ETF trading volumes across several comparisons hit all-time-highs on 24 January as pre-market losses in US equities sent investors into panic mode.

Sentiment was already mixed going into the start of last week, with a more hawkish Federal Reserve and an S&P 500 decline of 8.3% in three weeks creating what Bloomberg described as the worst-ever start to a year in history.

Initial uneasiness was then amplified several times over last Monday as the headline US equity index shed 4% before markets opened.

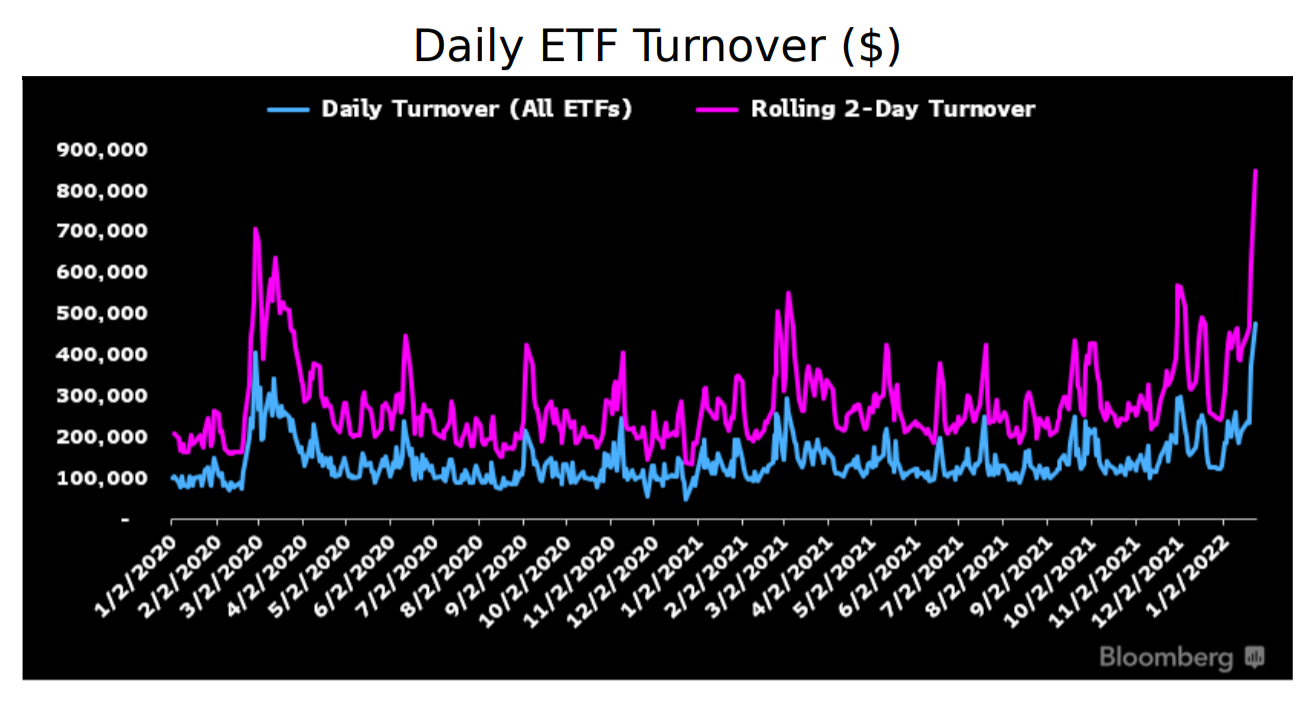

Reacting to this, ETFs traded more than $478bn in one day in the US, comfortably surpassing the $404bn benchmark set on February 28 2020, according to data from Bloomberg Intelligence. On a rolling two-day basis, turnover hit a record level of $849bn.

Of these sums, equity ETFs made up an even larger portion than usual, representing 89% of turnover versus 8% for fixed income ETFs, down from its 13% daily average, according to data from Bloomberg Intelligence.

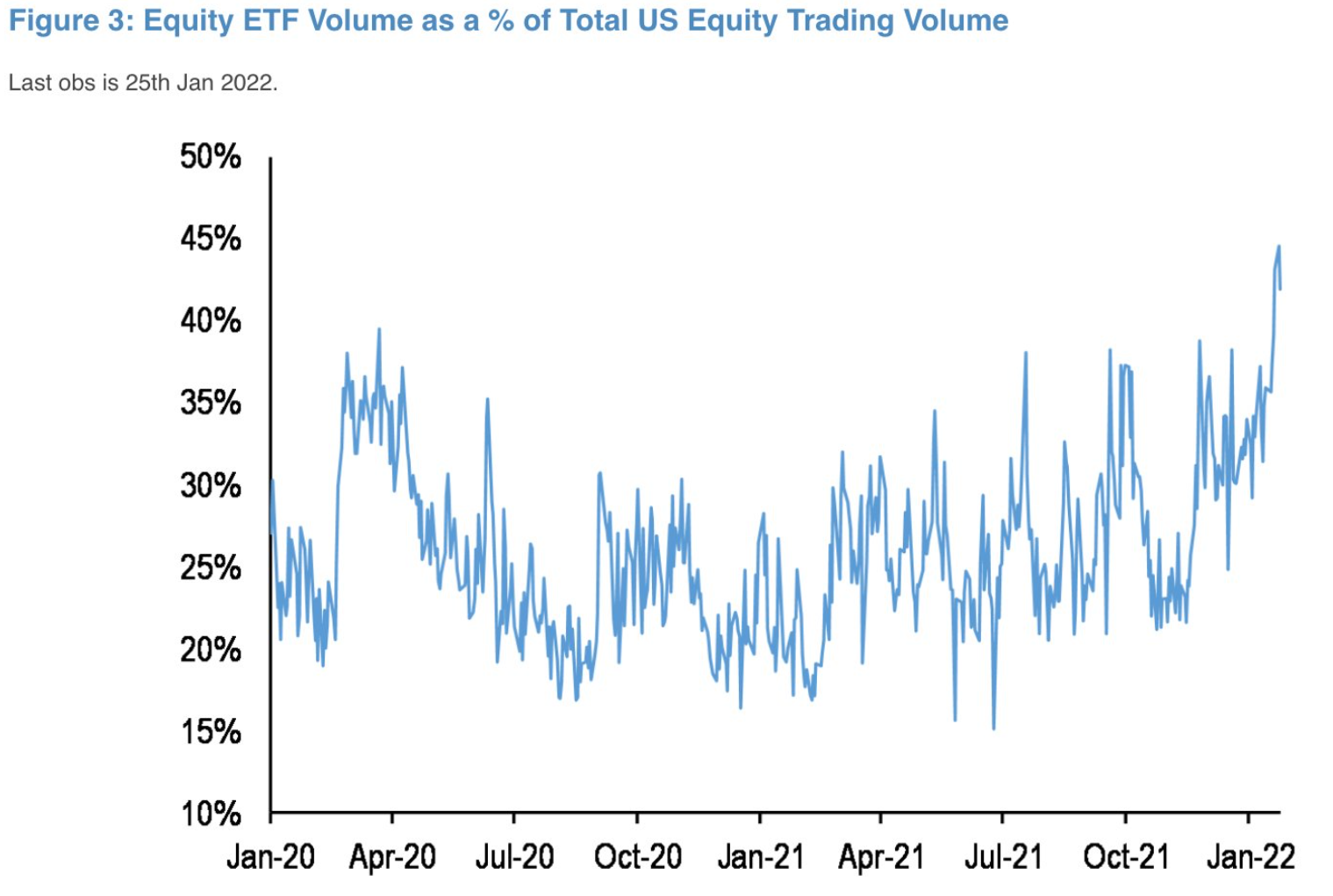

In fact, through January ETFs came to make up almost half of all US equity trading volume, up from around 30% in 2021, data from JP Morgan showed.

Source: JP Morgan

Explaining this surge in ETF trading, Andrea Murray, head of business development at Blackwater Search & Advisory, told ETF Stream: “There are two main reasons. One is heightened volatility in the markets combined with historically high inflation, rising geopolitical tensions and the prospect for higher interest rates which are making investors jittery.

“When the CBOE Volatility index (VIX) starts spiking, which we have seen over the past two weeks, there tends to be an increase in panic selling – this is one of the worst starts to a year for equities and the instinct is a flight to safety.

“On the other side, smart money or institutional players are jumping on buying opportunities – all increasing volumes particularly in ETFs where large allocation shifts are most likely being seen out of long-term bond ETFs, tech and growth into less interest rate sensitive ETF exposure.”

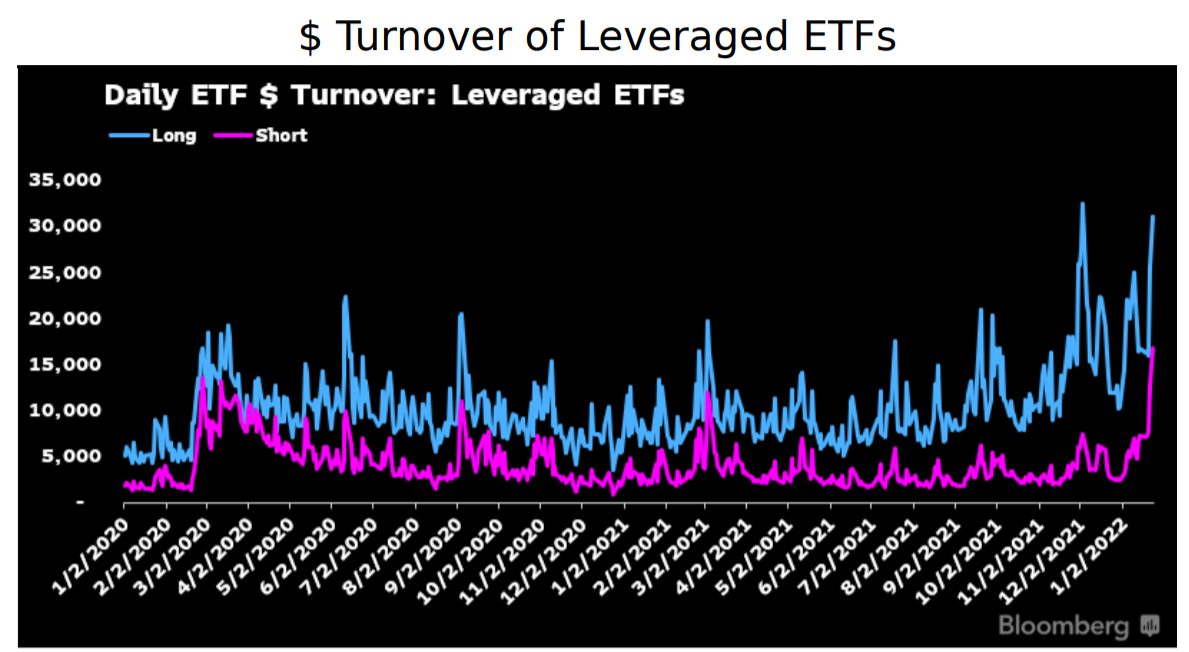

Perhaps unsurprisingly, the period of volatility also saw an increased number of investors take out positions to bet against the market.

Though options expirations contributed to elevated trading volumes, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said inverse ETF turnover was at its highest since February 2020, with a less pronounced spike in long leveraged ETF trading. He attributed this to a short bias in the market as well as the closure of some positions.

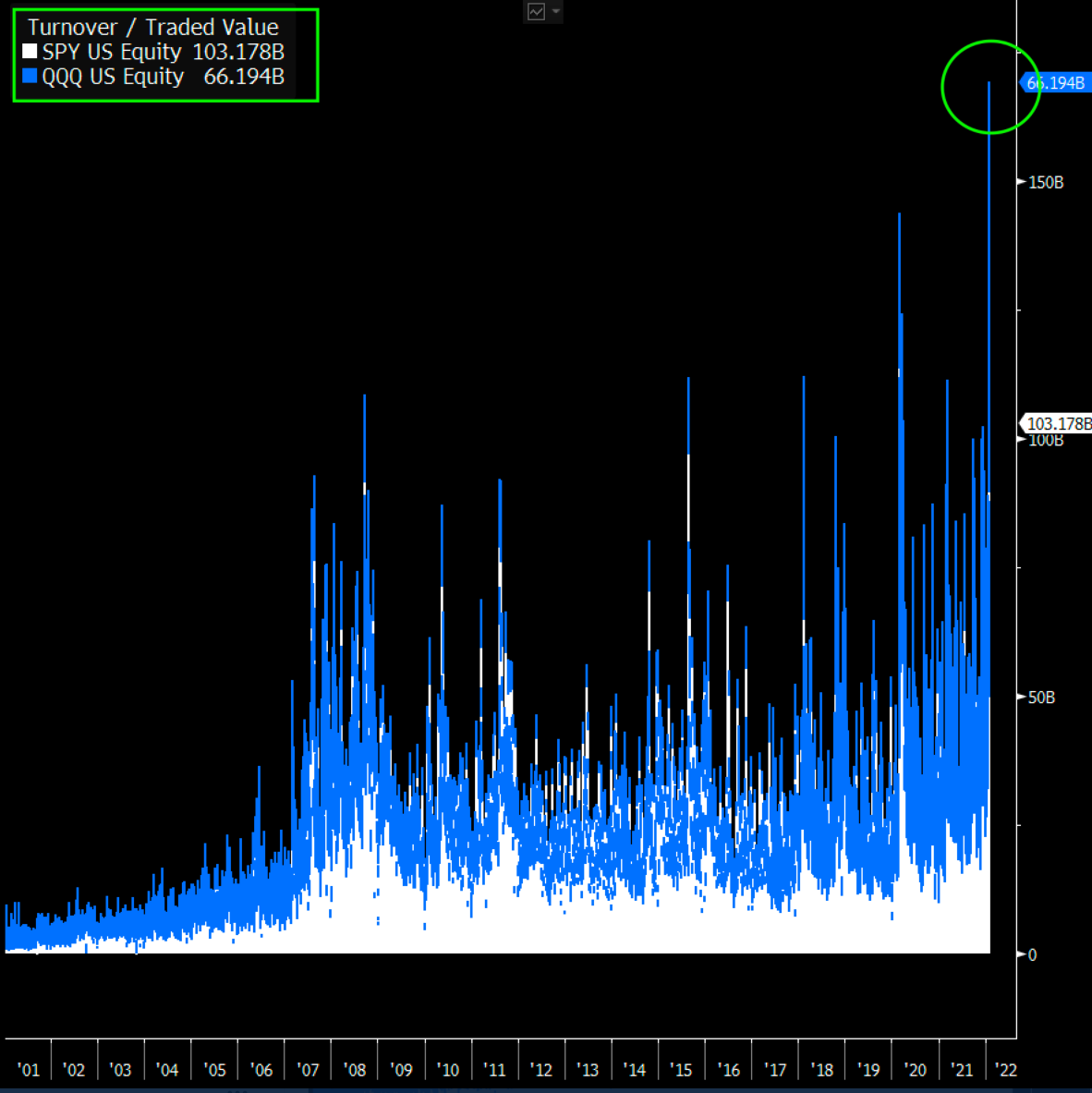

However, bets were not all against the market. The SPDR S&P 500 ETF Trust (SPY) traded over $100bn worth of shares for only the second time ever – more than the top four individual stocks combined – Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, said.

Likewise, the Invesco QQQ Trust (QQQ) broke its previous record with volumes of $66bn.

Source: Bloomberg

“What is unusual about this is both of them were up a bit on day (albeit after falling early),” Balchunas noted.

“That is rare on high volume days, almost always [ETFs are] down big. In short, this volume is panic and fear-based but also tug of war volume.”

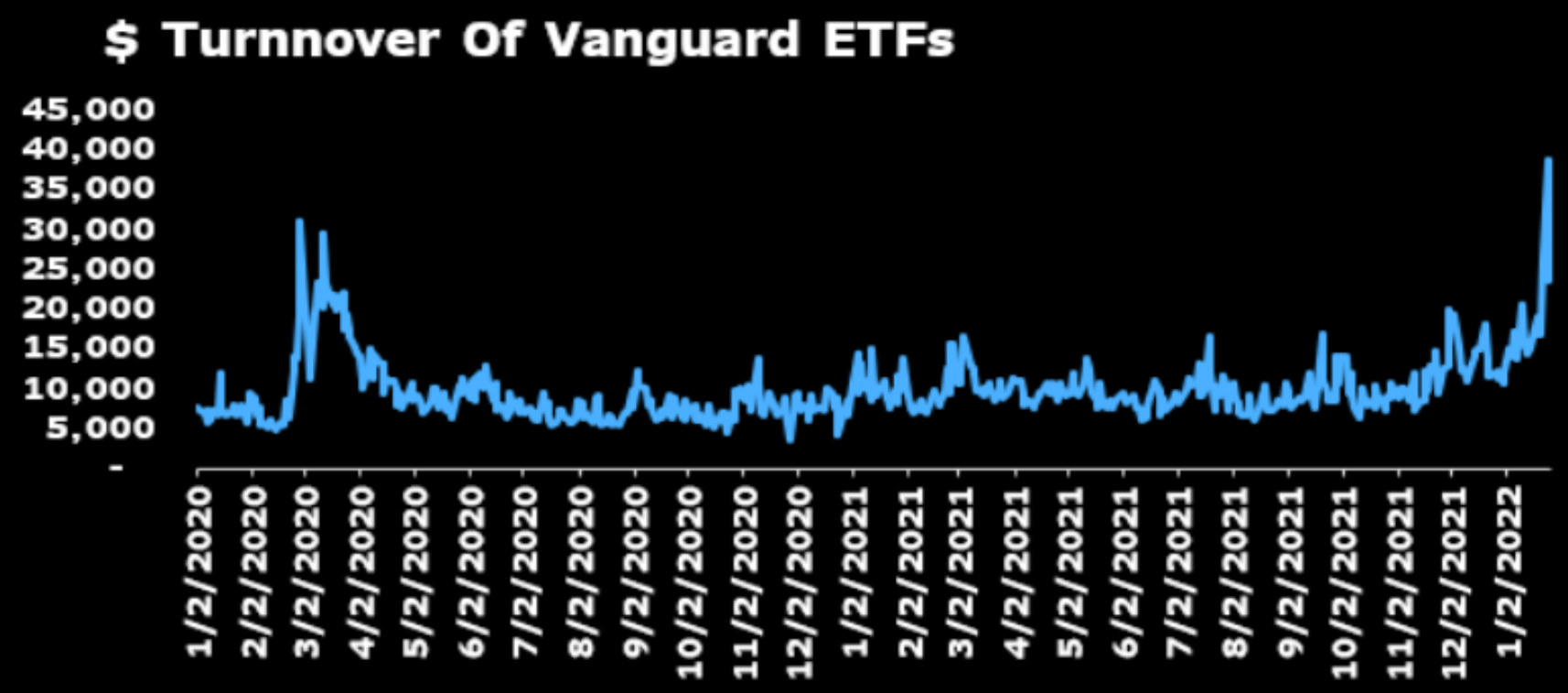

Similarly, Balchunas pointed to the $40bn volume traded by Vanguard ETFs on 24 January which is interesting as they tend to be a favourite among buy-and-hold investors.

Source: Bloomberg

Regardless of the convictions expressed during large trading days such as 24 January, the sums of assets moving in and out of ETFs shows investors believe the wrapper can be used as a vehicle to react quickly to market events.

Related articles