The proliferation of ETFs has given retail investors unprecedented access to liquid, low-cost, broadly diversified portfolios. This is brilliant and we can thank Jack Bogle and his partners for launching the original index fund, which later was the inspiration for the first ETFs. But where there is a great innovation, you can be sure there will also be a marketer who will exploit it and ruin it for investors.

I am talking of course about inverse and leveraged ETFs and other complex products that have no role to play in a portfolio except to make short-term bets. If you think these products do not ruin it for investors, let me give you some data.

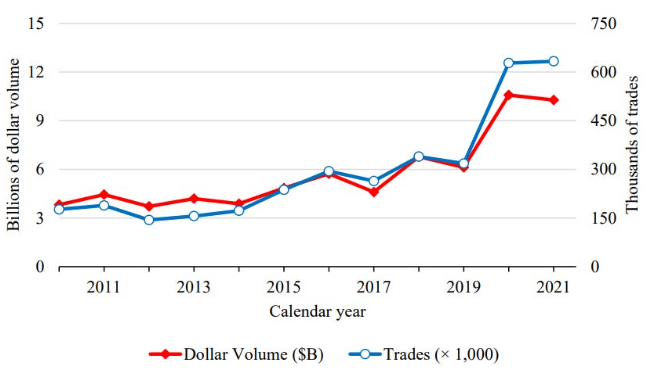

David Gempesaw and his colleagues examined literally every ETF trade made on a US stock exchange between 2010 to 2022 – talk about a big data exercise. In these 12 years, retail investor trading volume more than doubled to $5.8bn per day. This compares to $52.4bn daily trading volume for non-retail trades.

The market share of retail investors is thus 10%. Not too high, but still a force to reckon with.

Chart 1: The growth of retail investors in the ETF market

Source: Gempesaw et al. (2023)

But how do retail investors invest in ETFs? Is there any difference between them and professional investors?

On the one hand, retail investors tend to hold their ETFs longer than professional investors, something that can be explained by the fact that among professional investors a lot of the trading activity is driven by hedge funds and asset managers using ETFs for tactical trades.

Retail ETF investors are not day traders. Most of the ETFs they buy remain in their portfolio for more than a quarter – the longest time period the researchers examined.

But when it comes to the average performance achieved by retail traders, the picture looks much bleaker. Mind you, the average performance for retail investors in core equity ETFs is about the same as for professional investors. Over a quarter, retail investors trail the professionals by 0.22%.

But look at complex ETFs like leveraged and inverse ETFs and you feel the urge to rip your hair out.

First, retail investors hold leveraged and inverse ETF longer than professionals. That is a problem because by the very nature off their construction, if an investor holds them for more than a day, they no longer track the performance of the underlying asset in the way they claim.

The longer an investor holds onto these investments, the larger the performance gap becomes.

The result of retail investors using these complex ETFs inappropriately is that on average they underperform the professionals by 3.8% per quarter for leveraged ETFs and 4.2% per quarter for inverse ETFs. That is about 15% of underperformance annualised.

Now add to that the fact that retail investors use leveraged and inverse ETF far more frequently than professionals and you can explain why they underperform so badly. The share of volume in leveraged ETFs for retail investors is 6.9% higher than the share for professional investors.

In fact, among retail investors, 12.4% of all trades are in leveraged ETFs. Among professional investors, only 5.5% of all trades are in leveraged ETFs. That is 6.9% of excess volume among retail investors. Similarly, retail investors have 5% excess volume in inverse ETF.

Overall, 21.2% of all retail ETF trades are in leveraged or inverse ETF. This compares to 28.6% of all trades that are in core equity ETFs.

Retail investors trade in leveraged and inverse ETFs almost as often as they do in core equity ETFs and that is where the problem lies. Retail investors gamble too much with ETFs.

Joachim Klement is investment strategist at Liberum Capital and author of the Klement on Investing blog