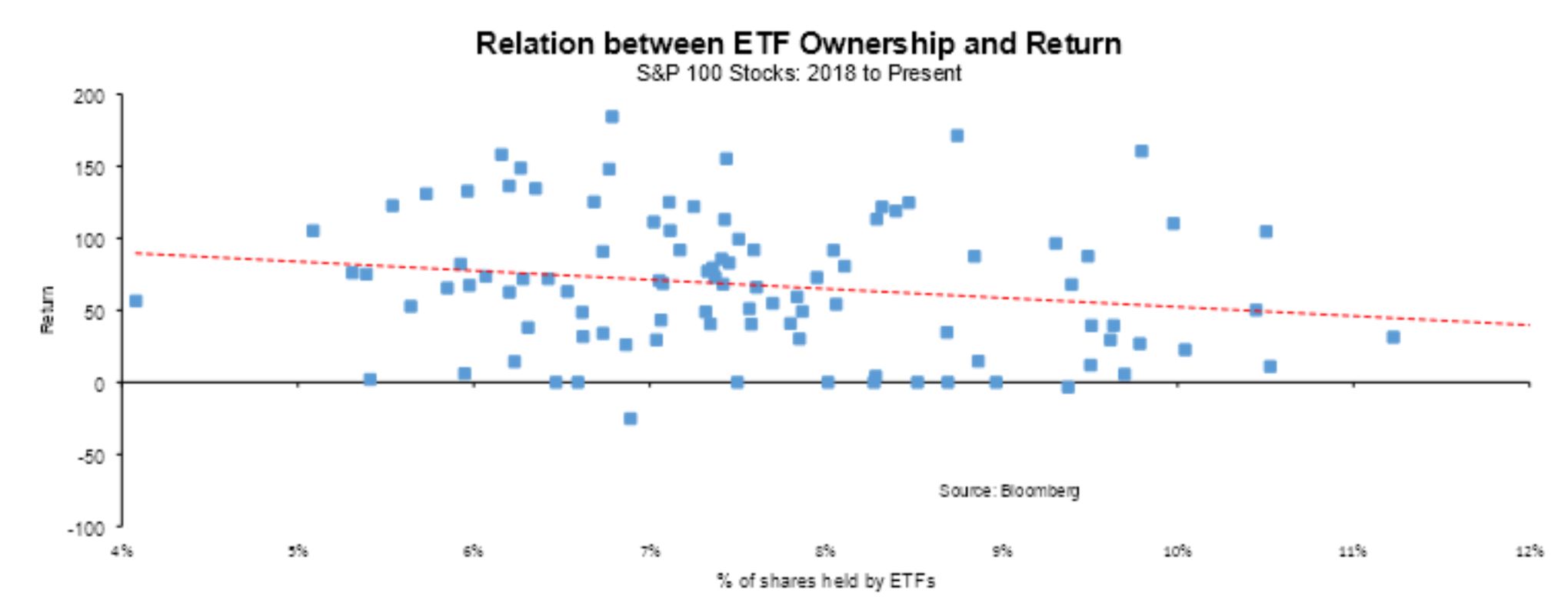

US large-cap stocks with high ETF ownership have underperformed companies relatively ignored by passives over the past three years, according to research conducted by Vincent Deluard, global macro strategist at StoneX Group.

The report, entitled The GARP lie and the ETF darling portfolio, found a link between the performance of stocks in the S&P 100 and their ETF ownership.

Since 2018, stocks that are owned heavily owned by ETFs have underperformed companies with lower ETF ownership.

Deluard, who is speaking at ETF Stream's ETF Ecosystem Unwrapped event on 26 May, said this was in line with critics’ view that “price-insensitive” passives have artificially increased valuations and depressed future returns.

However, he was quick to caution the tenuous relation: “ETF ownership explains just 3.5% of the variation in the S&P 100 stocks’ returns since 2018.”

Furthermore, he said further work needed to be done around the distortions the rise of ETFs causes in less liquid parts of the market such as junior gold miners or cybersecurity stocks.

Earlier this year, S&P Dow Jones Indices (SPDJI) revamped its clean energy index after significant inflows into two BlackRock ETFs tracking the index artificially drove up the price of many of the holdings.

“For now, money will keep flowing into index funds, whether we like it or not,” Deluard continued. “At the same time, bubbles, like stars, eventually collapse under their own gravity.”

Deluard is not the first – and definitely will not be the last – to warn about the dramatic rise of ETFs since the Global Financial Crisis (GFC). In 2016, an AllianceBernstein research note described ETFs as “worse than Marxism”, given that communists at least attempted to allocate capital efficiently.

The rise has also led to concerns around anti-competition risks – as highlighted by ETF Stream in 2019 – with BlackRock, State Street Global Advisors (SSGA) and Vanguard becoming the major shareholders for competing stocks in the same industries.

As a 2018 paper, entitled Anticompetitive Effects Of Common Ownership, said: “A long theoretical literature in industrial organisation predicts that partial common ownership of natural competitors by overlapping sets of investors can reduce firms’ incentives to compete: the benefits to one firm of competing aggressively – for example, gains in market share – come at the expense of firms that are part of the same investors’ portfolio, reducing total portfolio value.”

Another key consideration for Deluard is the rise of ESG that has become a dominant force within the ETF industry.

He highlighted companies that are in the S&P 500, Nasdaq 100, classified as both value and growth stocks and have a strong ESG rating – namely Google, Pepsi, Starbucks – to be the companies that are most impacted when the “passive bubble bursts”.

“Whether the passive/ESG bubble keeps inflating or eventually bursts, this is where the action is going to be,” he warned.