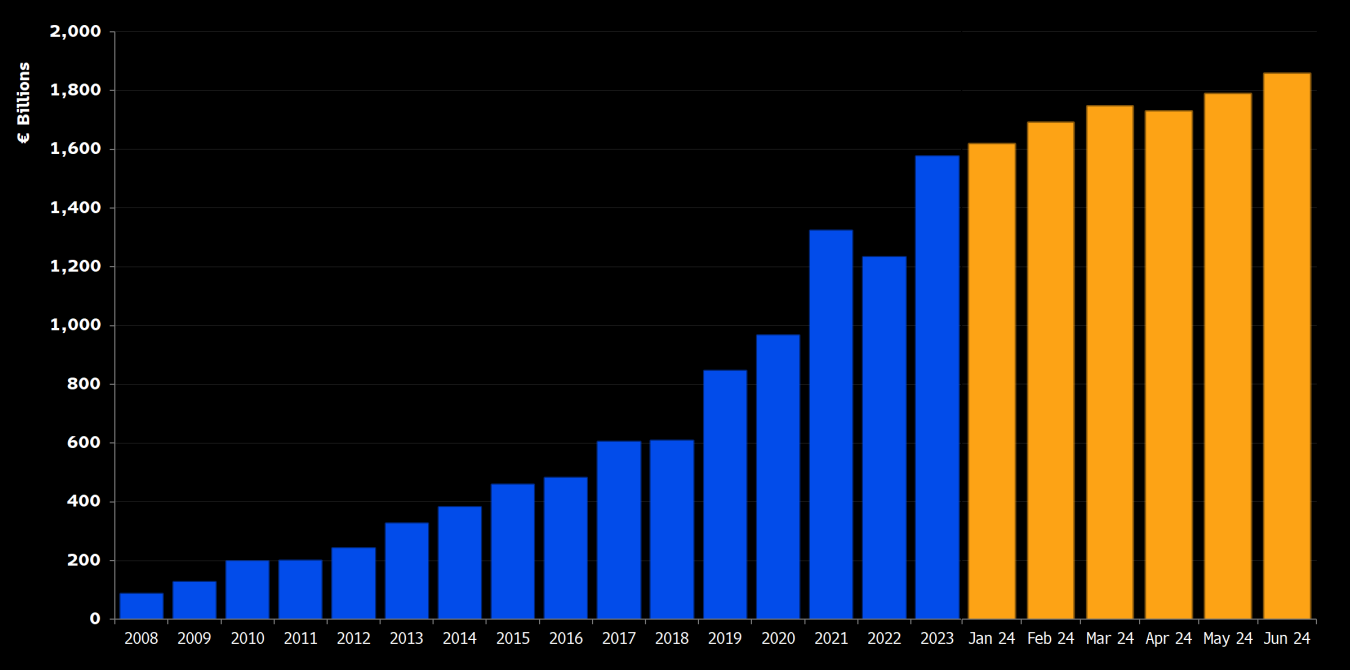

Exchange-traded products (ETPs) in Europe are on trend to easily surpass the inflows of all previous years after amassing over $108bn net new assets in H1.

According to a report by Bloomberg Intelligence, the pace of asset gathering through the first half of the year puts European ETPs on track to book $216bn inflows in 2024, around $50bn more than the existing record set in 2021.

While much of the 16% asset growth in European ETPs – from little over $1.7trn to $2trn in H1 – is attributable to market appreciation, continuing this trajectory would see the industry swell to $2.2trn assets under management (AUM) by the end of the year.

Chart 1: European ETP AUM

Source: Bloomberg Intelligence

However, the important role of market sentiment and performance should not be understated, as seen in 2021 when giddiness across risk assets saw European ETPs set their current annual asset gathering record.

In H1 this year, implied annual European ETP fee revenue grew behind the rate of asset growth – at a hardly sluggish pace of 11.2%. Combine this with the number of ETPs increasing 2.6% and turnover falling 6.5% and this would imply investors have been pouring assets into low-cost, beta or near-beta ETFs to capture upside across broad markets.

ETF product classes in focus

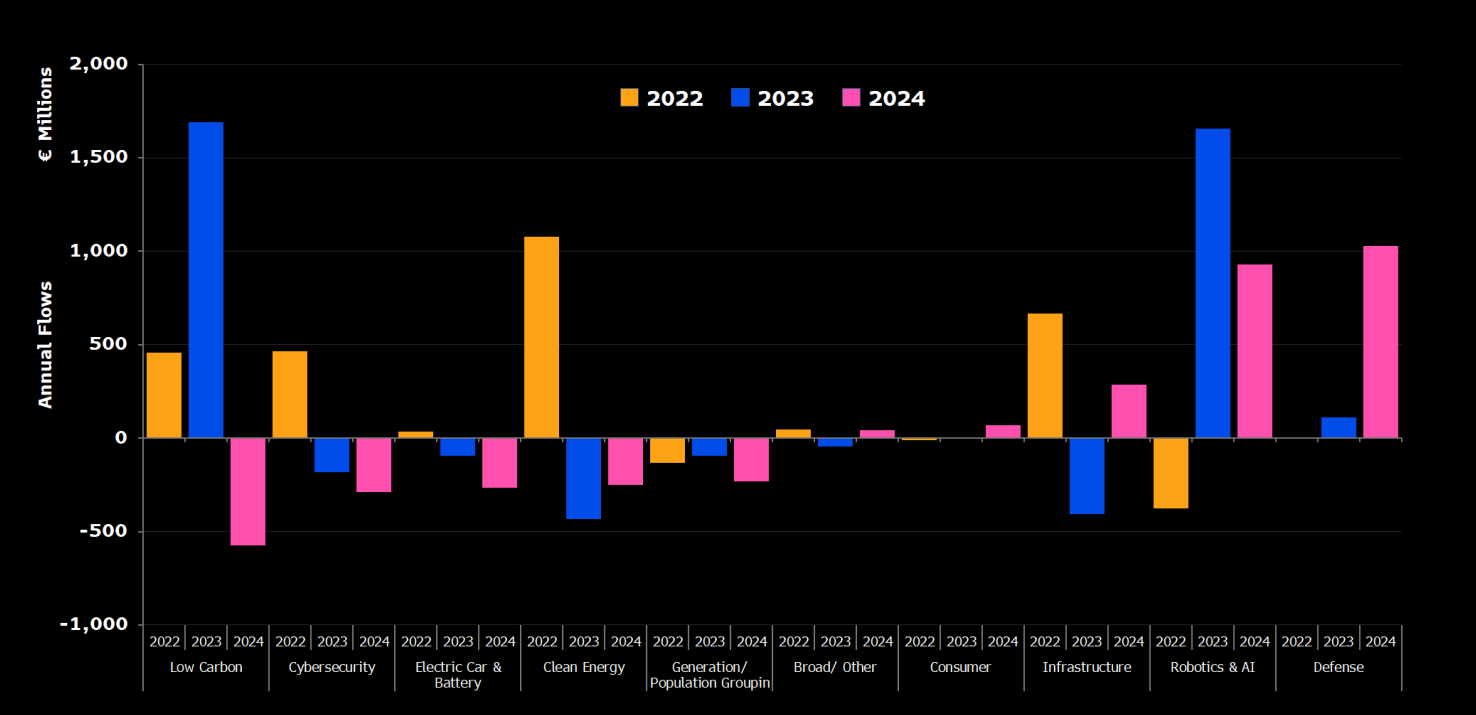

Delving into individual product classes, Henry Jim, ETF analyst at Bloomberg Intelligence, predicted environment-focused thematic ETFs could be primed for an AUM recovery as sustainable investors hunt for alternatives to screening-based ESG strategies.

While defence and AI thematic ETFs were the victors of H1, Jim noted environment-focused thematic ETFs suffered a $2.2bn exodus during the first half after strong form through 2022 and 2023.

Chart 2: Annual thematic ETP flows

Source: Bloomberg Intelligence

“Should investors reconsider ESG investments, environment focused thematic ETFs may reap the largest rewards rather than ETFs that bear the ESG label or track ESG indexes,” Jim said.

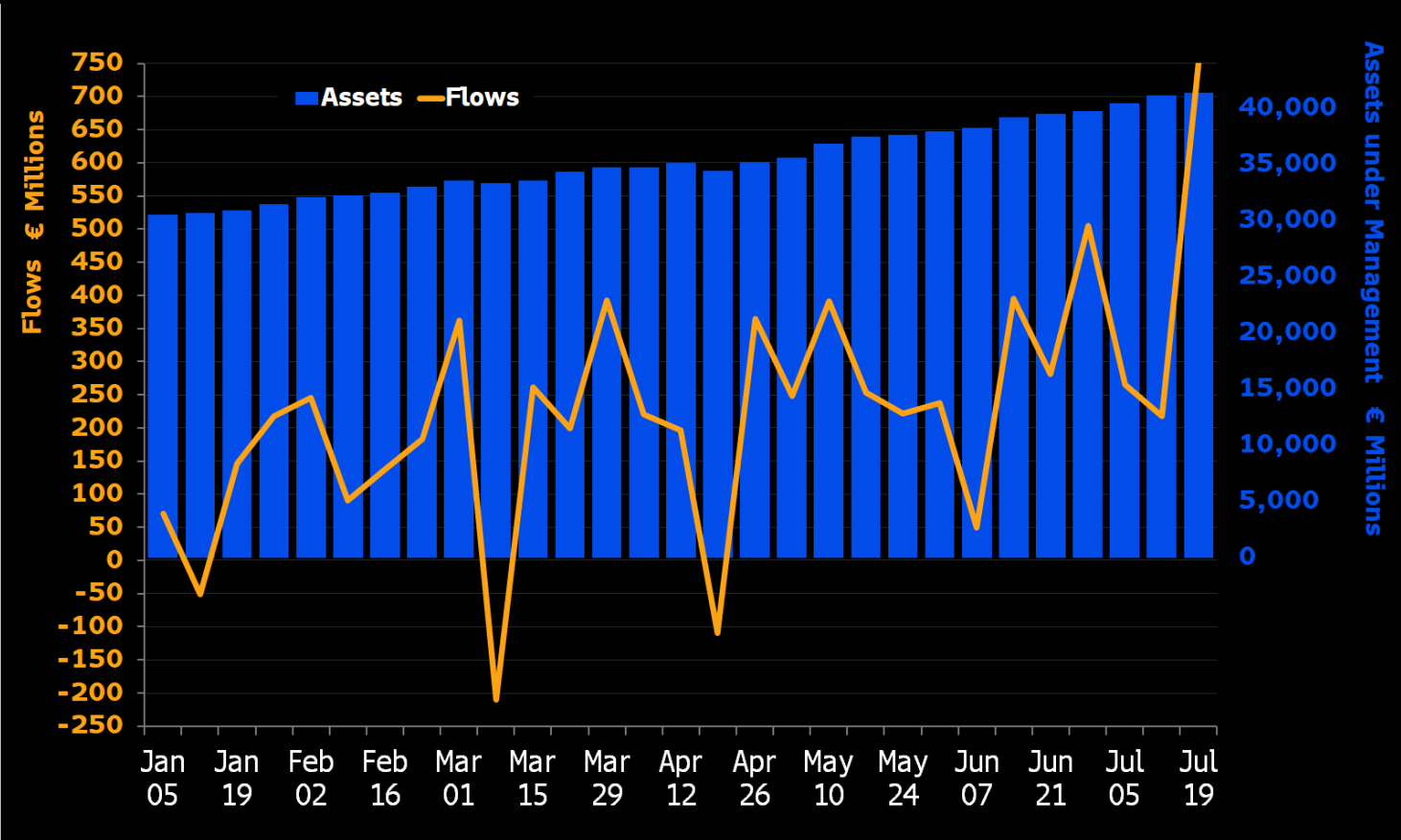

Elsewhere, Jim zeroed in on Europe’s burgeoning active ETF market and the one horse currently leading the race.

Of the $44.3bn housed in active ETFs at the end of H1, $21.6bn was claimed by JP Morgan Asset Management alone after its range of ‘index-plus’ equity, fixed income and money market active ETFs booked $5.7bn inflows during the first half.

Chart 3: Active ETF AUM and flows

Source: Bloomberg Intelligence

European market structure in focus

Away from products, tailwinds for further asset growth muster in the expanding ETP userbase in Europe.

Jim highlighted institutional investors are increasing their use of the wrapper to capitalise on the implied liquidity in the primary market while ETF-based digital wealth solutions are gathering attention from retail investors.

“A nascent retail market for ETFs also is stirring as tech-savvy investors seek DIY investment vehicles after realizing they might not be able to depend on public pensions in retirement,” he added.

However, while European ETPs may in time enjoy a retail ETP market resembling that of the US, the structure of Europe’s trading landscape remains far more fragmented and inefficient to the detriment of ETPs and end investors.

Evidencing this, ETP trading volumes in Europe have trended near 1.5x total ETP AUM in recent years versus 5x in the US.

“This is due mainly to the fragmented nature of the region's markets, and the investment culture in Europe, where retail investors participate less than Americans.

“The 1.5x ratio looks likely to persist until the introduction of a consolidated tape for the region's trading venues and the easing of market access for retail investors,” Jim concluded.