Editor's note:

This article has been updated to specify the time period of the simulation. (7/12/18)

A new line of ETFs is coming to market that offers insurance-like strategies for retail investors. As part of that, TransAmerica-backed DeltaShares is listing a "new managed risk" ETF for emerging markets. The DeltaShares S&P Emerging Markets Managed Risk ETF (DMRE) will track a highly sophisticated set of indexes from S&P.

DMRE has three indexes: an equity index, a fixed income index, and a cash index. DMRE then "manages risk" by jumping between the three indexes, depending how volatile they are. It then uses a synthetic put option to tone down the risk of the equity and fixed income indexes even more.

While the indices are complex, the investment objective is simple: bag the upside of the equity market, while only getting the downside of bonds and cash when volatility shoots up.

The fund will charge 0.60%.

Analysis - will they work?

The question for today's managed risk listing is: will it actually manage any risk?

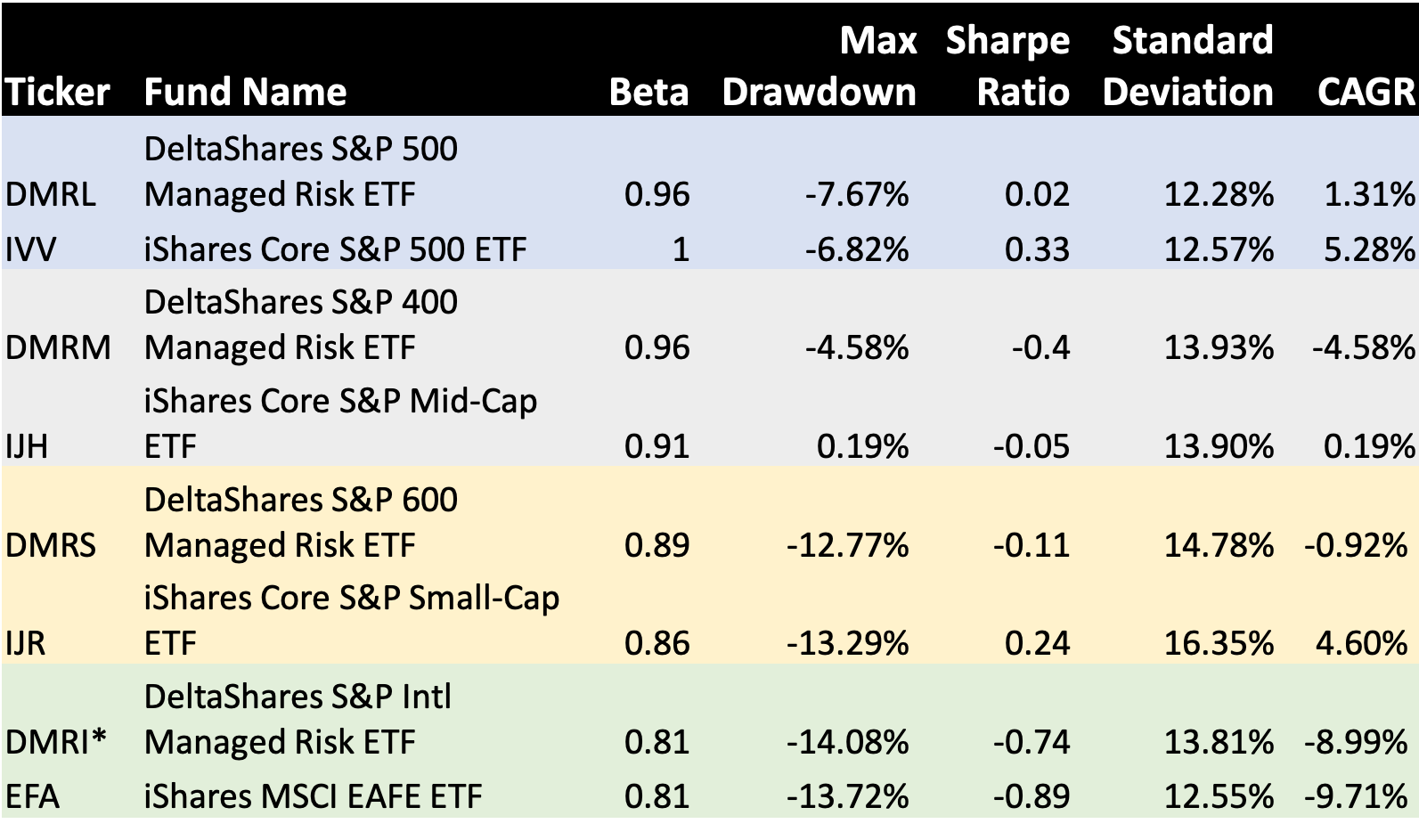

This may sound rude, but we have good reason for asking. We ran simulations on every managed risk ETF by DeltaShares, comparing their past performance to their plain vanilla benchmarks year-to-date. In almost every case, we found that they took on more risk (standard deviations, drawdowns) and underperformed.

DMRI, the Europe and Asia Pacific fund, appears to be an exception - although it is hard to tell how much of its outperformance comes from excluding Korea. (DMRI tracks a boutique index from S&P that excludes Korea, there is no obvious plain vanilla pairing to compare it to). The underperformance has occurred the past 3 months, as volatility picked up.