Emerging markets aren't classically the place to look for eye-catching ETF inflows but according to the most recent data, such has been the case in August.

Looking at the data for fund inflows in the week to 30 August, the emerging market strategy team at UBS has noted that ETFs accounted for circa 80% or about $1.8bn of the money that went towards emerging market funds in the last week of the month.

The total amount of $2.26bn reversed the trend for earlier in the month when the data showed either light inflows or large outflows. Global emerging market funds accounted for 63% of the total with 35% going towards Asia ex-Japan. In terms of country inflows, China - reporting its second-largest inflow since March 2016 - and Korea accounted for 60% of the total despite fears regarding tensions over North Korea.

The remaining 20% of the inflows went to long-only funds, still below the 27% level for the year-to-date and far below the 40% level from the peak period of emerging market inflows in 2010.

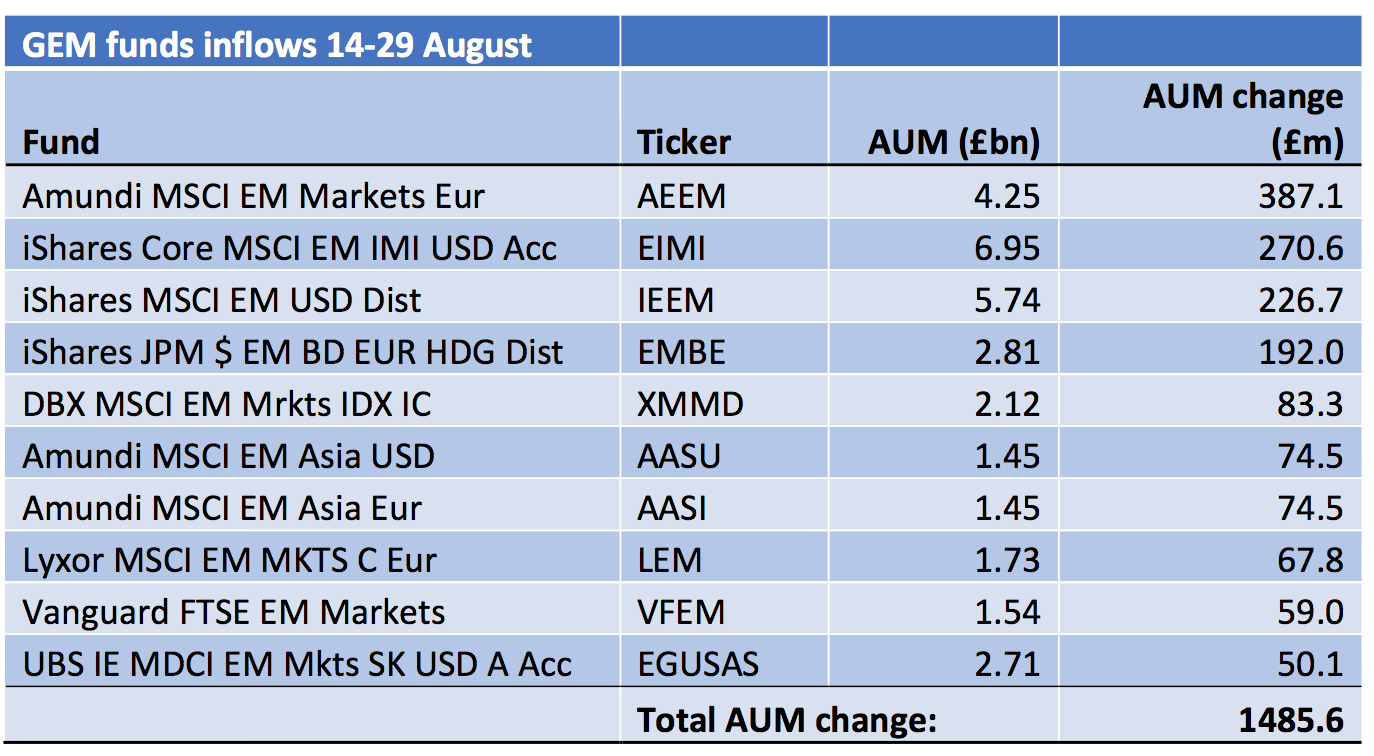

In terms of European-listed emerging market ETFs, both single-country and general emerging markets, it can be seen over the period from the 14-29 August there were substantial inflows to the market leaders.

Data from Ultumus shows the top 10 general emerging market funds drew in £1.49bn in the 15-day period with the Amundi MSCI EM Markets Euro fund topping the list with inflows of over £387m, some way ahead of the next of the list, the iShares Core MSCI EM IMI USD Acc fund with nearly £271m.

Source: Ultimus

The single country top 10 drew in total inflows of £214.3m for the same period with Chinese funds dominating with five funds in the list including Lyxor, Deutsche Asset Management and iShares versions. It is the Lyxor CN ENT HSCEI C Eur that tops the list, bringing in £33.4m of inflows to end the month with assets under management of £418m.

Source: Ultimus

This looks like it will be a record year for emerging markets inflows generally. According to UBS, eight months into 2017 the cumulative year-to-date inflows into emerging markets equity funds stands at $44.7bn.

"This continues to be a historically high run-rate for this time of year," says Geoff Dennis, strategist at UBS who points out that the gap over the second-best year for general emerging markets fund flows - now 2010 - has risen considerably in recent weeks and is now at a new high of 29%.