Government bond and US treasury ETFs are popular among investors who are looking for safe and predictable performances as it is highly

unlikely the government would ever default

on a bond it issued however, performances have dipped in October and November following geopolitical uncertainty.

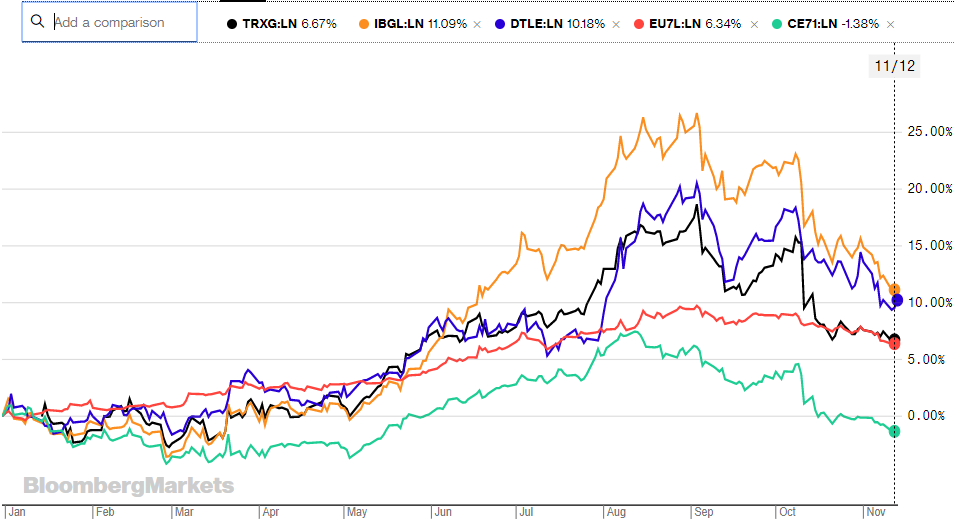

Since mid-October, the iShares Euro Government Bond 15-30yr UCITS ETF (IBGL) has had a continuous negative performance, with its net asset value falling 5.9% in the space of a month.

This trend was in tandem with equity markets rallying following the news of the UK’s Prime Minister Boris Johnson agreeing a Brexit deal with the European Union which was later to be rejected by Parliament.

IBGL's slide has come after a significantly strong performance in Q2 and Q3 having climbed 22.5% over the course of the two quarters. Year-to-date, returns are down to 11.9%.

In tandem with Brexit negotiations, the US's trade discussions with China and Europe has impacted treasury bond ETF performance.

The iShares USD Treasury Bond 20+yr UCITS ETF (DTLE), similarly to IBGL, has fallen 3.9% over the last month following rallying performances in Q2 and Q3. Between April and October, DTLE had risen 13.4% and has a YTD return of 11.6%.

It has not just been bond ETFs with long maturities that have suffered a loss in the last month. The SPDR Bloomberg Barclays 7-10 Year Euro Government Bond UCITS ETF (EU7L) has fallen 1.7% as well as the iShares EUR Government Bond 3-7yr UCITS ETF (CE71) falling 3% and the Invesco US Treasury 7-10 Year UCITS ETF (TRXG) falling 3.6%.

YTD Performance – Source: Bloomberg

Amid the rallying performances earlier this year, a number of issuers have launched bond ETFs such as Invesco with five euro government bond ETFs and BlackRock launching a US treasury bond ETF.