The first half of 2022 was been defined by peaks and troughs in activity as geopolitical and market headlines created an unsettling backdrop for bringing new strategies to market.

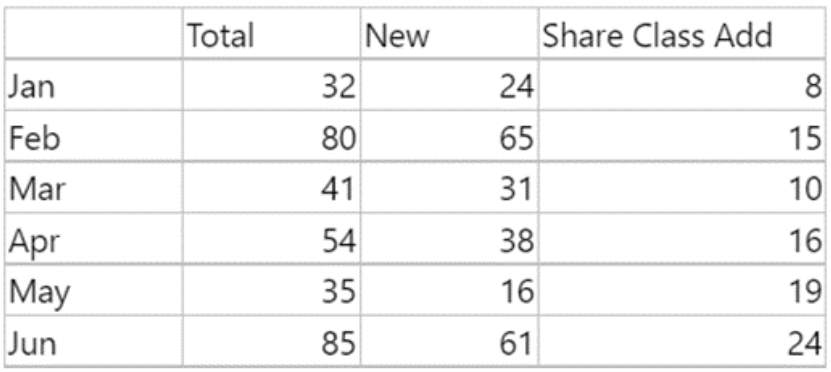

Coming off the festive period, ETF issuers in Europe got off to a lethargic start with 32 launches in January including new share classes, according to data from Bloomberg Intelligence.

The pace picked up in February with 65 new products and 80 total launches, however, this dropped off quickly following Russia’s invasion of Ukraine on 24 February.

As Russia ETFs halted trading and markets took stock of a conflict with global implications, new entrants in March were half what they were the previous month, with 31 new products and 41 total launches.

While picking up somewhat in April with 54 ETF launches, May marked a second lull with 35 launches and only 16 of these being new strategies.

From a product perspective, Henry Jim, ETF analyst at Bloomberg Intelligence – who spent 10 years developing ETFs at BlackRock, State Street Global Advisors and JP Morgan Asset Management – suggested the uncertainty around Ukraine could have made issuers pause some of their planned launches until the situation became clearer.

Supporting this, as markets became more acclimatised to Ukraine headlines, the number of launches picked up dramatically to 85 in June, with an impressive 61 of these being entirely new products.

Source: Bloomberg Intelligence

Interestingly, Michael Mohr, head of passive products at DWS, told ETF Stream recent launches had been unaffected by the geopolitical situation.

“The recent product launches were accompanied by varying product development schedules. The timing was not related in any way to the Ukraine crisis,” Mohr said.

Worth noting, though, that many of DWS’s recent launch efforts have been focused on filling out its ESG line-up. The iron is still hot for ESG in Europe – and its use case is less sensitive to short-term returns and volatility – so it makes sense the timetables for these ETFs were less impacted by a challenging period for most asset classes.

Looking ahead, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, suggested the US economy entering a technical recession could actually spur issuers to be more active in H2.

“Bad markets now will bring in more launches as issuers try to catch a recovery and get those inception performance numbers up,” he told ETF Stream.

This could also go some way to explaining the ETF launch spree in June, when US equities officially entered a bear market. Between its low on 16 June and 28 July, the S&P 500 has rallied 11.1%.

The ‘launch to catch a recovery’ activity also makes sense if asset managers follow the ‘priced-in’ or ‘soft landing’ narrative currently followed by risk-on investors, who are effectively betting on inflation easing quickly and the ‘Powell pivot’ to smaller hikes to begin at the next Federal Open Market Committee (FOMC) meeting in September.

Related articles