Over a 12 month period from October 2017 to October 2018, the number of ETF investors in Australia grew 22%, reaching a new high of 385,000. This is according to BetaShares' recent report which studies the demographic of a typical ETF investor in Australia.

The survey questioned 8,000 investors and 800 advisors and found the average age of an ETF buyer has fallen by nearly 10%, from 51 years old in 2013 to 46 years old in 2018. The percentage of investors who are Millennials has also increased from 19% to 29%.

The Australian Stock Exchange ETF market cap was $44.8bn by the end of February this year, but BetaShares forecasts the market to grow to $55bn by the year's end.

One factor for the increase in adoption by younger generations is the rise in the number of financial advisors which use ETFs in Australia. There were 9,300 financial advisors using ETFs by the end of 2018, 1,500 more than 2017. BetaShares also reports that 45% of advisors surveyed said the adoption of ETFs has enabled them to service more clients.

With a growing number of Millennials investing in ETFs, it is unsurprising to see an increased interest in socially responsible investing. Environmental, Social and Governance (ESG) ETFs' market cap grew from $77m at the beginning of 2015 to $844m in 2018. A third of all Australian ETF investors have applied ESG into their portfolios in the last year.

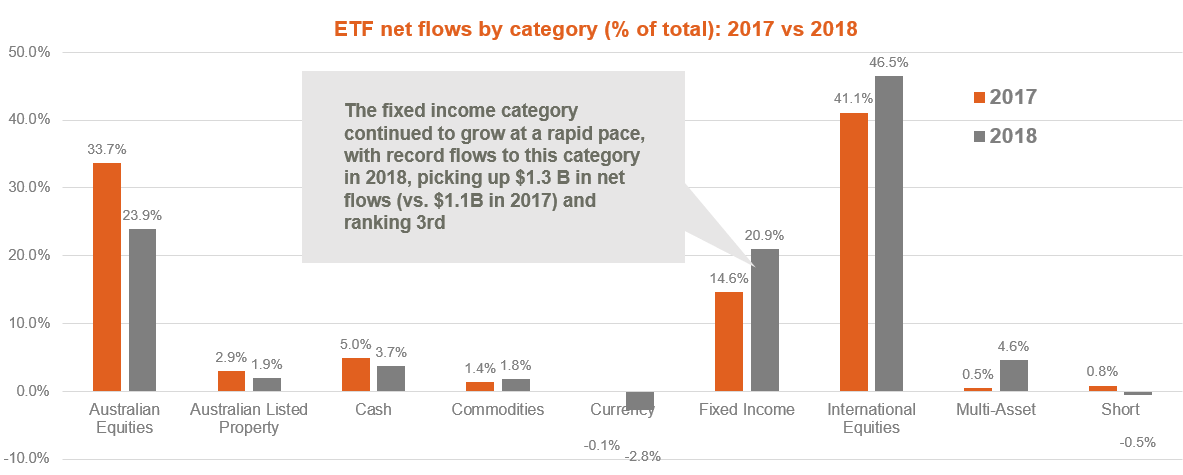

Whilst equity ETFs, both Australian and international, remain the largest in terms of flows, BetaShares expects there will be a wider adoption of fixed income products. Furthermore, the firm believes fixed income as well as other non-equity asset classes will be key drivers to the further adoption of ETFs.

Source: BetaShares