The contrasting fortunes of European-domiciled ETFs focused on large cap US funds and their European equivalents helped explain a dip in the inflow figures for August after a record-breaking July.

According to figures from Morningstar released this week, total net inflows for European-domiciled slowed to €3.5bn last month, their lowest level since September last year. Total assets under management hit €615bn in August compared to €613bn the previous month.

Morningstar ascribed the slackening of the pace of growth to equity ETF inflows hitting an 11-month low at the same time that demand for bond ETFs remained subdued and commodity ETPs suffered net redemptions for the first time in eight months.

Within the equity figures, the record-breaking performance of US large caps continued to attract huge investor interest.

The main US indices achieved record high in August and September culminating in the S&P 500 hitting 2,500 for the first time in mid-September.

US large-cap blend ETFs enjoyed the highest inflows in August, which Morningstar said was a rare feature in a year where European equity funds have dominated sales.

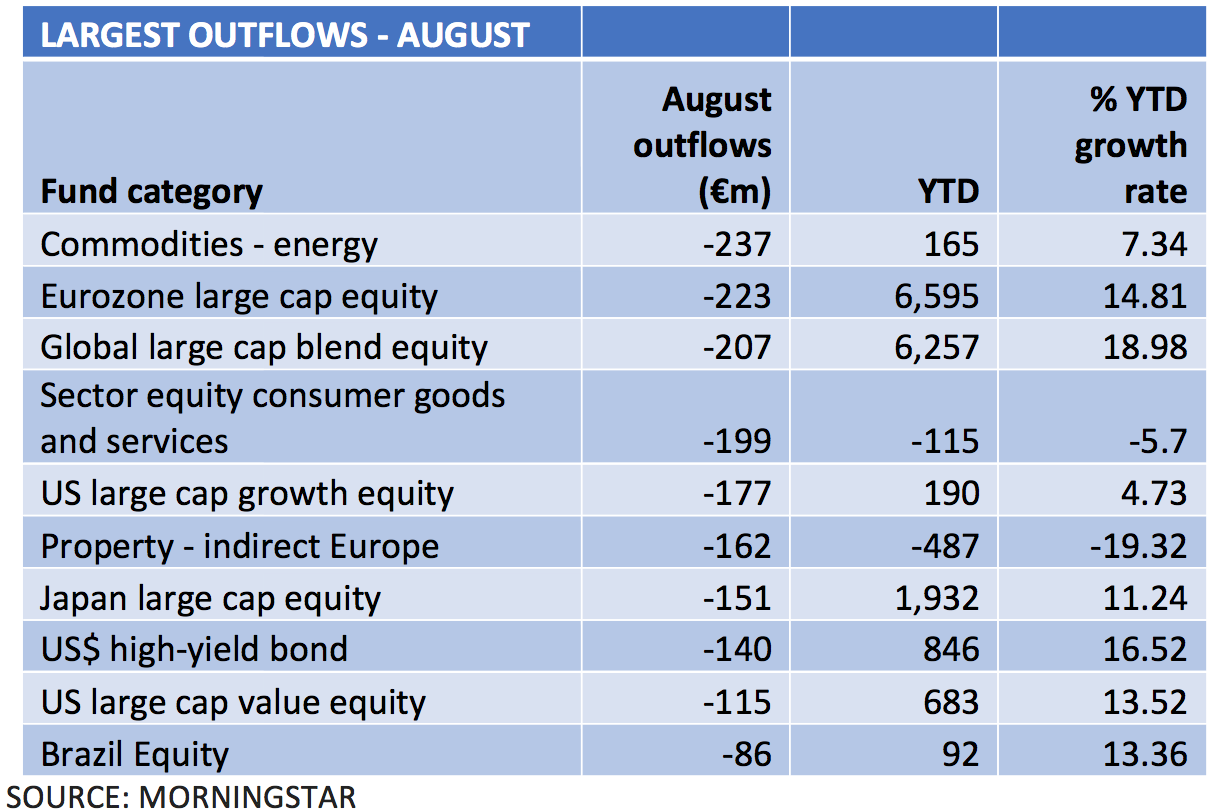

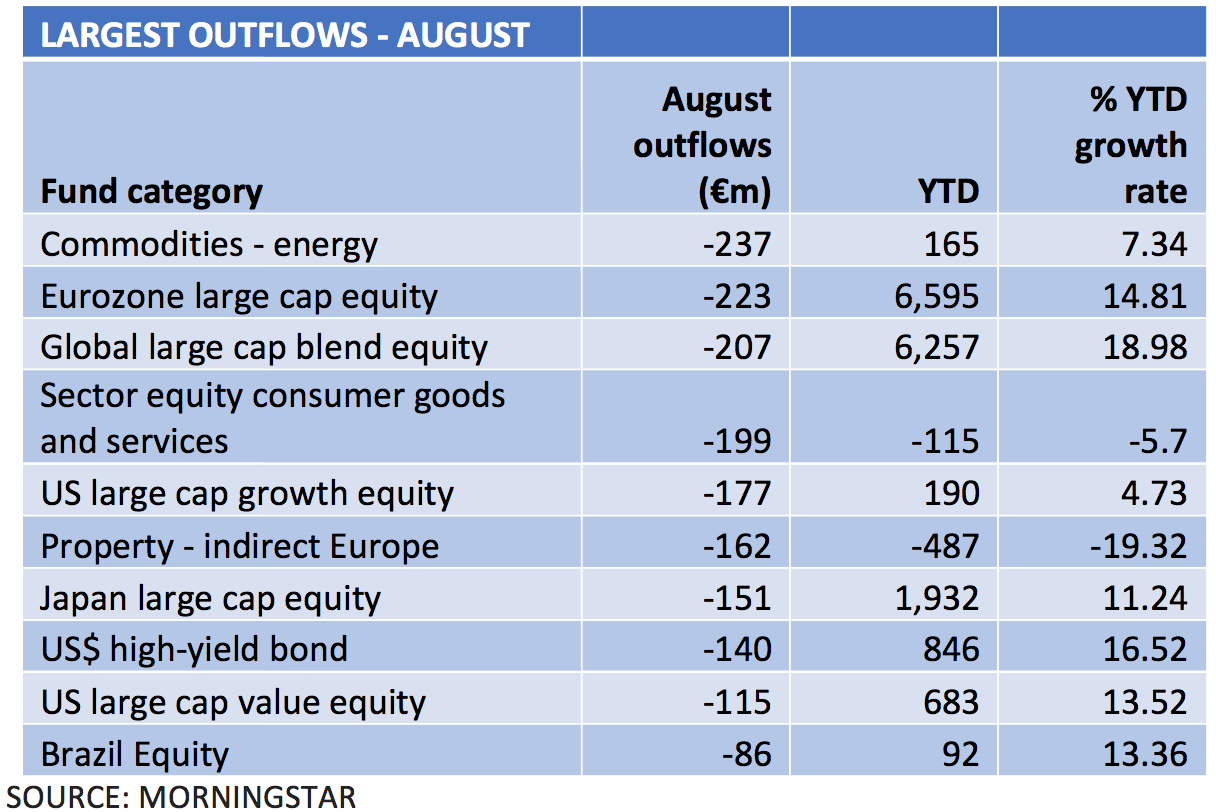

In contrast, The Eurozone large cap equity category saw net outflows in August for the first time since October 2016, with EURO STOXX 50 ETFs from iShares and ComStage posting the highest outflows.

Morningstar also pointed to a rare month of outflows from ETFs in the global large cap equity category as the MSCI World ETFs had their first negative month since April 2016.

In terms of fund categories, commodity funds saw net outflows of €237m, topping the €223m outflow level of European large-cap. (See table below).

Morningstar said that net redemptions were the second-highest on record in a one-month period after December 2016. It added that ETCs (exchange traded commodities) offered by ETF Securities that track WTI and Brent crude oil bore much of the pain.

ETF Securities topped the list of providers with the largest outflows at €141m for the month, followed by Deutsche's Xtrackers and then Amundi, both suffering on the equity side despite net inflows to fixed income products.

Financial sector ETFs continued to enjoy healthy inflows at €410m, second only to US large cap at €804m.

Ali Masarwah, EMEA editorial director for Morningstar, said the above-average financial services sector inflows followed record levels of interest in July. "The continuing demand for these highly cyclical assets indicates investors remain confident about the growth prospects for the Eurozone economy."

When it comes to emerging markets, a single fund - the Amundi ETF MSCI Emerging Markets fund - was the main driver of inflows for global emerging markets, taking in €370m. It accounted for almost all €392m net inflows into the category.