Financial markets are playing an important part in meeting global environmental and social challenges, thanks to support from governments and central banks combined with innovation and demand from the broader investment community. Green, social and sustainability (GSS) bonds – debt instruments issued to fund environmentally and/or socially beneficial projects – have a unique role because they directly link government and corporate efforts to fund sustainable activities and public interest in investing in a more sustainable future.

While the market for GSS bonds has boomed, global enforcement of standards is still lacking. Active management backed by deep research resources will be key to avoiding greenwashing and regulatory risks.

Size up the market

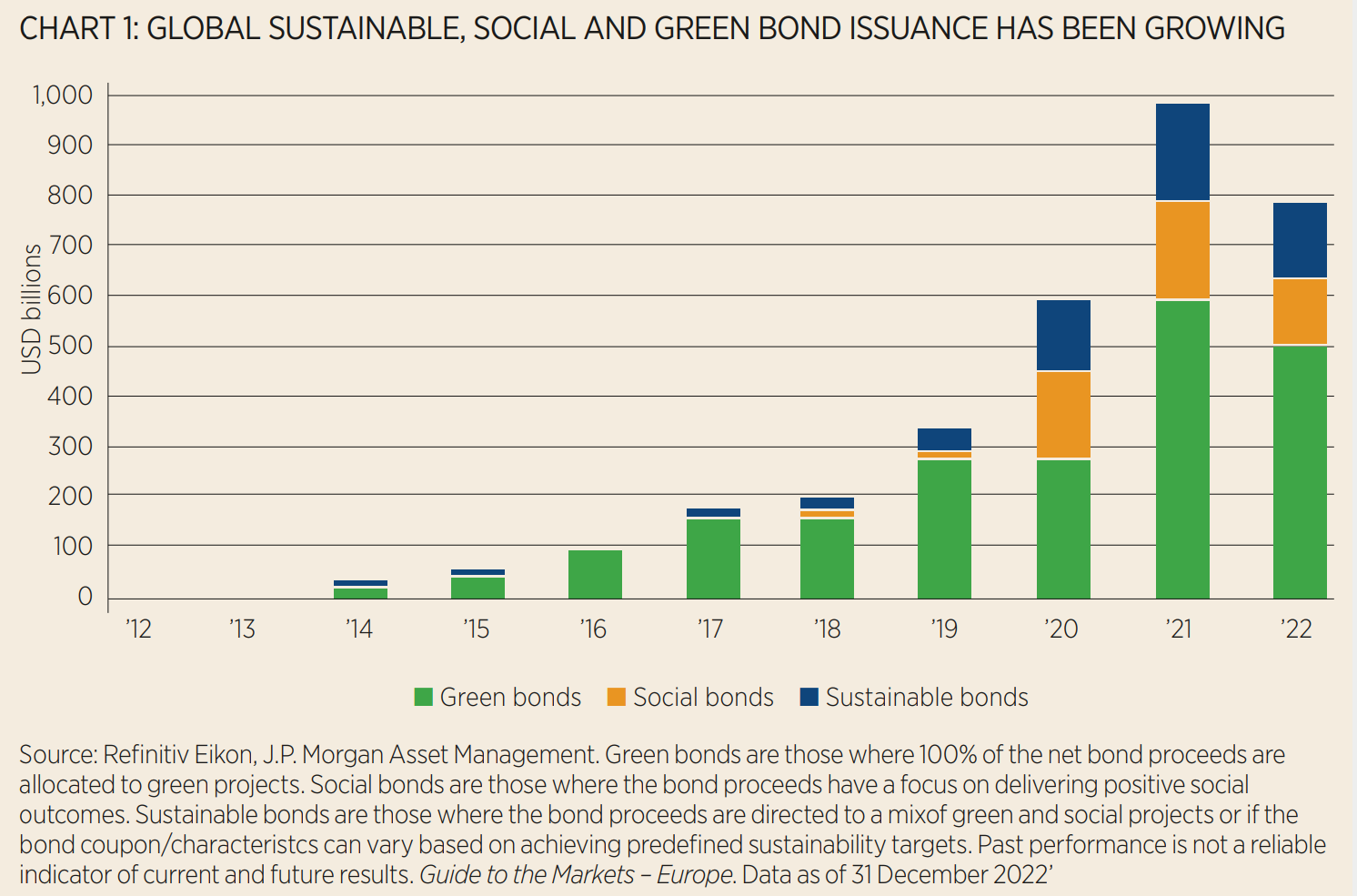

GSS bond have proven popular with both issuers and investors, leading to a significantly bigger, broader and more diverse market. Annual green bond issuance almost tripled from 2017 to 2021 and social bond issuance is now growing at a similarly rapid pace, increasing over 500% in 2020.1 As a result, total GSS debt stands at roughly $2.6trn (see Chart 1).2

This growth in market size is one piece of good news for investors; they can also cheer the increasing diversification of the GSS market, particularly by issuer type. For example, while the private sector still dominates green bond issuance, the growth in social and sustainability bonds is being fueled by governmental bodies and supranational issuers. With robust investor demand for GSS bonds and further plans from issuers to finance sustainable initiatives, these issuance trends look set to continue.

Actively assess the ‘greenium’

Due to strong demand, GSS bonds tend to trade at a premium – often known as the “greenium” – to non-green bonds, resulting in a lower yield. The greenium may vary by sector, credit rating and geography, as well as sensitivity to broader market liquidity conditions.

For investors, it is important to look at the greenium in context. It is a function of strong demand, which means it also provides technical support for GSS bond prices. The strong demand could also lead to increased issuance because the cost of capital is lower for GSS issuers, creating a positive feedback loop that helps further grow and diversify the market.

Critically, as the GSS market expands, premiums are increasingly differentiated. For example, social bonds appear to command a smaller premium than green bonds, while high yield and emerging market GSS bonds will trade at a discount to their investment grade counterparts.

The greenium, therefore, presents an advantage for active managers who can look across the entire spectrum of GSS bonds and may be able to find opportunities through a strong understanding of the technical factors related to demand and the drivers of relative valuations across sectors.

Guard against ‘greenwashing’

The potential for greenwashing demands active management in GSS portfolios. Given the investor interest in GSS bonds and greenium’s effect of lowering the cost of capital, issuers may have financial incentives to raise capital with GSS bonds. But definitions of and standards for sustainability may vary because issuers are not required to adhere to any one specific framework. The Green, Social and Sustainability Bond Principles from the International Capital Markets Association and the forthcoming EU Green Bond Standard are respected efforts, but they are voluntary for issuers.

As a result, GSS bonds may not necessarily meet requirements to qualify for inclusion in some of the more prominent regulatory frameworks, such as an Article 9 classification under the EU’s Sustainable Finance Disclosure Regulation (SFDR). To meet this criteria, an issuer must have good governance and do no significant harm toward any EU Taxonomy objective. Yet these factors are not explicitly accounted for in international GSS bond frameworks or benchmarks. Instead, since investors must take on the risk of making these judgements; active management becomes essential.

Wrap GSS bonds in an active ETF

For investors interested in supporting sustainable initiatives through GSS bonds, an active ETF is a practical and efficient way to gain broad exposure to the asset class. In addition to being transparent, liquid and easy to trade, active GSS ETFs benefit from fixed income and sustainability insights from analysts and portfolio managers and can invest across the full range of GSS bonds.

GSS bonds offer investors a unique opportunity to support environmental, social and sustainable initiatives. An active ETF from an experienced provider is an efficient way to gain exposure to the wide range of securities in this rapidly expanding asset class.

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full article, click here.

1 Refinitiv Eikon, J.P. Morgan Asset Management 2 HSBC Global Research, Green Bond Insights, 30 September 2022.

Find out more at:

am.jpmorgan.com/ch/etf am.jpmorgan.com/de/etf am.jpmorgan.com/fr/etf am.jpmorgan.com/it/etf am.jpmorgan.com/nl/etf am.jpmorgan.com/uk/etf or on your J.P. Morgan Asset Management country website

For Professional Clients / Qualified Investors only – not for Retail use or distribution.

This is a marketing communication and as such the views contained herein are not to be taken as advice or a recommendation. The value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l. and in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. 0925231403131516