Most Aussie bond ETFs struggle to outperform cash. But a new actively managed bond ETF aims to fix that.

The Aussie bond market has proved a stubborn beast for ETF providers.

While assets in Aussie ETFs now sit at $40.6B - only $5.4B of that is in fixed income. The preference for equity ETFs comes despite the fact the bond market is roughly the same size as the equity market.

Why have ETFs struggled? Partly history. Bond ETFs are newer than equity ETFs. As such, they've had less time to gather assets. But more importantly, however, is the fact that many investors think bond ETFs are flawed instruments.

Problems: performance and transaction costs

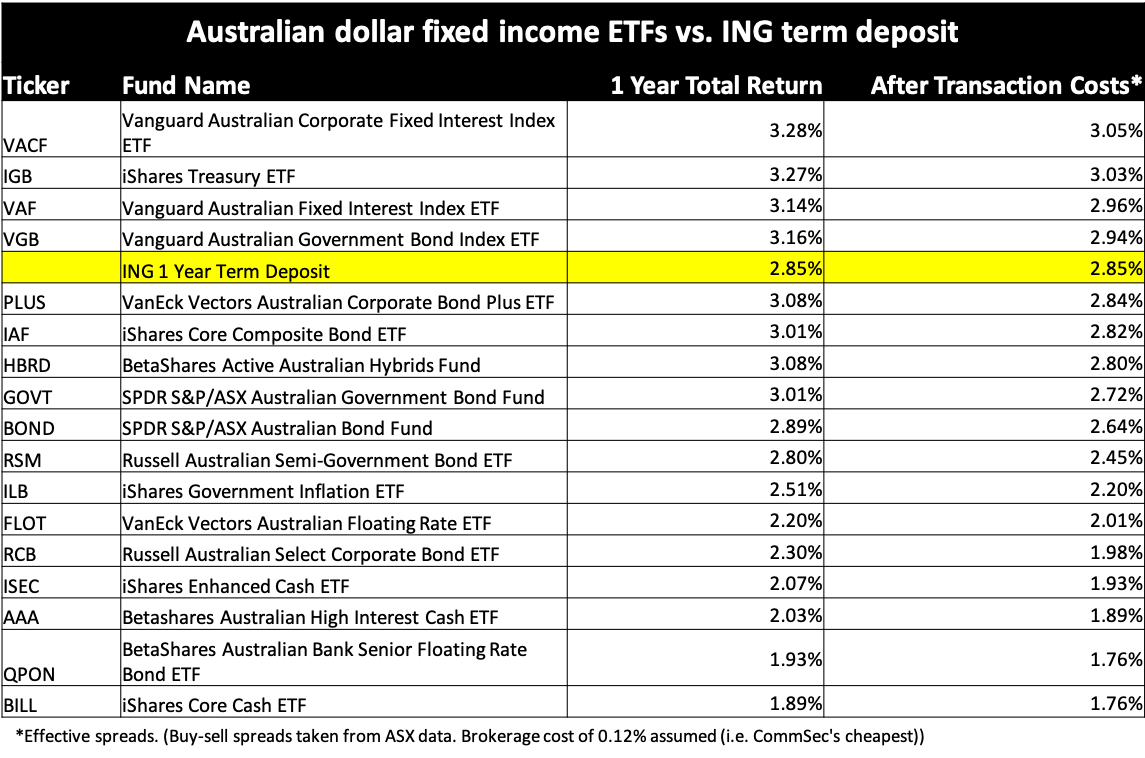

The first and most obvious flaw is performance. Most bond ETFs have delivered a worse return than cash over the past year. International bond ETFs have delivered an average return of 1.67%, ASX data indicates. While Aussie dollar fixed income ETFs have delivered an average return of 2.59%. Meaning that, after netting for transaction costs, almost every Aussie bond ETF has underperformed cash in 2018.

The second problem relates to the first: fees are too high. The average fee for an Aussie dollar bond ETF is 0.25%. This may sound cheap, but given the low single digit performance bond ETFs provide, a 0.25% fee represents a substantial portion of an investors return. And again, a competitive term deposit will give you a 2.85% yearly return free of charge.

Market weighting and the bums problem

But the most important reason may owe to how bond ETFs are made.

Passive bond ETFs are market weighted. This means they weight their holdings based on total debt outstanding. In other words, the more heavily indebted an entity is - be it a government or company - the more a passive ETF buys its debt. Which can lead to a famous risk known as the "bums problem".

But another potential weakness is their duration exposure - which is, by design, on the longer side. The long duration exposure is typically in an effort to harvest what financial economists call the "term premium": where longer-dated bonds tend to have higher returns than their shorter dated peers. As Vanguard explained:

"Vanguard does not believe that cash plays a meaningful role in a diversified portfolio with a long-term horizon, as investors are giving up the term premium received by holding duration exposure."

For Sam Morris, an investment specialist at Fidante Partners, it's exactly these types of issues that make actively managed bond ETFs the better bet.

"Passive investing doesn't make as much sense in fixed income markets as proponents of passive investing might argue it does in equity markets. If you're allocating to passive fixed income ETFs you can run into risks due to the fact that the most indebted companies or governments are generally the most heavily weighted in the indices.

"End investors in passive benchmarks have taken on a lot of potential duration risk by being benchmark aware in recent years. It's been a good trade as interest rates globally have fallen and duration has paid off and credit spreads have tightened.

"Going forward it's not unreasonable to expect that, with rates low, duration high and the withdrawal of central bank stimulus combined with the jitters we're seeing in credit markets passive fixed income portfolio allocations aren't as effective for generating the defensive returns investors expect from fixed income."

In effort an effort to outdo passive bond ETFs, Fidante Partners is listing a new actively managed bond ETF, the ActiveX Ardea Real Outcome Bond Fund (XARO).

XARO, which is structured as an ETF share class of its 6-year old wholesale fund, has delivered an average annual return of 3.5% the past 5 years. It invests overwhelmingly in Australian government bonds as well as some derivatives to hedge risk.

To generate outperformance, XARO conducts relative value arbitrage trades designed to extract a free lunch from the bond market. These arbitrage trades include, ironically, index arbitrage on bond ETFs.

And the free lunch is not a ruse, Mr Morris claims, because bond markets are not beset by the same competitive economics as equity markets.

"In equity markets investors are overwhelmingly there to make money from buying and selling shares and earning dividends. [But] in fixed income you've got a lot of investors that aren't there to buy and sell for purely profit and value maximisation purposes," he said.

"Banks and insurance companies are hedging liabilities. Corporate treasuries are placing money to work in a low-risk fashion. Central banks are trying to achieve their objectives. You have, what I might term, non-economic participants. They're there for other reasons in addition to purely making money."

XARO began trading on the ASX on Tuesday.