In the land of passive investing, all ETFs are equal. But some are more equal than others.

Most investors tossing up which ETF to buy think two things. That two ETFs tracking the same index should perform the same, even if they have different issuers. And it is impossible for ETFs to beat their benchmark, if only because of fees.

But this is wrong, says TrackInsight, a French ETF data provider.

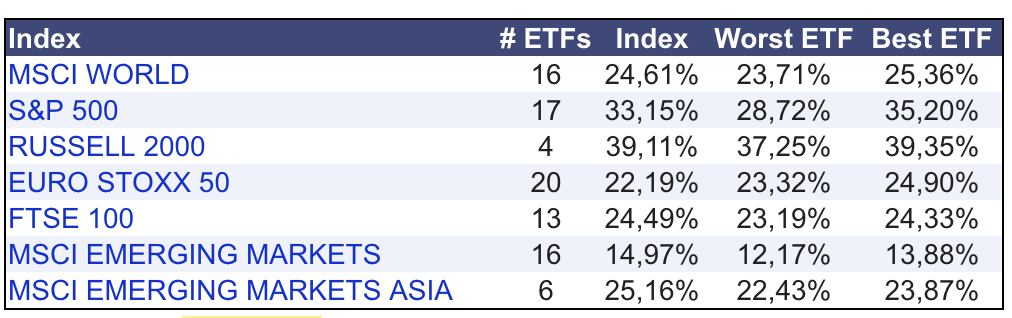

There are big differences between how well different ETFs can track an index. Some ETFs can beat their index; others fall several points below it. The difference between the best and worst S&P 500 trackers is over 6% on 3 years cumulative returns.

"We see discrepancies between different ETFs due to the different ways they are managed - especially their dividends," said Julien Scatena, head of platform at TrackInsight.

"Some ETFs are even able to outperform their own benchmark partly thanks to the dividend reintegration."

Aside from different fees - an obvious drag on performance - ETFs replicate indexes with different dividend policies.

These dividend policies can mesh with different countries' tax laws and cause performance to diverge, sometimes heavily.

"Most of the major plain vanilla indexes, [in the table above] use a net total return policy - with the exception of the FTSE Russell 100," Mr Scatena said.

"This means the indexes take into consideration the dividend tax investors are going to face. So they only reintegrate a part of what dividends get paid out. ETF managers, by locating the funds in a country where the taxes on dividends are interesting, can reintegrate more than the index."

And this tax reintegration, it turns out, is one of the main way ETFs can beat their benchmarks.

Discrepancies can also come from more familiar places, such as replication method. Synthetic ETFs, which use swaps provided by major investment banks, can perfectly track their indexes (minus fees). Besides the extra cost due to the swaps, synthetic ETFs also have to deal with an additional counterparty risk compared to physical ETFs.

But for physical ETFs, it's not so easy. Sometimes, especially when tracking bigger indexes like the Russell 2000, they only buy a "sample" of the shares in the index. This means replication cannot be the same as the index.

Another source of divergence is securities lending, where physical ETF issuers lend out the securities they hold to short sellers for a small fee. Different ETF issuers have different policies on this, but some chose to give the profits from securities lending back to investors. Others, however, do not.