Cloud computing investing remains a niche part of the market, however, there are two ETF providers in Europe looking to dominate the space.

GinsGlobal became the first provider to enter the space in Europe in October 2018 after it teamed-up with white label provider HANetf to launch the HAN-GINS Cloud Technology UCITS ETF (SKYY).

Hot on its heels was First Trust Global Portfolios, who launched the First Trust Cloud Computing UCITS ETF (FSKY) at the end of last year, a mirror image of its US strategy, SKYY.

Somewhat controversially, GinsGlobal selected the same ticker as First Trust in the US meaning the US giant had to pick another ticker for its European strategy.

There is no doubting the success story in the US. First Trust’s SKYY has gathered $2.2bn assets since launching in 2011, which, for a thematic ETF, is very good going.

However, it remains to be seen whether the same strategy will capture the huge flows given First Trust’s brand in Europe is not as strong as it is in the US.

Overall, the theme is yet to capture the imagination of investors in Europe with both ETFs yet to see any significant flows. FSKY has seen $22m net inflows since launch while SKYY has gathered just $2m meaning the opportunity to dominate is still there. Here is a breakdown of both ETFs.

ETFFirst Trust Cloud Computing UCITS ETF (FSKY)HAN-GINS Cloud Technology UCITS ETF (SKYY)AUM$23m$2.7mBenchmarkISE Cloud ComputingSolactive Cloud TechnologyExpense ratio0.60%0.75%Inception27/12/201805/10/2018

Investment strategy

When First Trust launched SKYY in 2011, it teamed up with Nasdaq to help launch the ISE Cloud Computing index, which FSKY also tracks.

However, in June, Nasdaq revamped the index, changing it to the ISE CTA Cloud Computing index. Instead of tracking companies which are either pure-play cloud computing services; non-pure play cloud computing companies or technology conglomerate cloud computing companies, the index tracks companies that are either infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and software-as-a-service (SaaS).

IaaS is a way of delivering servers, storage and operating systems, PaaS enables the creation of software that is delivered over the internet and SaaS is a process for delivering software applications over the internet.

The index now offers investors exposure to 62 names that are all based in the US and must have a minimum market cap of $500m.

Furthermore, to be included in the index, a security must also be classified as a cloud computing company defined by the Consumer Technology Association (CTA).

When using GICS sector classification, 81% is in information technology, 9.6% is in communication services, 7.5% in consumer discretionary and 1.9% in health care.

The top 10 holdings make up 40.2% of the portfolio and include big names such as Amazon, Microsoft and Alphabet.

Meanwhile, SKYY tracks the Solactive Cloud Technology index, which offers exposure to 51 securities in the US (96.1%) and Asia (3.9%). Its top 10 holdings account for 43.2% of the portfolio and also includes big names such as IBM, Adobe, Alphabet and Amazon.

Solactive says the index tracks companies which are “active or are expected to be active” in the near future in the field of cloud computing.

Both products are fully replicated but SKYY rebalances semi-annually while FSKY rebalances quarterly.

Cost and tradability

Although First Trust is not known for its low prices across its ETF range, FSKY is 15 basis points cheaper of the two with a total expense ratio of 0.60% while SKYY charges 0.75%.

More generally, charges across thematic ETFs have yet to be disrupted compared to other segments of the market due to a lack of competition.

In terms of tradability, FSKY is trading at a 3.86% premium on the exchange compared to its NAV price. This means investors do run the risk of buying in at a premium price versus when they sell out, adding to total costs. While SKYY is currently trading at a 1.21% premium.

Performance

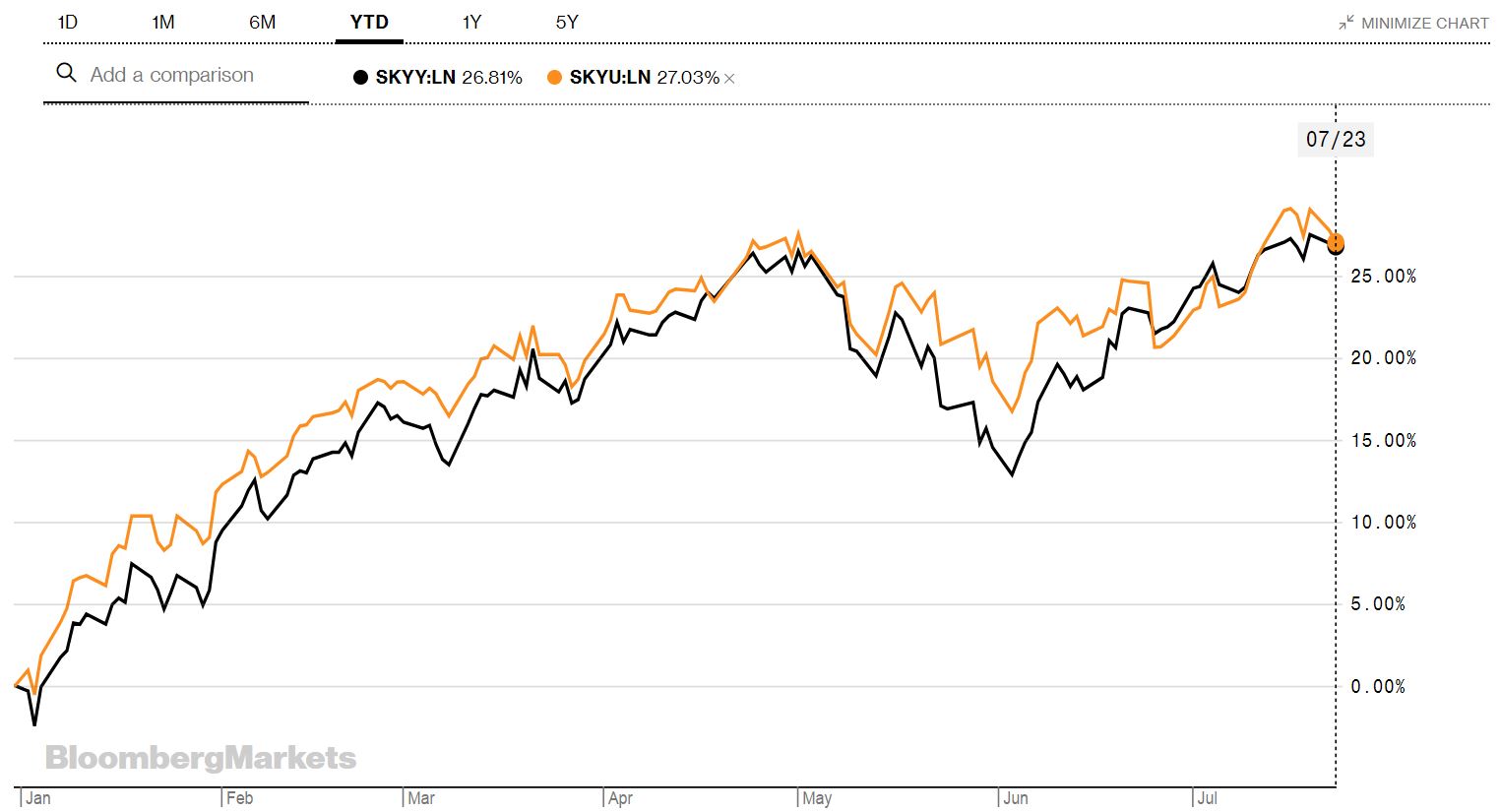

So far, 2019 has been a strong year for markets and cloud computing as a sector has been no different. The USD version of FSKY, SKYU, has slightly outgunned SKYY this year returning 27% to SKYY's 26.8%, as at 23 July.

Australia’s best ETF: Vanguard’s VAS or VanEck’s MVW?

As FSKY is the same strategy as the US version, investors have the advantage of being able to look at its historical performance dating back to 2011.

Source: Bloomberg

Domicile

As both ETFs are domiciled in Ireland, they benefit from a tax treaty in place between Dublin and Washington. When trading US shares in Ireland-domiciled funds, the tax on dividends is 15% compared to the standard rate of 30% for the rest of Europe. This will boost the performance of the two ETFs.

Conclusion

SKYY offers investors exposure to companies further down the market cap and offers a small portion of Asian exposure while FSKY is a pure US play. FSKY has delivered slightly stronger performance since the turn of the year.

Overall, there is an issue with the current cloud computing universe from an investment perspective. Many of the big tech names such as Amazon and Microsoft are leading the charge meaning there is a danger investors could become doubly exposed to these names if, for example, they hold an S&P 500 ETF.

It is important investors make sure their exposure does not become too correlated when investing in thematic ETFs because, although the theme may have long term prospects, they may end up having their fingers burnt in the short term.