Big Tree Capital’s

Emerging Market Internet & Ecommerce UCITS ETF (EMQQ)

has surpassed $100m in assets under management (AUM) following a performance growth of 32.7% year-to-date.

With the assistance of white-label ETF platform HANetf, the firm listed EMQQ on the London Stock Exchange in October 2018.

It offers exposure to companies from the emerging markets that derive more than half of their profits from ecommerce or internet activities. This includes online retailers, social networks, online gaming and e-payments, to name a few.

This strategy has resulted in significant performance having delivered 16.6% in June 2020, adding to its YTD growth of 32.7%.

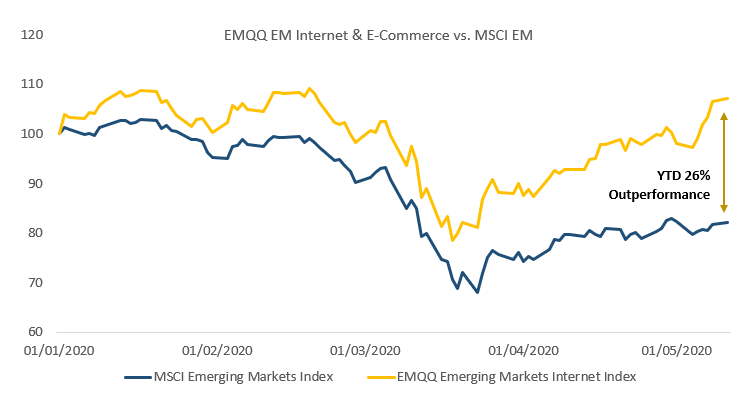

EMQQ has outperformed the MSCI Emerging Market index by 26% YTD.

Source: HANetf

Kevin Carter, CEO of Big Tree Capital, commented: “EMQQ has resonated as the story is simple – as emerging market consumers become wealthier, they will do more, buy more and work more via their mobile phones and tablets.

“EMQQ taps into the heart of this massive change that is affecting more than half of the world’s population.”

HANetf hires van Leeuwen as Benelux sales director

Hector McNeil (pictured), co-CEO of HANetf, added: “Kevin Carter put his faith in a new idea with a white-label platform that would manage all the operational, regulatory and distribution elements that make an ETF successful and we are delighted that we have helped support his vision of bringing EMQQ to European investors with a strong start.”

HANetf has also issued seven more products including the Royal Mint Gold ETC which the firm launched in February 2020 and a Bitcoin ETP launched by ETC Group in June.

Sign up to ETF Stream’s weekly email here