ETF buyers are far more inclusive of global portfolios compared to regional and local exposures than inferred, according to a recent survey conducted by Vanguard.

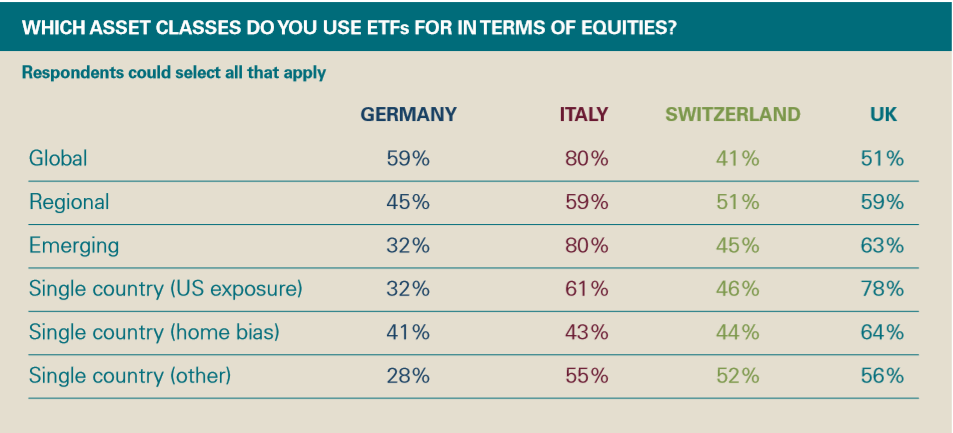

In its bid to shine a light on several myths which have developed in the ETF industry, Vanguard questioned 400 European ETF buyers asking for their ETF preferences. The leading asset manager discovered global ETFs was the most popular asset class in a number of countries, contrary to belief. The survey found majority of German (59%) and Italian (80%) ETF buyers invested in global funds compared to regional, emerging markets or single countries.

Over half (51%) of UK-based ETF buyers invest in global funds, but this was the lowest scored category for the UK. British investors are more attracted to US ETFs with 78% of those surveyed including the region in their portfolios.

Source: Vanguard

UK, German and Swiss investors do share one interest which is in single and multi-factor ETFs, with 61%, 42% and 47% of those surveyed choosing this type of product, respectively. 65 % of Italian investors prefer sector ETFs with 43% of those surveyed still selecting single and multi-factor ETFs.

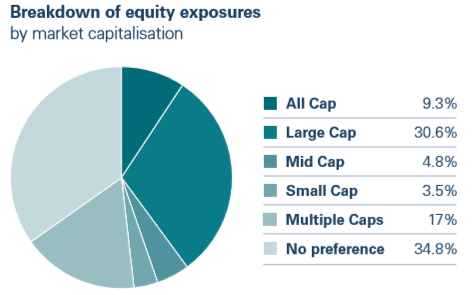

Furthermore, over a third (34.8%) of European ETF buyers have no preference of market cap exposure. For those that did have a preference, large cap ETFs were the clear favourite with 30.6% of the vote, significantly ahead of multiple cap ETFs with 17% in second. Only 3.5% of investors selected small cap exposure.

Source: Vanguard