A survey of portfolio managers and senior asset management decision-makers has found that at present they prefer direct bond exposure over either active funds or index funds and ETFs.

The survey was conducted by Elston Consulting and head of research Henry Cobbe suggests the data points to the adoption of ETFs within the bond arena as not being linked to the active versus passive debate that currently swirls around equity investing.

“While there is reasonable awareness of bond ETFs, we believe there is scope for increasing education around advantages of using bond ETFs over direct securities for diversification and accessibility purposes,” he adds.

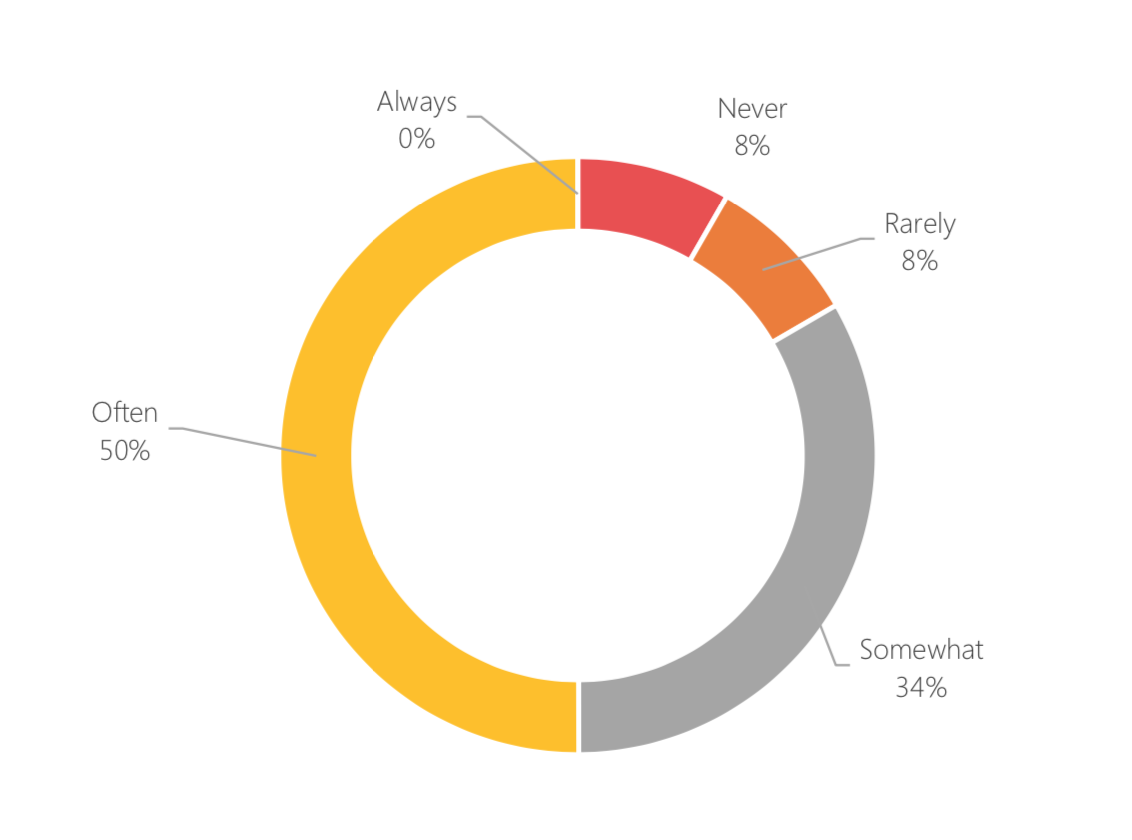

Asked specifically the extent to which they used either ETFs or index funds, the managers – who control over £500bn in assets under management – 50% said they used them often while a further 34% said they used them somewhat.

Table 1: To what extent do you access a bond exposure using index funds/ETFs?

Source: Elston Consulting

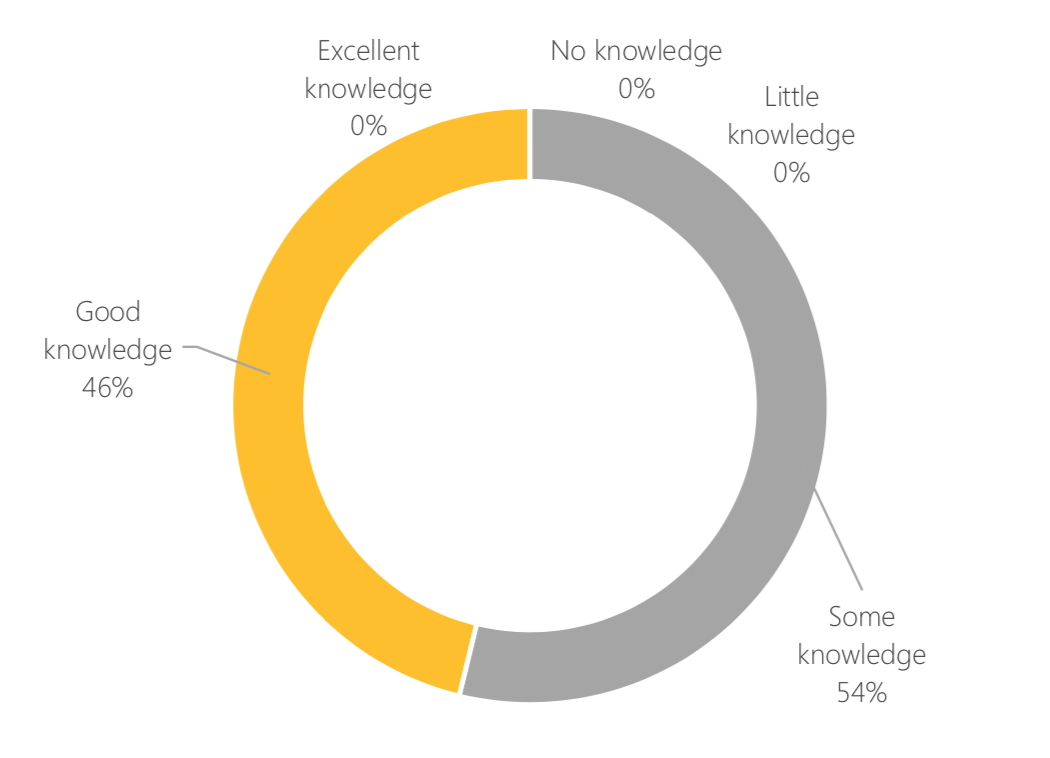

Encouragingly, the survey also found that knowledge of the availability of bond ETFs was reasonably high with 46% saying they had a good knowledge of the concept and a further 54% saying they had some knowledge. No respondents said they had no knowledge.

Table 2: How would you describe your knowledge of bond ETFs?

Source: Elston Consulting

However, when it comes to actual take-up, there is definitely a lag with 61.5% of respondents have a low exposure of between 0-20% dedicated to bond ETFs with a typical balanced mandate. Still, nearly 31% had between 40-60% exposure to bond ETFs while 7.7% had a 20-40% exposure.

In terms of what attracted the managers to bond ETFs, the most common response was diversification with the ability to access targeted exposures for lower nominal sizes than would be associated with accessing securities direct also given a mention. Simplicity of transaction was also mentioned by a number of respondents.

In terms of the concerns on the part of the managers when it comes to bind ETFs, the most common mention was liquidity, though the researchers at Elston suggested there might be some confusion among the respondents as to what that actually means. There was also a worry that index construction necessarily overweights the most indebted issuers.

Cobbe said these last answers were indicative of a general lack of knowledge and awareness of how bond ETF portfolios are constructed. He noted, for instance, that the concenrs around the overweighting of the most indebted issuers was not necessarily the case.

Meanwhile, on liquidity Cobbe pointed out that passive ETFs might actually have an advantage over active funds. “While bond ETF liquidity is only as good as its underlying assets, the ability to trade bond ETFs on exchange means there is a secondary market which does not existing for traditional active or index funds,” he said.

On the issue of greater awareness, Cobbe said that more could be done. “We believe there is scope for increasing education around advantages of using bond ETFs over direct securities for diversification and accessibility purposes.”

The survey was conducted in December last year on behalf of State Street Global Advisors.