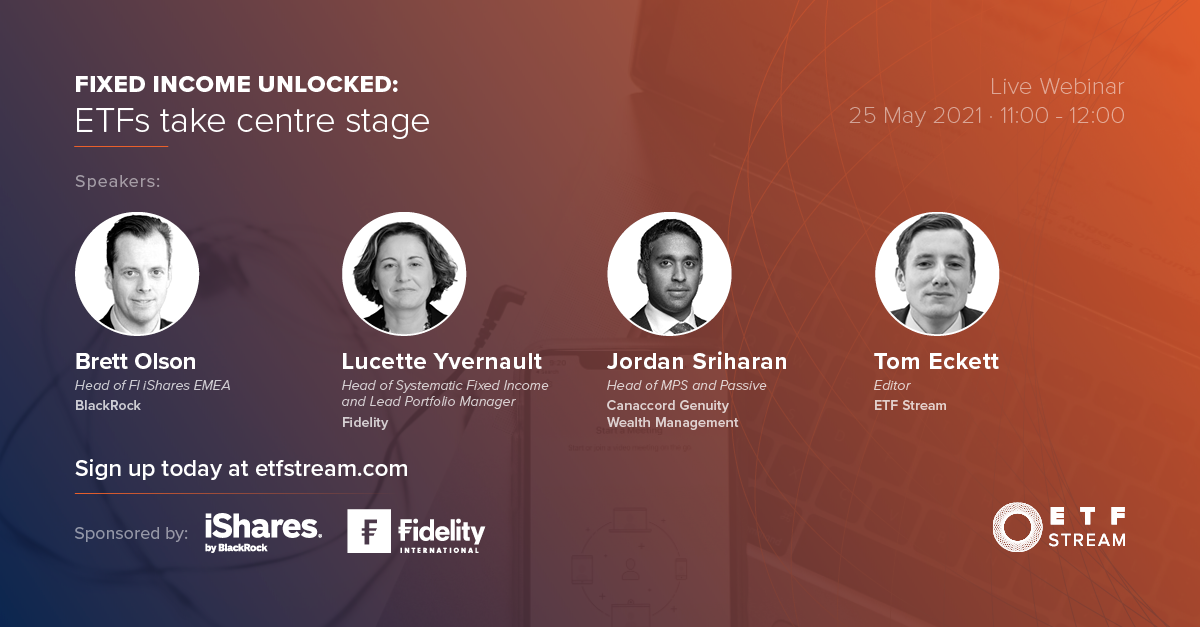

ETFs weathering volatility, green debt and opportunity in emerging markets were some of the main talking points during ETF Stream’s webinar on fixed income ETFs.

The webinar, titledFixed income unlocked: ETFs take centre stage, started by looking at the evolution of bond ETFs and their resilience during COVID-19 disruption.

With last year’s black swan event creating the kind of volatility not seen since the Global Financial Crash in 2008, fixed income ETFs passed the period of rapidly vanishing liquidity with flying colours by providing levels of transparency not seen before in the opaque bond market.

Dealing with uncertainty

The rise of the bond ETF market in recent years has provided investors with the building blocks to not only weather the storm but also seek alpha.

Jordan Sriharan, head of MPS and passive at Canaccord Genuity Wealth Management, said this active approach to profit-seeking during yield cycles is a development that would not have been possible five years ago, and has been facilitated by the widening range of products on offer.

“Now you can invest in short durations, break-evens and ETFs with short interest rates element to them,” Sriharan said.

Brett Olson, head of iShares fixed income ETFs EMEA at BlackRock, agreed, adding that as the fixed income ETF market matures, their uses will become increasingly diverse.

Olson said: “We see many use cases for fixed income ETFs: strategic asset allocation, tactical allocation, liquidity management, hedging and as a cash continuum.”

ETF creation and redemption baskets have been a key topic this year following a report from the Bank for International Settlements (BIS), which stated fixed income ETFs can act as a shock absorber by offloading illiquid securities onto authorised participants during periods of market stress.

However, Olson commented on a recently released BlackRock report which found redemption baskets evolved as outflows "intensified” in February and March 2020 but they continued to match the risk characteristics of the underlying ETFs.

BlackRock hits back at questions over ETF redemption process

“A robust and durable primary process and resilient infrastructure are both necessary for the bond ETF ecosystem and underlying bond markets,” Olson continued. “In 2020, the primary market process functioned throughout and in Q1 in particular – despite the levels of market stress – and this allowed for orderly redemptions.”

Defining fixed income and ESG

Another area of contention is the challenge of defining environmental, social and governance (ESG) standards within fixed income ETFs, with the debate particularly focused on sovereign debt.

On this, Lucette Yvernault, head of systematic fixed income and lead portfolio manager at Fidelity, said: “For sovereigns, ESG data is a little bit more patchy and not as in-depth as our analysis for corporations.

“We also have to look at how countries’ policy on energy has been evolving,” Yvernault added. “If you look at wind power and solar, for instance, a lot of this is sponsored by local sovereigns.”

The difficulty comes with trying to reconcile progressive emissions policy and green energy transitions with countries’ day-to-day activities, which for regions such as Germany and the US include coal and oil extraction, respectively.

One avenue investors might explore for green sovereigns, according to Sriharan, is on sustainable development bank bonds.

“Where we do have some exposure on the sovereign side is on World Bank bonds, we are also interested in green gov bonds used to fund sustainable projects,” Sriharan said.

Amundi’s Guignard: Fixed income ESG ETF boom still in its infancy

Fixed income ETF participants are also watching the impact of regulatory shifts such as the Sustainable Finance Disclosure Regulation (SFDR), with Sriharan stating the initiative has helped aggregate who is doing ESG properly but wonders how many bond products will comply with the most stringent SFDR standards.

Sriharan said: “The challenge that I see for fixed income ETFs is that: will they really be able to achieve SFDR nine status if they are still using generically filtered approach?”

Emerging market opportunities

Panellists also considered the rise of emerging market debt opportunities, with China government ETFs pulling in€2.9bn new assets during the first three months of 2021 alone, according to data from Morningstar.

Investors flee to China bond ETF amid inflationary storm

“We could be in this regime of low yield for quite a long time,” Yvernault said. “You definitely want a well-diversified basket to best respond.”

Olson added investors are looking for yield, leading more to look at IG, HY and EM, including China.

“Not only are investors looking for yield but they’re looking for assets that are less correlated to their equity investments, and this has been a core driver of flows into China,” he noted.

To watch the full webinar, click here.