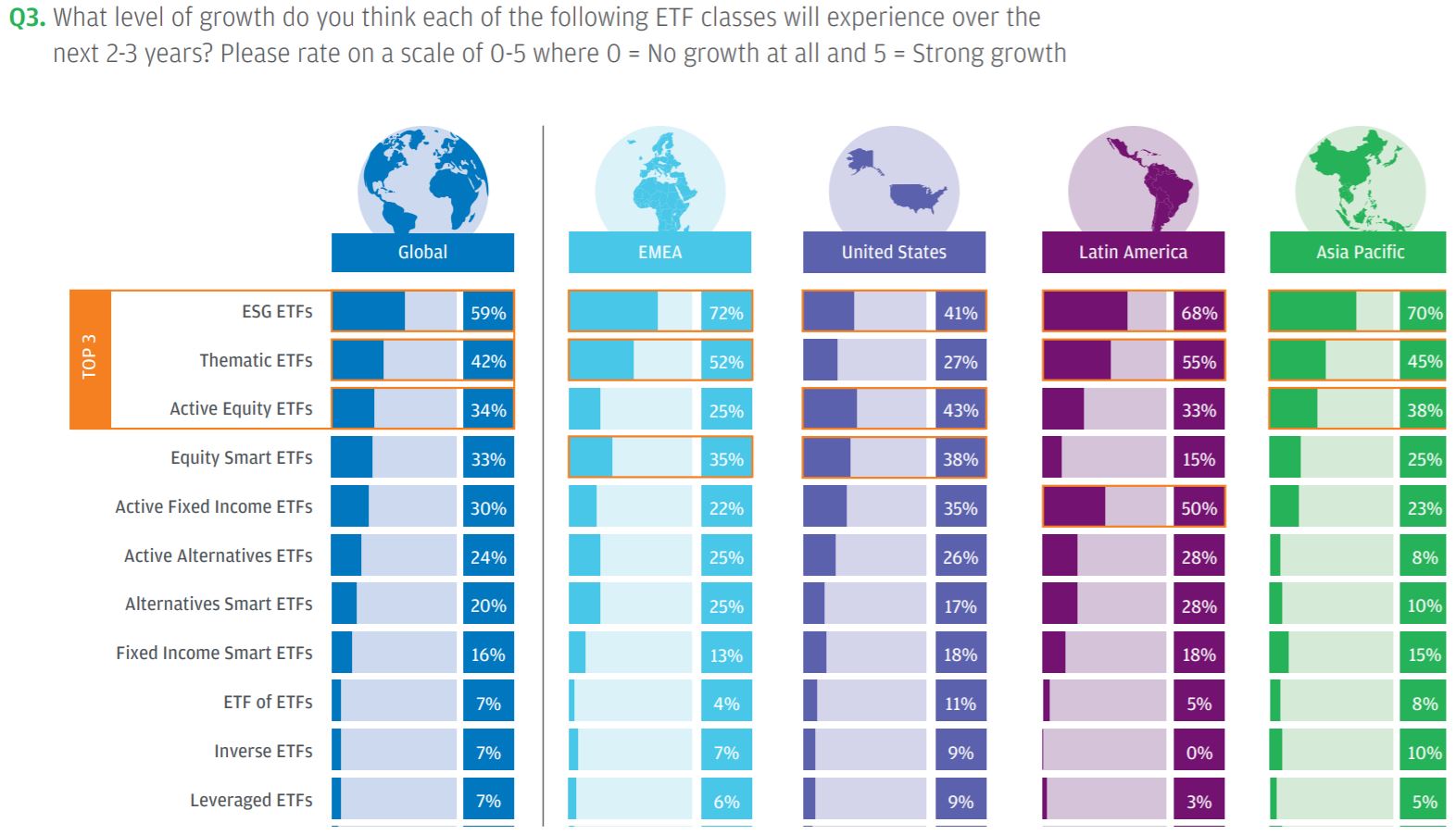

ESG and thematic ETFs are the two areas where investors in Europe believe there will be rapid growth, according to a survey conducted by JP Morgan Asset Management (JPMAM).

The survey, which interviewed 320 global professional investors about their ETF usage, found 72% of respondents predicted there will be "strong growth" in ESG ETFs while 52% said thematic ETFs.

The rising demand for ESG and sustainable products is seen to be significantly impacting the growth of the ETF market, according to respondents from all regions, however, more notably in EMEA which rates it at 63% ahead of the US with 45%.

The rise in ESG is seen to be more impactful than the accessibility of ETFs to new segments of the financial market and developments within technology.

Nonetheless, low investment costs, ease of trading and the simplicity of the products are core reasons why investors are using ETFs. EMEA investors in particular also ranked highly the use of ETFs for flexible building blocks for client portfolios.

"Investors outside the US expect higher growth from ESG and thematic ETFs in the next 2-3 years, compared to smart beta and active ETFs," the report added.

Source: JPMAM

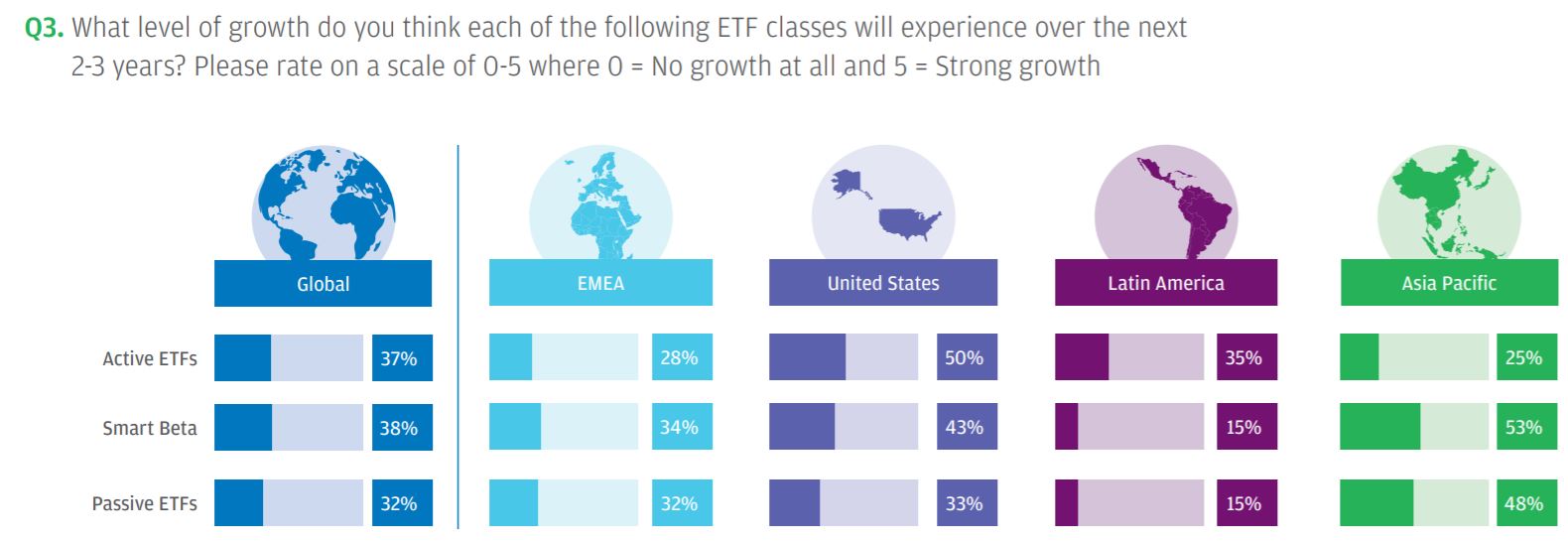

Overall, some 36% of EMEA-based assets allocated to ETFs are expected to be in active or smart beta ETFs by 2023.

Active ETFs are yet to gain traction in Europe yet due to regulatory rules around non-transparent ETFs.

As a result, just 28% of investors in EMEA said active ETFs would experience strong growth while this rose to 50% when US investors were asked.

Source: JPMAM

Four out of five EMEA investors incorporate ETFs into their strategies which is only beaten by the US with 84%.

Over the course of the next three to five years, investors expect smart beta and active ETFs to account for roughly 20% of their clients’ portfolios globally, primarily in the equity and fixed income asset classes.

Investors usage of passive ETFs is at 69%, down from 80% three years ago. This figure is expected to continue falling to 61% over the next two to three years.

Product Panel: Fidelity’s active ESG ETFs

Over this three-year time frame, investors are expecting to reallocate their passive ETF assets to active and smart beta ETFs with these strategies growing by 5% and 3%, respectively.

The US is seeing the biggest reallocation with passive strategies once accounting for 78% of ETF allocation three years ago, to being predicted to only account for 55% in three years’ time. Active ETFs are forecasted to account for over a quarter of all ETF allocation.

Furthermore, EMEA investors expect a relatively equal level of growth across the three ETF strategies in the coming years.

A driver behind these investors using active ETFs is to gain exposure to specific investment criteria, such as ESG, and targeting specific objectives and outcomes. For investors to become confident in an active ETF, it should hold a strong track record with an investment philosophy and should have strong trading expertise with a dedicated team.

The issuer of the active ETF is a factor among investors on whether they would buy the product. JPMAM is the third most popular active ETF issuer behind industry giants Vanguard and BlackRock.

For investors not using ETFs, liquidity can be seen as a risk, notably in bear markets. Additionally, tracking error and market distortion are also factors as to why some investors are not confident in using the vehicles.

When looking at the underlying benchmark of an ETF, size matters. The market cap is a key factor across all regions as well as the weighting method. The ESG scoring of the index is also a notable factor for EMEA investors, with 31% compared to just 13% in the US and zero in Latin America.

Jed Laskowitz, global head of asset management Solutions at JPMAM, said: “We’re seeing a significant shift in sentiment and in the way investors use ETFs in portfolios. They are exploring their options and increasingly looking to diversify their use of ETFs beyond passive strategies.

"For example, the current and expected growth in ESG ETFs and active ETFs is proof that these vehicles are likely to play a bigger role across investor portfolios.”