Passive investors and ETFs are pushing stock prices away from their intrinsic value and investors might be able to make money by betting against ETF flows, a new study from Deutsche Bank's quantitative research team has found.

The study, titled "What Happens When the Rest of the World Goes Passive?" tried to examine how ETFs were effecting stock prices.

When active investors buy big chunks of securities, prices often go up thanks to the market interpreting there being positive new information priced in. "Does the same phenomenon occur for passive investors?" the authors wondered.

"In contrast to active purchases, there is no information content associated with passive buying…Theory dictates that passive buying should not be met with any changes in market prices as they are uninformed purchaser of securities."

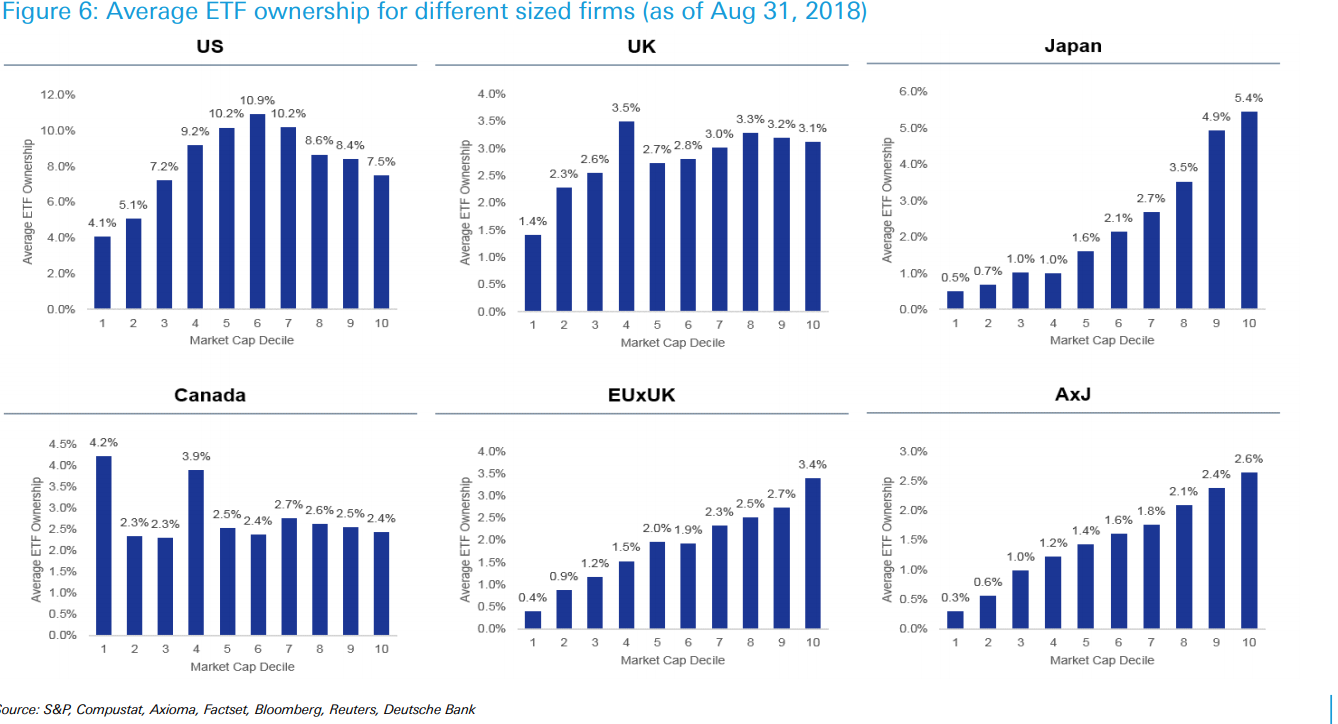

To test this, DB's quant team built a series of portfolios that grouped stocks based on how much ETF money they get. For each major country and region, DB sorted stocks into ten deciles ranked on which copped the most ETF flow.

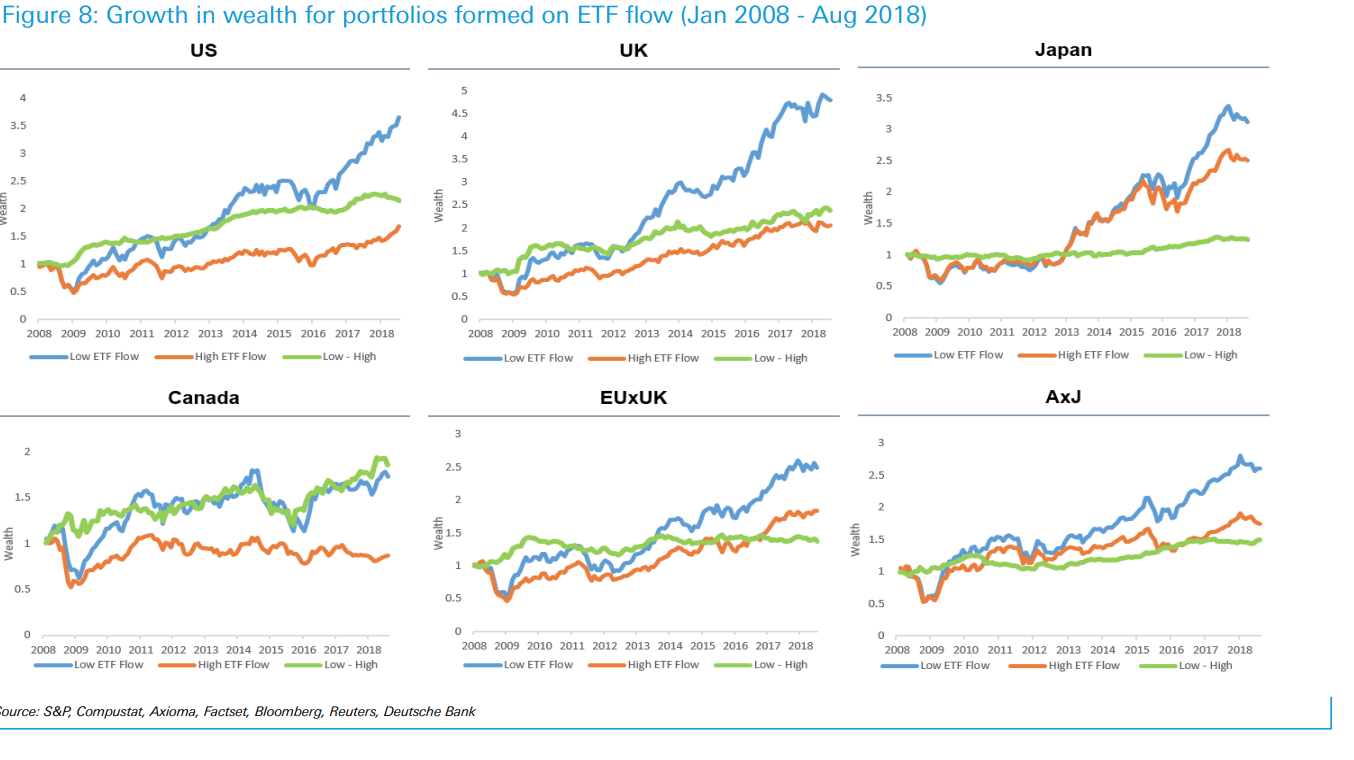

They then created long/short portfolios, which went long on the stocks that had seen the largest ETF outflow, and short the stocks that had seen the largest ETF inflows. If ETFs had no impact on prices - as theory would suggest - there should be no difference in pricing between the securities most and least purchased by ETFs.

Yet DB, disturbingly, found that this was not the case. They found that stocks which are most purchased by ETFs often suffered price distortions.

"We find evidence that large ETF flows push stock prices away from fundamental values - specifically, a long/short stock selection strategy that positions against ETF flows produces reliable risk-adjusted performance."

In trying to explain why ETFs may cause this mispricing, DB's analysts blamed passive investors indifference to fundamentals. For example, if passive investors - following Jack Bogle's advice - buy the US total stock market index and make no attempt to time the market, prices of stocks within that index can move up.

But other market participants have no idea where this demand is coming from. They can interpret this demand as pricing in new information, when there is actually no new information per se in the buy order - just a happy Boglehead passive investor.

"Market participants do not realize that passive investors are buying or selling securities. Hence, an 'information-less' buy order by a passive investor due to flows into an index or an index reconstitution is construed the same way as an 'information-led' buy order from an active investor. Thus, market participants overreact to passive flows and eventually learn there is little price discovery associated with passive flows and prices revert."

DB's portfolios did not attempt to distinguish causation from correlation. They also made no attempt to draw discrete causal inferences: it was left entirely open to possibility that a separate cause made ETFs buy a stock more and also caused price distortions.