The acceleration of interest in low-cost ETFs looks all but guaranteed going by the evidence from the Deutsche Bank Institutional ETF Ownership guide released late last week.

The general trend of increased institutional ownership of ETFs in the US has been confirmed by the 2019 survey. Looking at the data from last year, the report analysed the holdings of 4.318 investment advisers, private banks and wealth managers, hedge funds, mutual funds and pensions.

It found that institutional ownership of ETFs now totals $2.1trn or 64% of ETF assets. This is a four-fold increase within the past five years. Equities represented $1.7trn, fixed income at $460bn and a further $26bn in commodities.

Yet it would appear this four-fold increase in the past five years has been driven by a tenfold increase in interest in low-cost ETFs over the past decade.

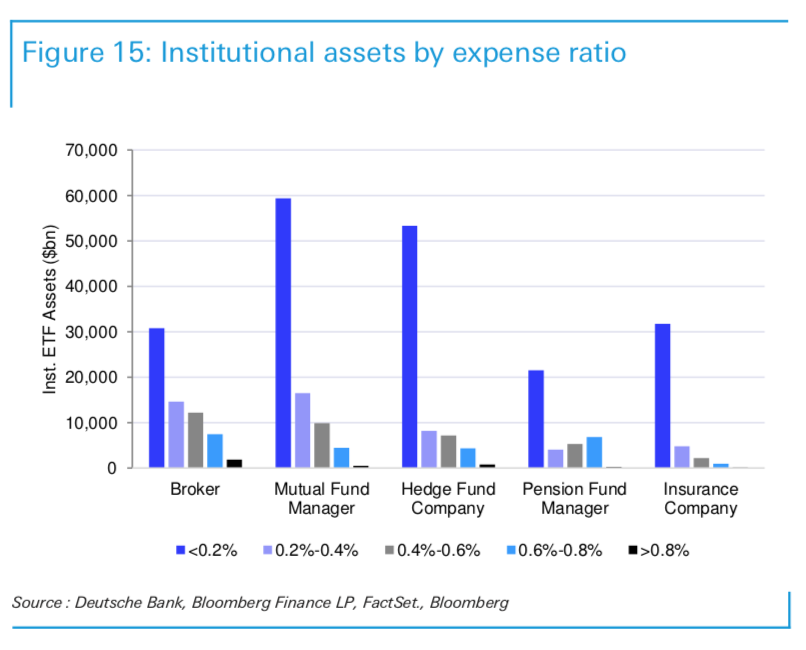

The Deutsche Bank team of Chin Okoro and Hallie Martin identifies investment in low-cost ETFs options as the reason for the increased institutional investment and likely a major driver of further fee compression. The report shows that allocations to low-cost ETFs rose 4% or $146bn in 2018 to $1.4trn or 64% of total institutional ETF assets.

“We believe that institutions will continue to play a vital role in the acceleration of the low fee trend,” says the Deutsche Bank US delta-1 strategy team. “Putting the demand for low fees in perspective, institutions have increased ownership of low fee ETF assets by tenfold over the last decade, compared to a fourfold increase in ownership of higher priced funds (60bps – 80bps).”

The Deutsche Bank report points to the secular drivers for investment advisers to be leading the low-cost charge. “With a shift away from the fee-based business model, investment advisers have a renewed focus on cost mitigation in the investment process,” says the team.

As a group, investment advisers increased assets in low-cost ETFs by $125bn, comprising the majority of institutional ownership in this category. The Deutsche bank team note the percentage of investment adviser money in low-cost ETFs rose from 63% to 65% in 2018. Breaking down the investment adviser section, Deutsche Bank said the notable rises came from mutual funds (up by $15bn) and hedge funds (up $27bn).

If low-cost ETFs are a major driver then it is fair to say the attractions are bringing in even more institutions to ETF ownership. In fact, 2018 saw a record number of institutions using ETFs with the largest year-on-year increase in numbers (up over 900).

Again, investment advisers were at the forefront of the change with ownership of ETFs among this cohort rising 4 percentage points to 41% or $1.3trn. The analysts posited that the changing market dynamics of 2018 were a major cause of the increased ETF ownership.

But low-cost wasn’t the only important factor helping to entice this increase in adviser ETF ownership. The market volatility in 2018 was the cause of a broad repositioning of portfolios, and ETFs were seen as one route to taken by institutional investors seeking what Deutsche Bank suggests were “non-traditional means of portfolio protection and alpha generation.”

Cue smart beta and what the Deutsche Bank team says was “increased usage of ETFs for factor overlays for risk mitigation functions.”

“Within Smart Beta, institutions incorporated factor exposures to better position for prevailing market conditions,” they added, pointing out that in 2018 single-factor ETFs were 16% of total institutional ETF assets.

“Low volatility, growth, and momentum were among the top themes sought by major institutions last year through ETFs,” the report states. “Across the top-three factor themes, institutional investors increased ETF asset share by half a percentage point to $145bn (7% of total institutional ETF assets).”

Liquidity and ETFs

Then there is the issue of liquidity. Deutsche Bank suggests the market volatility had another effect on the ETF landscape as institutions turned to ETFs for liquidity. Citing trading volumes that rose 59% year-on-year (and totalling $27trn), Deutsche Bank says the market volatility was the “catalyst for various investor groups to re-engage in portfolio hedging and liquidity decisions.”

Notably, the report shows that during the worst of the market uncertainty during the October and December sell-offs, ETFs registered record trading activity versus cash volumes (>43% of total market tape), alluding to increased institutional usage.

This extra liquidity is also flowing through to wider usage of other exchange-traded products. Compared to a decade ago, when over 80% of total trading was accounted for by the top-20 most-traded funds, that percentage now stands at 60%.

“With access to a growing number of funds and improved understanding of the ETF mechanics, institutional investors are trading relatively more funds,” the team write. “In recent years, we saw a growing mixture of fixed income and commodity funds among the most traded ETFs. We see this as a trend that will continue to evolve as the ETF ecosystem continues to mature.”

Later this week, ETF Stream will look into the data from the Deutsche Bank report into institutional ownership by asset class and product categories.