ETF Buyer Zurich in March marked ETF Stream’s inaugural event of outside of the UK, bringing leading ETF insights to Swiss professional investors within weeks of UBS’s acquisition of Credit Suisse.

Cutting through headlines of an uncertain monetary policy backdrop, the event sought to offer actionable insights on ETF asset allocation amid volatility while putting burgeoning investment opportunities – ESG and active management – under the microscope.

Kicking off the discussion, Jim Masturzo, CIO, multi-asset strategies at Research Affiliates, reflected on the end of 40 years of moderate inflation, stating his firm expects inflation, interest rates and in turn rate volatility to remain higher on a structural basis. However, volatility brings opportunity, he said.

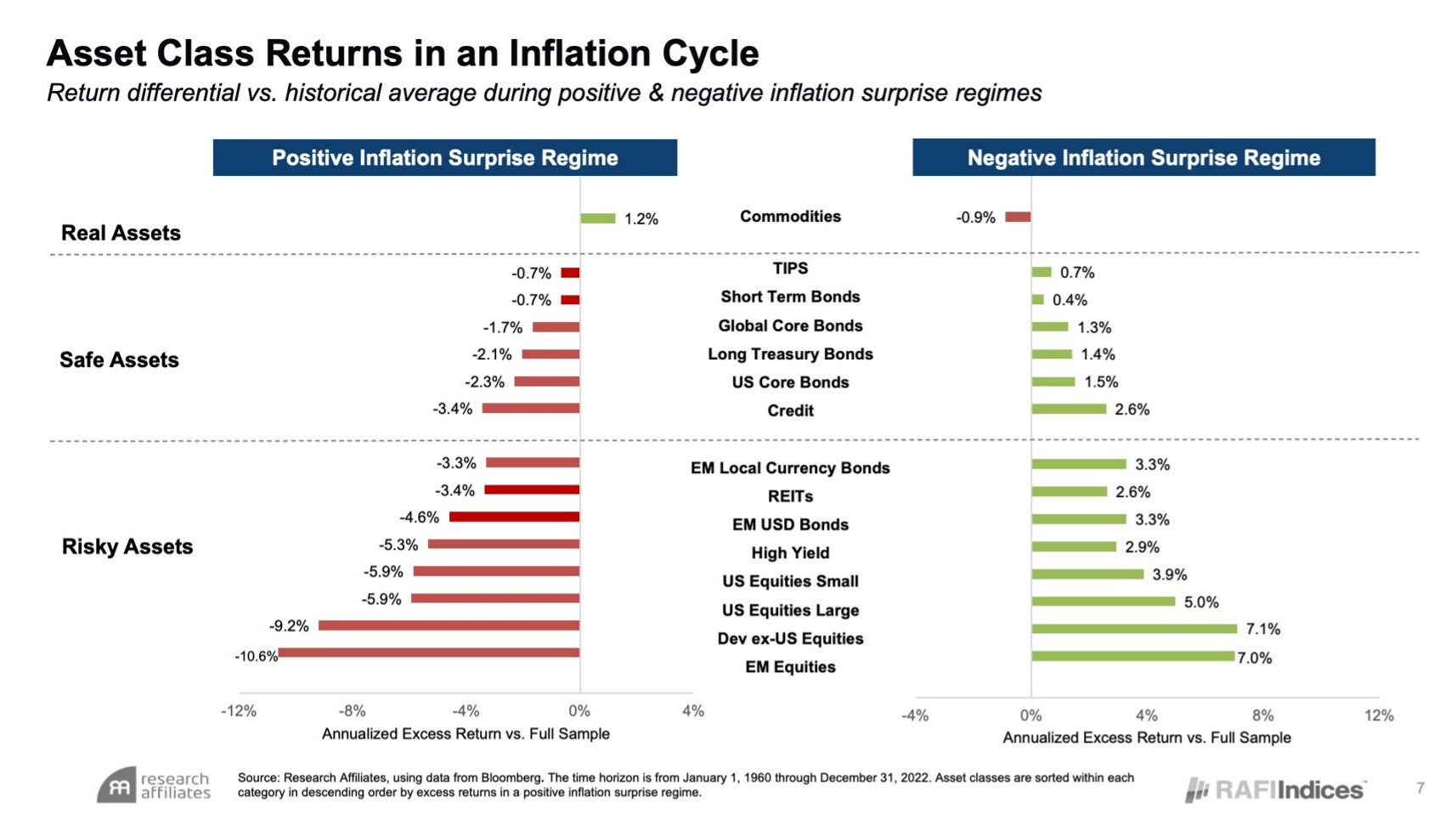

He noted what impacts asset classes more than high inflation are CPI readings that deviate from expectations.

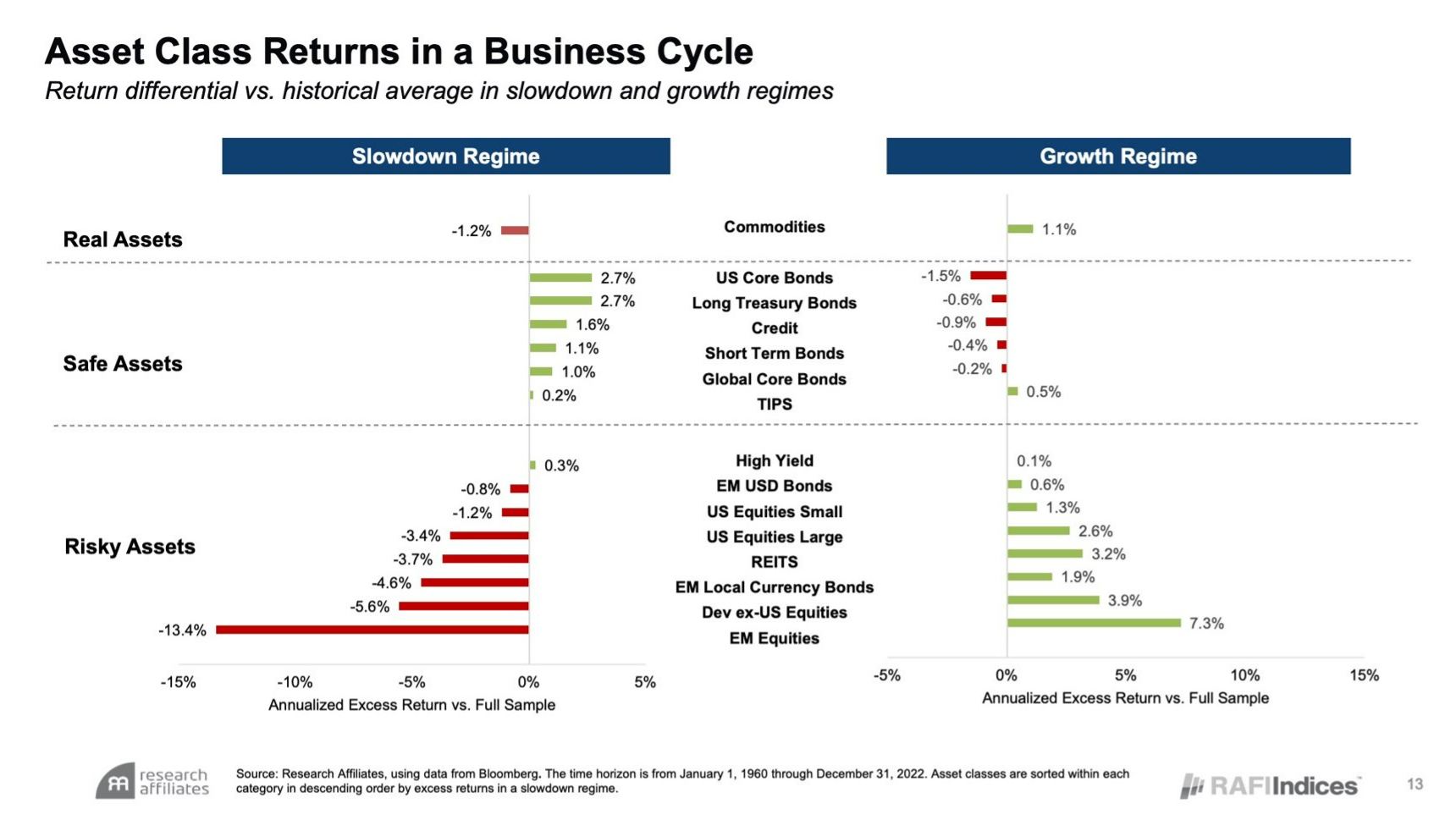

With purchasing managers’ index readings in negative territory and the US Treasury yield curve inverted, Masturzo said “our slowdown model is blinking red”. Against such a backdrop, “we are taking risk off the table”, he concluded.

Continuing in a similar tone, Antoine Denis, head of advisory at Syz Group, said the fastest pace of rate hikes in four decades has exposed “cracks” in banking and it is not the time for investors to be “dynamite fishing” in regional bank stocks, US commercial real estate and US credit cards.

Denis added his firm uses ETFs for their beta portfolios and currently view high quality investment grade and shorter-dated sovereigns favourably, however, high yield remains too high beta with equities.

Roman Mayer, global head of fund advisory at Union Bancaire Privée (UBP), warned recent banking uncertainty has shown investors risk having a “loss of memory”.

“These things evolve slowly and the first signs were last year. Now there is an avalanche of bad news and we are on thin ice”, he continued.

Mayer argued onlookers should not be reliant on central banks stepping in as they have done over the past 13 years. In fact, he views monetary policy as the biggest risk investors face, with the Federal Reserve shifting from “inflation is transitory”, to no longer providing forward guidance, to being scrutinised by the US Treasury.

On asset allocation, Mayer concluded equities remain “too complacent” with return on equity and margins too high. Instead, he favours floating rate bonds as tail risk remains in terminal rates – “there are no prizes for going further up the curve”, he said.

At the cutting edge on ESG

Next, attendees heard speakers offer a lay of the land on ESG products outside of passive tilt and exclude strategies.

First, Ilia Chelomianksi, portfolio manager at Fidelity International, said on his firm’s efforts to offer active fixed income exposure: “It is very hard as the target moves each month in line with regulatory developments.”

While the EU is constantly redefining and shifting the importance of its Sustainable Finance Disclosure Regulation (SFDR) classifications, the UK and Switzerland are developing their own frameworks, while Germany does not allow investors to buy bonds issued by sovereigns it does not consider “free”.

Chelomianski said his firm excludes issuers not rated by MSCI and those in prohibited sectors, however, as an active house, prefers engagement to exclusion where possible.

Ivan Durdevic, head of ETF distribution for Switzerland, Germany and Austria at JP Morgan Asset Management, spoke on the active approach to ESG, with his firm engaging 184 companies in 2022, equivalent to 71.2% of the basket of the JP Morgan Global Emerging Markets Research Enhanced Index Equity ESG UCITS ETF (JREM).

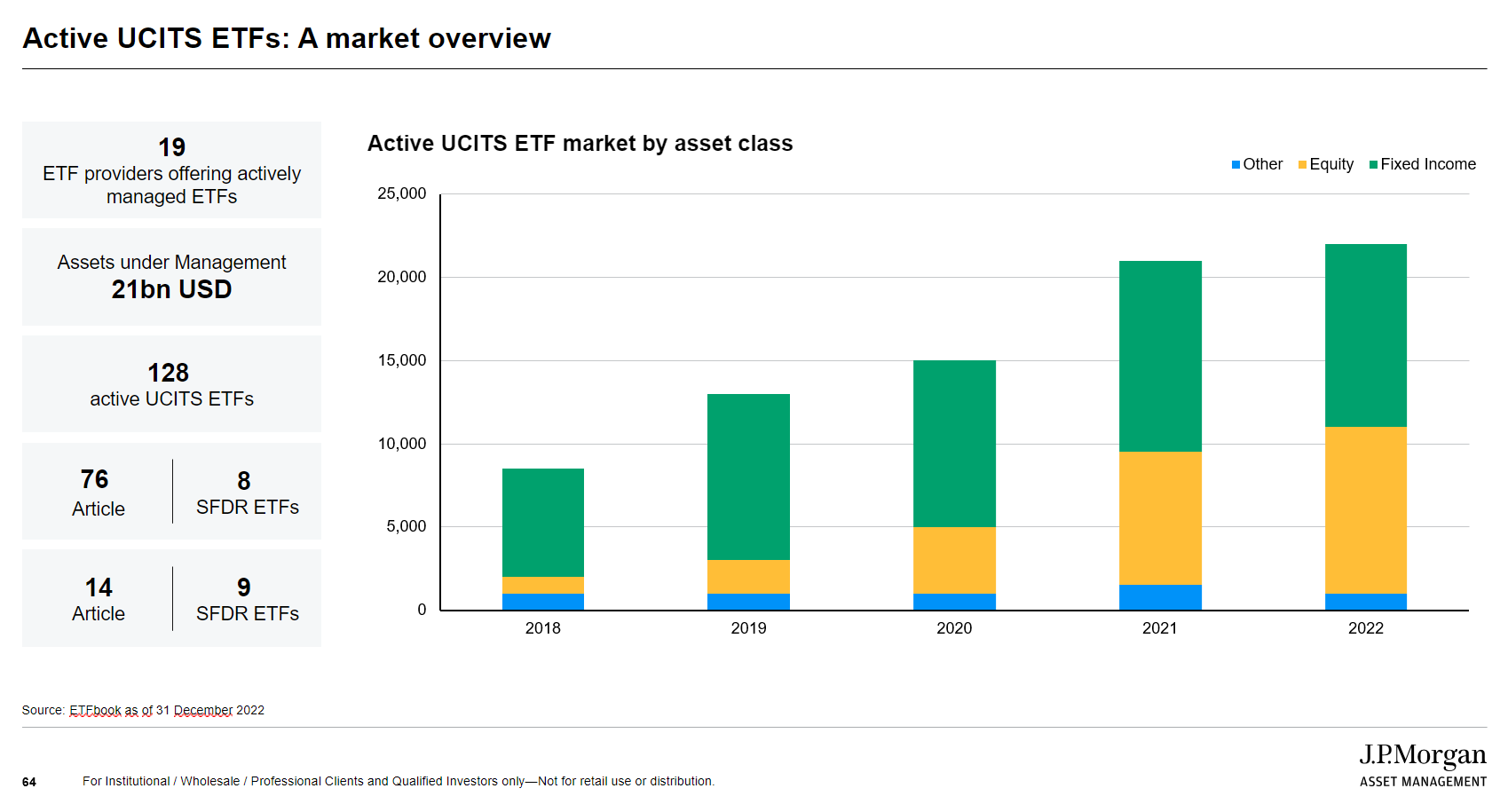

Investors are increasingly buying into active wrappers, Durdevic said, with active ETF assets jumping from $9bn in 2018 to $21bn by the end of 2022.

Gilles Boitel, head of Xtrackers sales Switzerland at DWS, set out new routes for impact investing through ETFs. First, he suggested equity baskets aligned with the UN’s 17 Sustainable Development Goals, whose 169 targets require at least $5trn investment per year until 2030 to be achieved.

Boitel then pointed to ETFs targeting green bonds which finance issuers’ projects in energy efficiency, emissions reduction and water management, however, he warned transparent use of bond proceeds is essential for product integrity.

Switzerland in focus

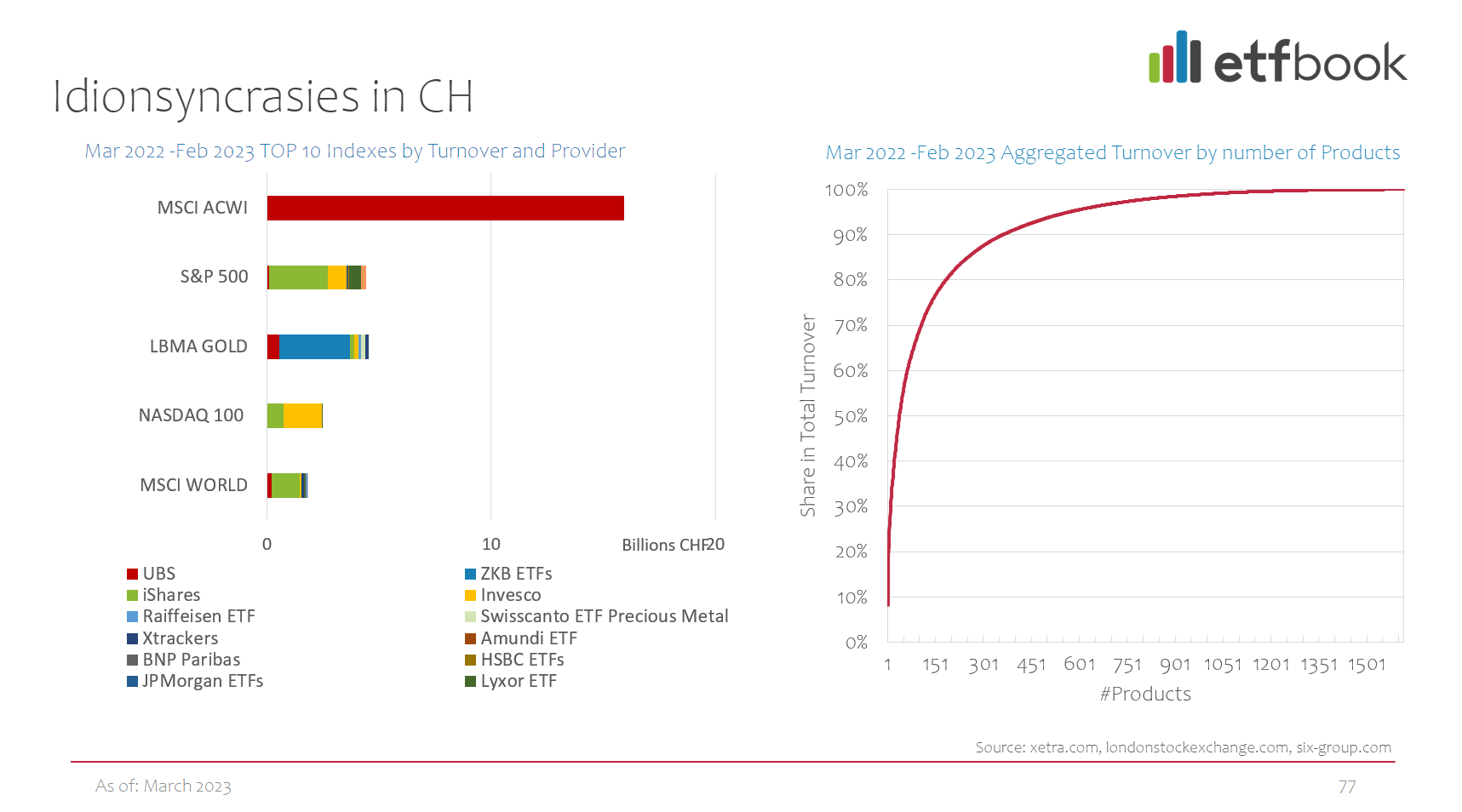

Rounding off the discussion was a look at the ETF market in Switzerland. Pawel Janus, co-founder and head of analytics at ETFbook, noted the country’s ETF volume over the past year was dominated by a single MSCI All Country World index exposure provided by UBS Asset Management.

André Buck, global head of sales and relationship management at SIX Swiss Exchange, added that since the first ETF was listed on his firm’s venue in 2000, more than 1700 wrapped products have since listed, boasting CHF94bn turnover last year.

He added over 1000 pension funds in the country manage $1.4trn in ETFs and some are now turning to ETFs. Already, around $200bn of ETF assets are housed in Switzerland.