Gold’s surge to an all-time-high in May was short-lived as a buying pause by China’s central bank and resilient US jobs market data has since pushed its price down 5.7%.

Even while shy of the $2,450 peak hit last month, gold has still shot up 12.1% since the start of the year after the People’s Bank of China (PBoC) spent 18 months adding to its reserves of the precious metal.

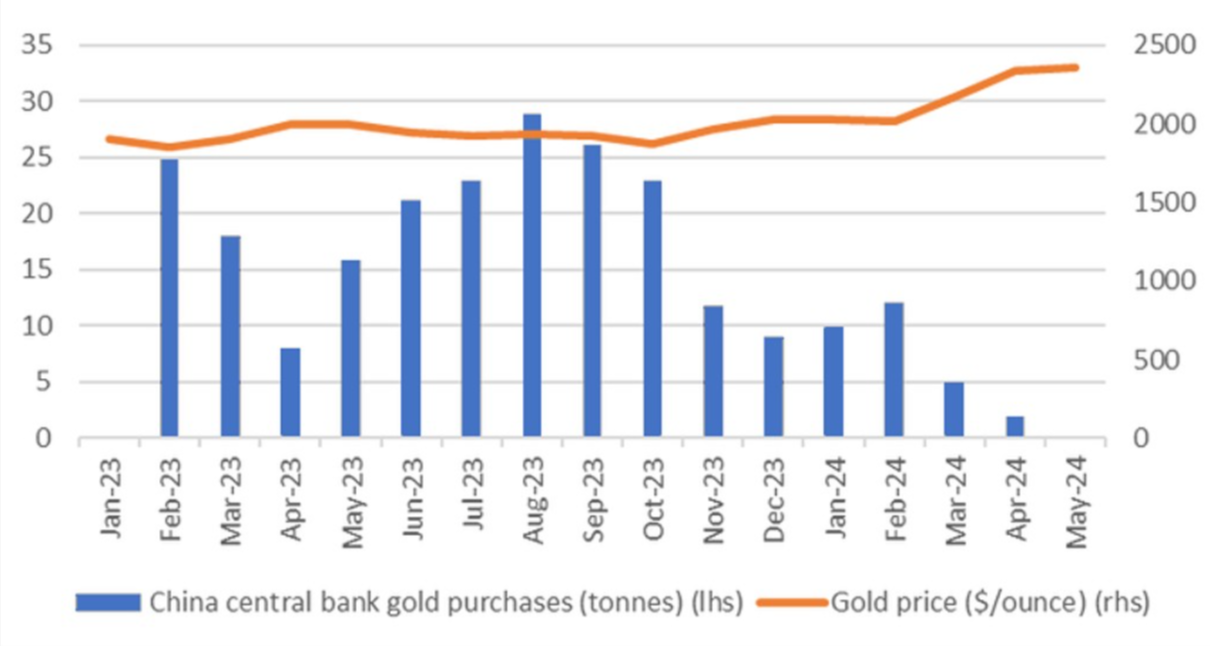

Data from CN Wire and Bloomberg last week revealed the central bank’s gold holdings remained unchanged at 72.8 million troy ounces in May marking the first time the policymaker has left its gold reserves unchanged since October 2022.

Chart 1: PBOC gold buying

Source: CN Wire, Syz Group

“Gold demand from central banks posted its strongest start to any year on record in the first quarter, with China being the biggest buyer,” said Ewa Manthey, commodities strategist at ING.

“Gold tends to become more attractive in times of instability when investors pile into safe-haven assets as a hedge against the economic climate, geopolitical tensions or inflation.”

China gradually decreased its gold buying activity each month through H1, having added 390,000 ounces in February, 160,000 ounces in March and 60,000 ounces in April, prior to the May pause.

While the Sino pause may only be a tactical decision to wait for prices to moderate, the Federal Reserve is also putting a dent in the yellow metal’s price outlook.

The recent US jobs report noted 272,000 jobs were added in May, considerably ahead of consensus expectations and in turn reducing pressure of the Fed to begin cutting its headline interest rate in the near-term.

With the Federal Open Market Committee (FOMC) choosing to keep rates unchanged on Wednesday – and the CME Fedwatch pricing the same outcome at the FOMC July meeting with 91.7% probability – this creates a supportive outlook for the US dollar and headwinds for non-interest-paying assets such as gold.

“With inflation having remained sticky and the latest jobs numbers beating all expectations, our US economist expects the Fed to push their projections for rate cuts back, so they end up with two cuts in 2024 and four in 2025 instead of three and three,” Manthey continued.

“If the Fed continues its cautious approach to easing, gold prices risk a pullback. We expect gold prices to remain volatile in the coming months as the market reacts to macro drivers, tracking geopolitical events and Fed rate policy.”

The climbdown in gold’s outlook is unfortunate timing for ETF issuers, given gold exchange-traded products (ETPs) globally ended a 12-month outflow streak in May.

Gold ETPs welcomed $529m new assets, taking total physical gold housed in the strategies to $234bn, according to data from the World Gold Council.

However, further moderation in the precious metal’s price may present an entry point for investors to exploit through ETPs.