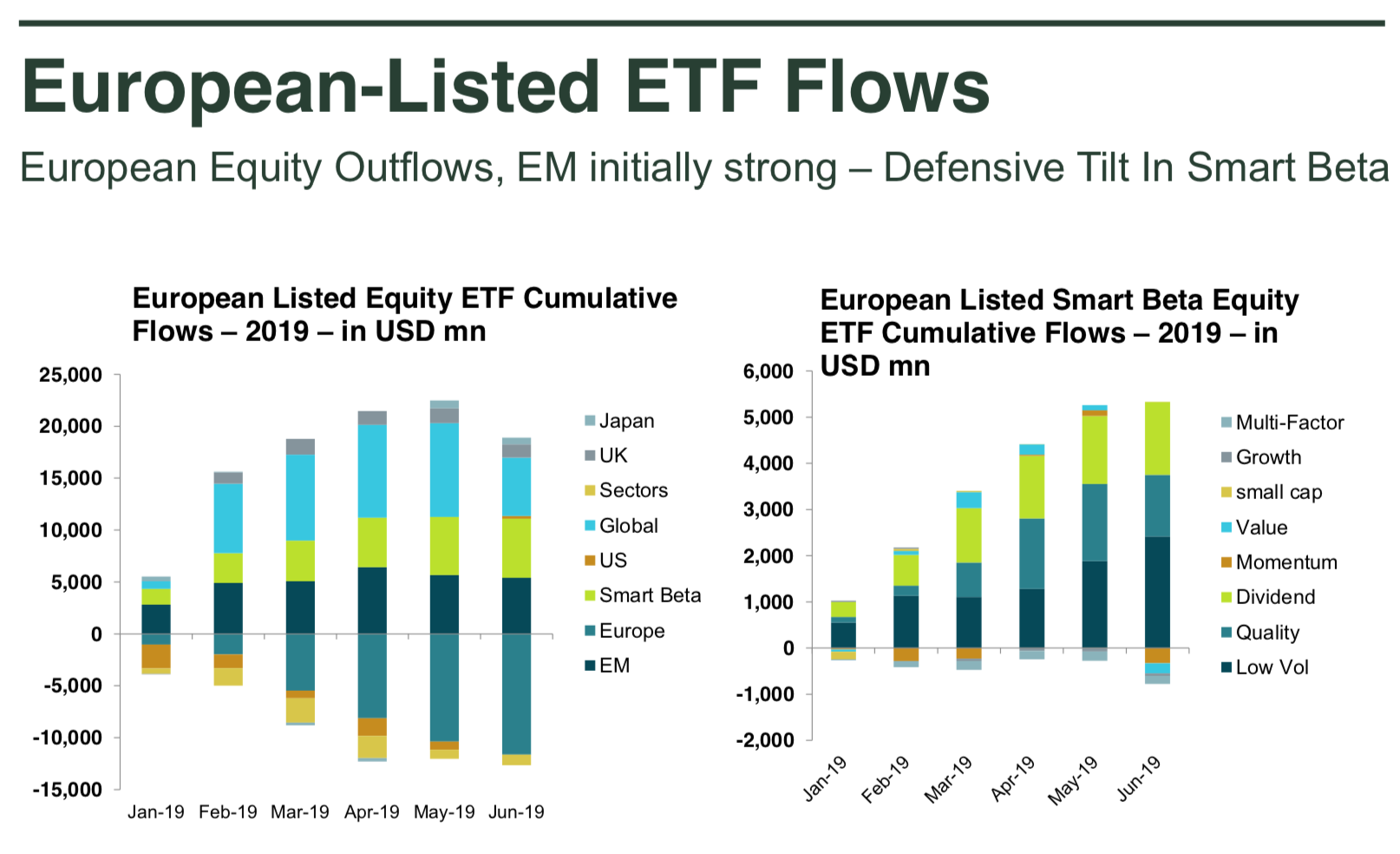

The nervousness has also been apparent in the equity flows where the degree of interest in smart beta was specifically namechecked.

“For me the very noticeable element is that a lot of investors have gone into smart beta,” said Lesné. “Looking at the breakdown, the factors that have been bought – the type of smart beta strategy targeted by investors – are defensive strategies. So (people are) invested in equities but remaining cautious and defensive is resonating pretty well with investors.”

He noted that the three most popular smart beta factors were low volatility, quality and dividends.

Rick Lacaille, State Street’s global chief investment officer, said that despite the recent signs of stabilisation, particularly on the China/US trade dispute, it has been “an anxious time for the economy”.

But the still, the fundamentals were still “not as bad as people think.”

“The data is consistent with a slowdown rather than a recession,” he said. “We are a little more anxious about Europe… and there are better growth opportunities in the emerging world.”

This week the US economic recovery became the longest-lived in history hitting the 121st month of expansion. But Lacaille pointed out that the recovery was also shallow.

“We’re uncomfortably risk-on,” he said. “We are overweight equities and underweight the safe havens. But overall we are positive on the US and the emerging markets. And Europe is a little bit neutral.”

Fixed income

Speaking about the fixed income inflows, Lesné said the company had seen inflows into EM debt. “This is based on growth in emerging markets is not going to be too strong, that most central banks will remain accommodative from a monetary policy standpoint and valuations of currencies are at a three-year low.”

As for current positioning, Lesné pointed to what State Street was suggesting were the best bets for those looking to hedge against softening economic data.

“In that context, you might want to go back to neutrality; and potentially look for convexity, as a hedge against bad news by buying long-dated bonds. Maybe the Treasury 15-year plus gilt. But we think there is further to run and continuing to invest in equities while looking for yield is still an interesting play.”