The term “smart marketing” is often used when writing about smart beta and there is good reason for this.

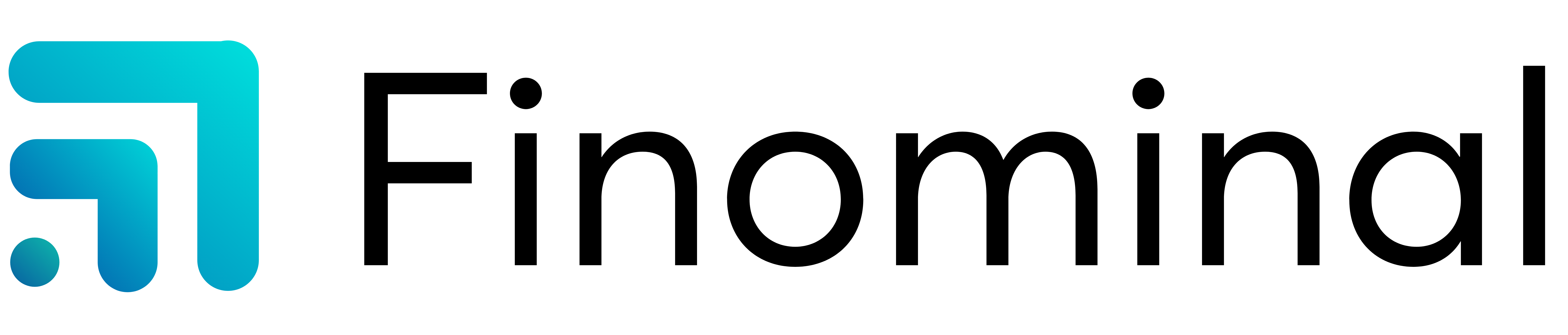

When studying the correlation between the largest smart beta ETFs and the S&P 500, one can see there is very little discrepancy.

According to analysis conducted by FactorResearch, the smart beta ETFs measured have a correlation above 0.9 to the S&P 500, across the value, growth, dividend, low vol, momentum and quality factors.

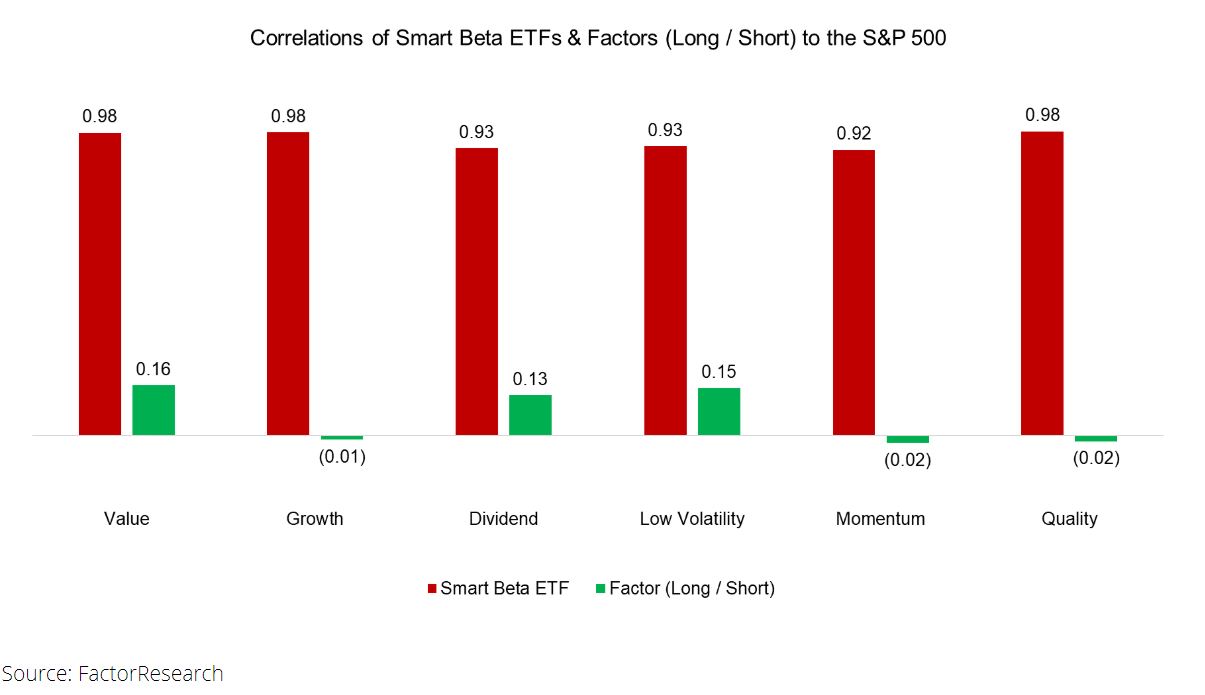

If the products ETF providers are offering have a correlation above 0.9 to the S&P 500, it seems strange why these products charge significantly more than their market cap counterparts.

This could explain why flows are slowing into smart beta products. According to data from Morningstar, inflows into global strategic beta ETPs hit $87bn last year, an organic growth rate of 11% but a deceleration of ETF market share gains.

Meanwhile, long/short factors from the academic research demonstrate a negative correlation to the S&P 500 in some cases (growth, momentum and quality) and a low positive correlation in others.

This suggests ETF providers should be looking to offer products that move away from the traditional benchmark while having a stronger exposure to the factor.

However, the problem with this is investors do not want significant tracking errors relative to their benchmarks meaning these products are unlikely to attract inflows.

This leaves ETF providers in a catch 22 situation where they are offering products to the market with high factor intensity that do not capture any interest from investors.

As Nicolas Rabener, managing director at FactorResearch, says: “Smart beta will disappoint some investors, but that is as much their fault as the product providers.

“Given the higher price tag of smart beta ETFs compared to plain-vanilla equity ETFs, they are probably not worth the higher fees.”

When looking to get exposure to the different factors, investors should not be concerned the products they are investing in have a high tracking error to the benchmark.

Research Affiliates: Alice’s Adventures in Factorland

“Investors cannot have their cake and eat it,” Rabener continues. “If investors are committed to replicating the factor investing returns found in the academic research, they should aim to capture these as efficiently as possible.”

iShares has predicted the smart beta industry will grow to around $3.5trn assets under management (AUM) by 2022, however, it seems providers will need to move further away from the underlying market cap benchmark if they want to shake off the “smart marketing” tag.