Managed future ETFs are a fairly new phenomenon in the European ETF market, although in the US they have been available for somewhat longer. The concept of offering investors access to managed futures through an ETF is a curious one given the sector has performed badly for the last decade.

It raises the question why bother considering them at all?

In case you are not familiar with managed futures, they are typically a portfolio of futures contracts that are actively managed. They sit in the alternatives sector and are mostly used by funds and institutional investors to get some kind of market diversification. This is because they are largely uncorrelated with other asset classes.

Historically, they have been accessed by wealthy individuals and hedge fund type investors, where they charge a typical 2 and 20 fee.

The ETFs now popping up have largely been ETFs tracking indexes of managed futures passively, although this year has seen the launch of some actively managed ETFs.

The benefits of managed future ETFs are fairly obvious. They are cheaper and easier to access for all investors. Being uncorrelated with the stock market also has benefits and with concern that there may be a market downturn in the next year or two, they could be a good addition to your portfolio.

However, if something is too good to be true it often is.

Managed futures have done really badly in the last decade since 2008. They struggle to perform in markets that suddenly collapse or rise, which can really hurt when they are invested the wrong way.

“A prolonged, very choppy market is kryptonite to a managed futures fund,” explains one market watcher.

So, why have a managed futures ETF in your portfolio now?

Well, they typically do the opposite of what the stock market is doing. If the S&P 500 is going up they are not going to be doing well. But if the S&P500 starts trending downwards, then they could be a good diversification tool.

This is where they shine, as they can make money in falling markets and it adds to their attraction as a diversifier to a traditional equity and bond portfolio.

Peter Sleep, senior portfolio manager at 7IM, explained: "Managed futures tend to lose money in flattish markets, which is what you tend to get most of the time.

"Many people see managed futures as being akin to buying a call option on the market and buying a put option. If the market goes up, you make money, if the market goes down, you make money, but if the market goes sideways you lose.

“Most consultants suggest that every diversified investment portfolio have an allocation to hedge funds and managed futures could be a component of that allocation,” he adds.

Managed future ETFs are also an easier way to access the market without the hassle of dealing with futures contracts, fees, rolling contracts and expirations.

They also have the benefit of investing in all markets, including equities, currencies, fixed income and commodities.

“While this breadth adds to diversification and your investment opportunity set, but it can also make it difficult to understand returns. For instance, gains from a great trending year in equities can be easily be wiped out by choppiness in currency or commodity or bond markets, which can lead to investor disappointment,” explains Sleep.

However, there are reasons to be encouraged by the concept of managed future ETFs.

In the US, there have been several new products launched already this year, including one by Sunrise Capital, which is actively managed ETF and more recently another actively managed one by Dynamic Beta. The increase in launches suggest that there is a drive towards making access to managed futures easier and hedge funds wanting a piece of the passive pie.

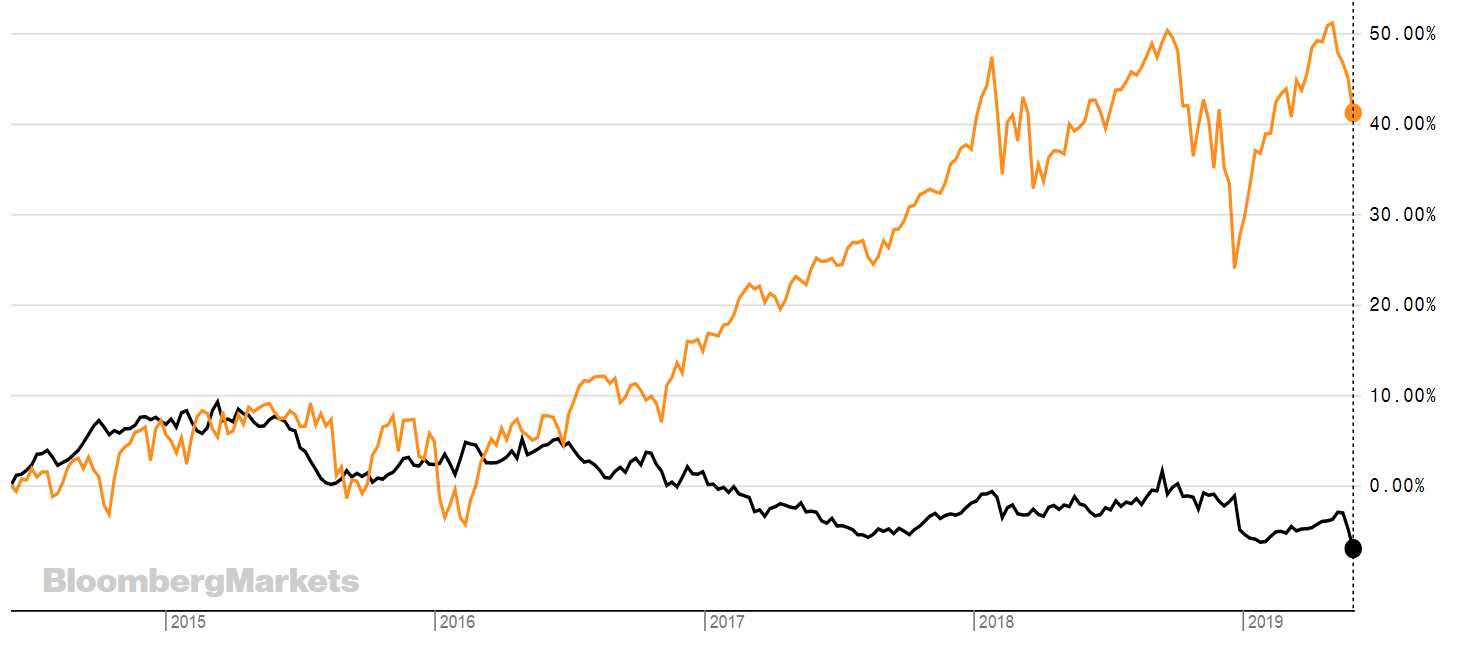

The oldest managed future ETF – launched in 2011 - is WisdomTree’s WTMF. It is available on NYSE Arca. The graph below shows WTMF in black and S&P 500 in orange over a five year term. The aim of the ETF is to achieve positive total returns in a rising or falling market, that aren’t correlated to broad market equity or fixed income returns.

Although it’s trended downwards over time it has avoided any volatile spikes.

There is only one managed future ETF on the London Stock Exchange and it is offered by JP Morgan.

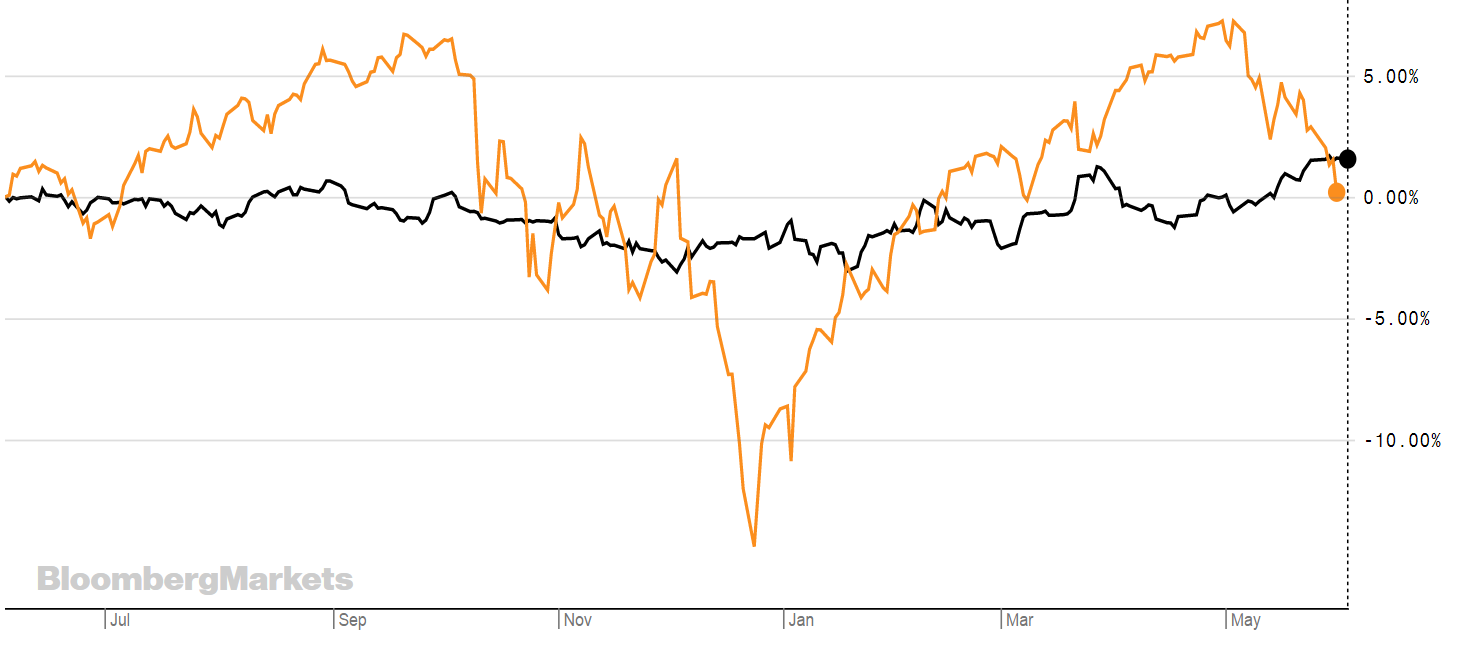

The ETF is relatively good value at 0.57% and since its launch in November 2017, its performance hasn’t been too awful. Year to date JP Morgan’s Managed Future ETF (JPMF) has returned 3.50% although its 1-year return is weaker at only 1%. But still positive.

The below graph shows JPMF (in black) and the S&P 500 (in orange) over the last year.

Source: Bloomberg

The JPMF ETF is denominated in dollars, and there are three other iterations in sterling and euro. If you want access in the UK or Europe then these are your options. See the table below.

JPMF ($)

JMFE (€)

JPFM (£)

JMFP (£)

ETFYTD RTNTERINDEXJPMorgan Managed Futures UCITS ETF3.50%0.57%The Fund will seek to achieve its investment objective by pursuing a systematic strategy that aims to exploit opportunities across global equity, bond, currency and commodities markets.JPMorgan Managed Futures UCITS ETF2.34%0.57%The Fund will seek to achieve its investment objective by pursuing a systematic strategy that aims to exploit opportunities across global equity, bond, currency and commodities markets.JPMorgan Managed Futures UCITS ETF2.47%0.57%The Fund will seek to achieve its investment objective by pursuing a systematic strategy that aims to exploit opportunities across global equity, bond, currency and commodities markets.JPMorgan Managed Futures UCITS ETF2.47%0.57%The Fund will seek to achieve its investment objective by pursuing a systematic strategy that aims to exploit opportunities across global equity, bond, currency and commodities markets.