Fund selectors are bemoaning the lack of fixed income ETFs as they look to adopt more granular exposures across government and corporate bonds, according to an ETF Stream survey of its ETF Buyers Club.

The survey, titled Quarterly Buyer Barometer, found 36% of respondents highlighted a “limited range of products” as the biggest challenge when investing in fixed income ETFs.

Meanwhile, 28% of respondents pointed to index construction as a challenge of fixed income ETF investing while just 13% highlighted liquidity.

Fixed income is a key area where fund selectors have been allocating to over the past six months as highlighted by the record $55bn inflows in 2023, according to data from ETFbook.

Despite the strong adoption, respondents pointed to “high yield”, “fixed maturity bonds” and “more granular options across credit” as areas of potential fixed income ETF product development.

One ETF Buyers Club member said: “I would like to see further ETF product development in the realm of fixed maturity bond ETFs. These products can provide investors with a defined income and the return profile is similar to holding individual bonds.”

Each quarter, ETF Stream surveys its ETF Buyers Club – a group of European professional investors with approximately $100bn ETF assets under management – to analyse their latest views on asset allocation.

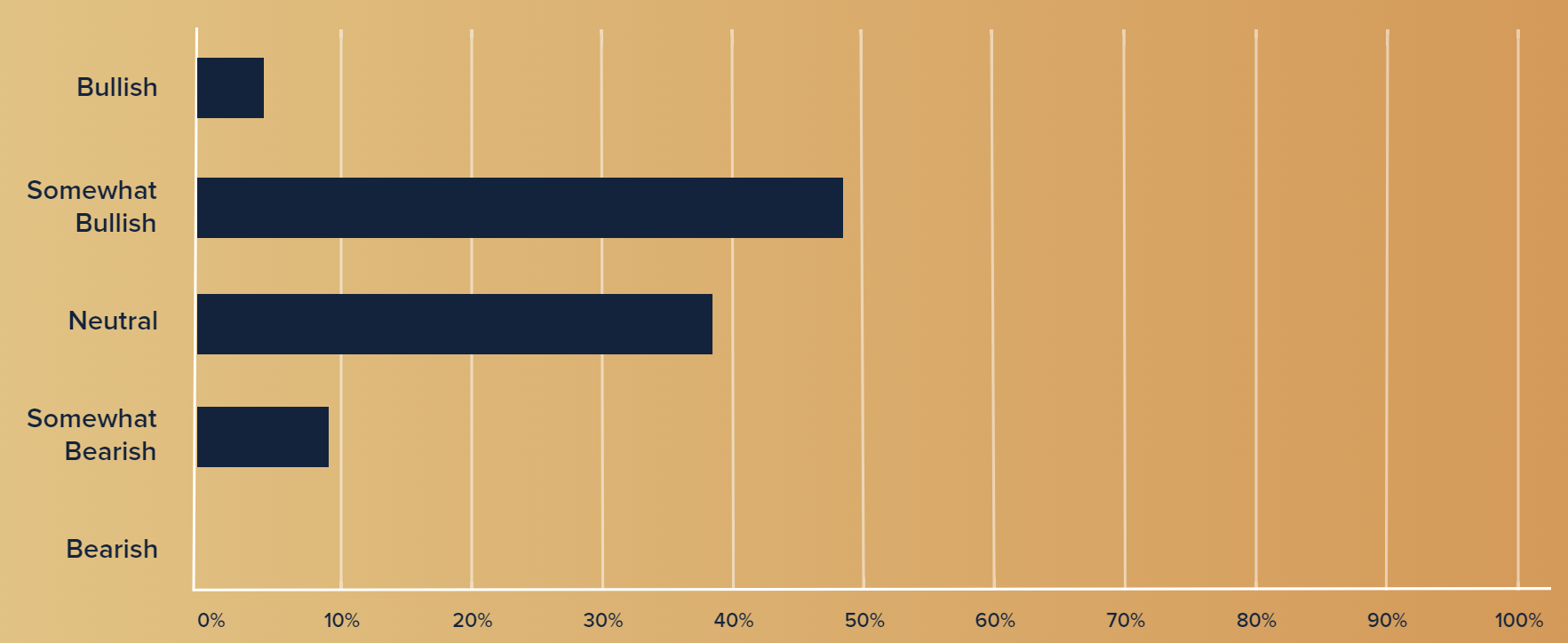

Overall, 86% of respondents said they are either “somewhat bullish” or “neutral”, highlighting market risks to both the upside and downside for fund selectors, while 5% stated they were “bullish” and 9% said “somewhat bearish”.

Chart 1: What is your current market sentiment?

Source: ETF Stream

In particular, government bonds (56%) were the most popular area where respondents increased their exposure over the past six months, followed by core equities (49%) and thematics (41%).

Core equities remain the most popular allocation for ETF investors, with the iShares Core S&P 500 UCITS ETF (CSPX) attracting $4.7bn inflows in Q1, the most across all European-listed ETFs.

Within core equities, respondents are most bullish about the US (54%) over the next six months, followed by emerging markets (22%) and Europe (20%).

High yield (23%) and emerging market equities (25%) are the areas where respondents have reduced their exposure over the past six months as fund selectors start to reduce their risk.

Interestingly, 8% of respondents have increased their exposure to cryptocurrencies over the past six months while the remainder of fund selectors surveyed still have no exposure.

To view the full Quarterly Buyer Barometer Q1 2024 report, click here