ETFs with a 0% fee sounds like an incredible offer. The ETFs on offer track either US equities or volatility, are listed in the US and have an expense ratio of 0% until at least next year. So should you invest in one?

Well, the first thing to say is that these 0% ETFs have come from relatively new players in the ETF space – online lender SoFi and ETF and data provider Salt Financial. It is a pretty brave move to stand out from the competition and when you take into consideration the costs of launching a fund you are going to lose money on day one and no ETF is going to pay its way to $10m overnight or in seed money.

Dave Nadig, ETF.com’s managing director, explains that the question every new fund and firm faces is "what do I do to get to critical mass?”

He says: “One way is to spend a lot of money you do not have on marketing. This is sort of the default. You hire a bunch of wholesalers, you take out some ads and you pray folks like your fund enough to give you the $100 million or so to get to break even.”

The alternative to this is to do what newcomers SoFi and Salt Financial are doing and take the money you might spend on marketing and instead lower the fees (to 0%) for a year or so.

“It is a teaser to stand out in the crowd, so you can get that $100 million (or whatever your breakeven is) and then go back to a normal level of expense, and then have a business.”

Online lender SoFi has said it will waive the 0.19% annual TER on the two ETFs it has launched until June next year. The ETFs on offer are the SoFi Select 500 (SFY), which tracks an index of large growing US stocks, and the SoFi Next 500 (SFYX), which tracks an index of shares of midsize and smaller US firms.

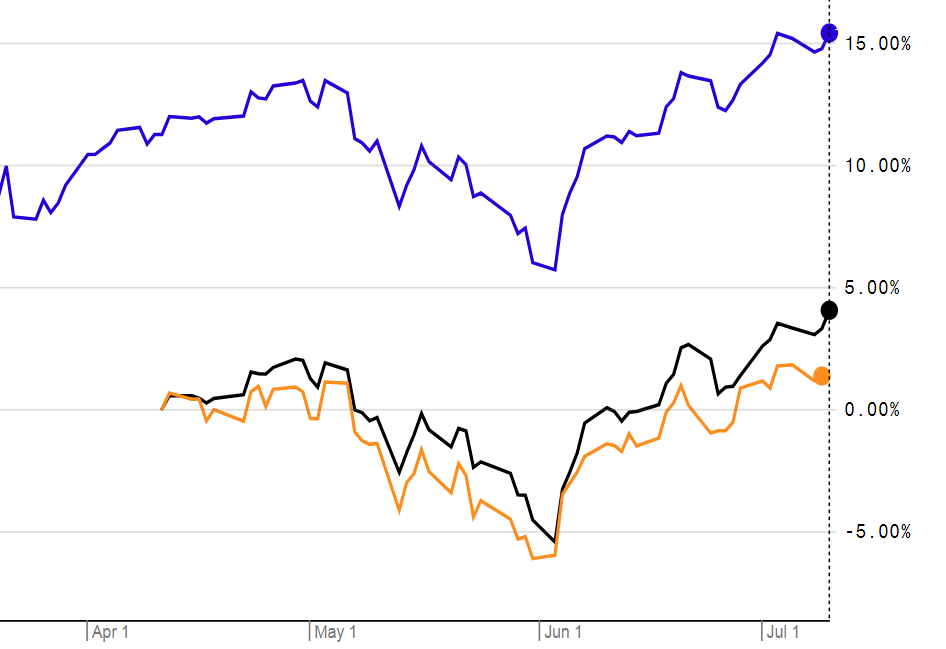

Performance has been unremarkable since launch and is charted below; SFY in black, SFYX in orange and the S&P 500 index in purple.

Source: Bloomberg

Nadig explains that in SoFi's case, the connection is tricky, because, as an ETF, anyone could buy their free fund, and get a "free ride" on their marketing efforts. Maybe this gives them enough press and visibility to drive a ton of business in other things where they do make money, maybe not. It is a big gamble.

This is unlike Salt Financial, which is a dedicated ETF and data provider, albeit new to the market – it launched at the beginning of last year as a niche index provider.

The Salt Low truBeta US Market ETF tracks the low truBeta index, which targets lower volatility and stocks that tend to maintain a more stable beta over time. The basis of this is that these stocks are able to potentially outperform the broader market and traditional low volatility index strategies in terms of risk-adjusted returns.

Tony Barchetto, founder and CIO at Salt Financial, said in a statement. “For the first time, investors are given the ability to customize their beta exposure with what we believe is a more responsive and accurate market risk measurement, helping optimize the risk/reward trade-offs in their portfolios.”

But market watchers argue that this fixation on low costs or now costs, while making headlines, could be bad for the industry.

Hector McNeil: "Costs are only one thing that investors need to consider before choosing an ETF, or any other fund. Replication style and quality, tracking difference, and (especially in light of Woodford) liquidity are also important considerations that risk being overlooked by investors who are dazzled by a shiny ‘free’ ETF.

"If negative fees are the only selling point a fund has to offer, I would question whether this is something I want to invest in – where’s the catch? I wouldn’t want a dentist who was so desperate for work that he paid me to do a root canal, and I feel the same about a fund manager who can’t attract investors based on the investment theme on offer."

The funds in question were launched in April this year. So, should you put them in your portfolio?

Views are mixed.

On the one hand, the difference between a low fee of 0.03% and 0% is material. But bear in mind there might be a catch.

If you want to test the market for a few months then maybe, but always check any entrance and exit fees. Similarly, know when the 0% free term is going to end.

And be aware of other costs.

McNeil says: "It is really not good for the end consumer because price should only be one factor when making an investment choice. For example, while you may pay zero fees for one tracker, you may have to shift your money on to a specific platform, which could cost more money and leave you out of the market for a significant period of time.

"Furthermore, there is the risk that you may also then find you have a limited choice of other funds or products (assuming you do not only buy the single, zero-fee tracker)."

The only other fund offering to have 0% fees is Fidelity who launched a range of 0% mutual funds in 2018. Save for a few big differences, Fidelity has over 500 mutual funds on offer, only two are free – so it’s fairly easy to see where they are making their money.

Nadig adds that Fidelity’s funds are also only available if you have a Fidelity account. “So the zero-fee funds are purely to drive new customer acquisition. SoFi, for their part, isn't really even in the asset management business, they’re in the personal loan/student loan/refinancing business. They're providing their "free funds" to folks to encourage them to work with them on other stuff.”

It seems the industry is not sold on the idea yet either.

McNeil says: "Launching a zero-fee ETF is ultimately an anti-competitive move that risks stifling new entrants to the ETF industry and the development of real value-add products. Instead of focusing on gimmicks, investors and regulators should look more at the dominant ETF issuers that use large, legacy products as cash cows while issuing new lower cost funds.

"But it will be harder for this [zero fee ETFs] to take root in Europe because it is more competitive here, with far more indices to monitor and focus on. The audience is also far less ‘retail’ than the US," he says.

The ETFs on offer are listed in the US on NYSE Arca, they have yet to hit Europe.

SFY

(until June 2020 then 0.19%)

SFYX

(until June 2020 then 0.19%)

LSLT

ETFTERINDEXEXCHANGESofi Select 500 ETF0%Solactive SoFi US 500 Growth IndexNYSE ArcaSoFi Next 5000%Solactive SoFi US Next 500 Growth IndexNYSE ArcaSalt Low truBeta US Market ETF0% (until April next year then 0.29%)Salt Low truBeta US Market IndexCboe BZX