[This is the first article in a series on making value investing work.]

Value investing has been on its back for more than a decade. And value indexes and funds have delivered market-losing returns for so long that many are now wondering if the factor is dead. In this series, we take a look at the value factor and how new research and funds are aiming bring it back to life.

Thomas Cole is the CEO of Distillate Capital, the Chicago-based ETF issuer. The company's first product, which listed this month, is a value ETF: the Distillate US Fundamental Stability & Value ETF (DSTL). Rather than pick companies based on the book-to-market value, DSTL picks value stocks based on free cash flow, low debt and earnings stability. We caught up with Thomas to find out more about how he and Distillate are trying to make value work.

Thomas Cole: Value benchmarks have lagged broader market benchmarks, and many value-oriented managers have struggled to meet their return objectives, so the skepticism is understandable. But there is little discussion as to why value would have stopped working. At its most basic level, the concept of value, whether shopping for groceries or stocks, is that being price conscious or value-aware makes sense. And there is a rich and growing body of work suggesting markets are not perfectly efficient and that people behave irrationally with some regularity. There is nothing to suggest the concept of value should not be working. We see the issue more as one of proper measurement of value. What is being labeled "Value" by the benchmark providers is often defined with accounting concepts that have lost their relevance in our current economy. The measure of Price to Book Value, the metric most often used to define benchmark constituents, makes an apples to oranges comparison between companies that depend more on physical assets and those that derive their value from branding and research & development. The mandated accounting treatments create significant comparability issues. When the economy was largely manufacturing based, Price to Book Value was a viable measure. As our economy has become one dominated by companies that spend their money on research and development, the comparison breaks down. Value as defined by many of the benchmark providers then becomes more a function of physical asset intensity rather than a measure of price to worth. This economic change and the struggle for accounting practices to keep pace have also caused issues for value-oriented managers on Wall Street who continue to rely on traditional accounting-based metrics that are not as comparable as they once were. We drew on our long-term experience as value investors and analysts across sectors to develop a comparison of relative valuation that is rational in today's economy and comparable across all companies, not just ones with physical assets. With this refreshed approach in mind, it is very clear that excess returns to value investors are still available.

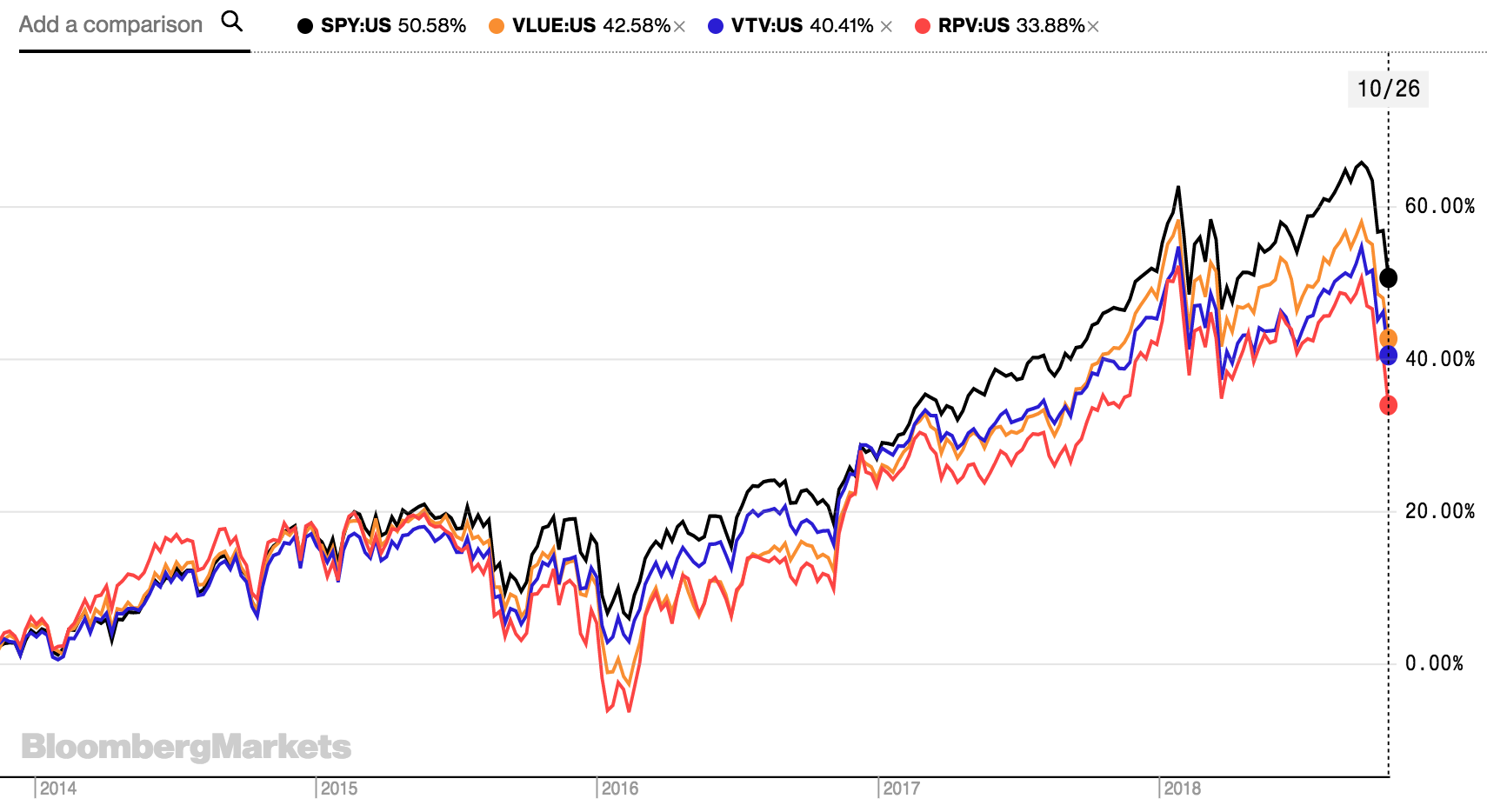

[Over the past 5 years, all the major ETF providers headline value funds have underperformed the index.]

It always has been necessary to understand what is being presented in a company's financial statements. Warren Buffet published a satire that Ben Graham (of Graham and Dodd fame) wrote that made a mockery of how changes only in accounting treatments had materially improved the profitability of U.S. Steel. Graham wrote the piece in 1936! So making sense of what you are given as an analyst to interpret accounting is an old story. Accounting is complicated, ever changing, and the amount of time and energy required to understand it is substantial. By itself though, accounting has not eliminated any premium earned by buying shares correctly. Undoubtedly, some changes in accounting have left some metrics, like Earnings per Share, Return on Assets, Return on Equity, etc., less informative than they perhaps once were, but it is up to the investor to understand what is presented to them and to then make accurate real comparisons. We created a measure of value we refer to as "Distilled Cash Yield". Using this measure, we see that excess returns are available to investors who buy those stocks that rank well and exhibit good risk characteristics.

You've chosen to measure value using free cash flow rather than book-to-market. Why did you choose those metrics?

Given the complications that come with accounting and the significant change that has occurred in our economy, we get back to cash as bedrock. We start with the basic and undeniable fact that the value of any asset is the present value of the cash flow that asset will produce in the future. This is true of real estate, bonds, stocks, any investment. By examining cash flow, we are able to create a measurement that is comparable across our available investment universe, and not get caught in the issues that come with interpreting other metrics where accounting pronouncements create comparability issues and allow for much greater variability in the way profitability is represented. Simply put, cash is king.

How do you avoid the value trap when putting a value fund together?

We do two things that help us to avoid value traps. First, our methodology defines quality and risk somewhat differently than is typical on Wall Street. We consider the though-cycle fundamental stability of a business to be much more important than the short-term price volatility of its shares. Share price volatility is often used as a proxy for risk, and many funds are constructed using that methodology, but for true long-term investors, that measure, to quote Warren Buffet, is "dead wrong". We combine our measure of fundamental stability with a test for balance sheet quality that eliminates from consideration in our index those companies that are heavily indebted. Debt, in the context of value traps, is often a contributing factor. So we end up with a portfolio of very high quality companies.

The other way we avoid value traps is to not let human bias interfere with our methodology. Our process is driven by fundamentals, but it is systematically applied. When the fundamentals change to the negative, and it does happen, we objectively reconsider where an investment stands and sell it if the value opportunity suggests it should no longer be a holding. The human tendencies toward overconfidence, anchoring, and lottery-seeking behavior are not allowed to come into our process and that helps us avoid the value traps typical of value-oriented managers.

Many worry that the ETF industry is getting too crowded in the US. Where do you see the opportunities for a new entrant like Distillate?

We see a large opportunity. Most of the existing products available are market capitalization weighted. Market capitalization weighting was an innovation in 1923, but we think there are more sensible and profitable ways to weight the holdings in a portfolio. Market cap weighted funds, by definition, hold too much of the stocks that are overpriced and too little of what is underpriced. As well, many ETF products are constructed using factors derived from elegant statistical models, but they lack causality and don't always have much intuition behind them. Moreover, these factors may not contain the same meaning that they used to given the economic and accounting changes that have taken place over the last several decades. Because of this, many funds are constructed using accounting metrics that do not really deliver what they intend to deliver, or are branded as low risk or low volatility, but are buying those factors regardless of price, which we see as a big risk.

By contrast, we have a holistic offering that casts aside many of Wall Street's points of focus and conventional wisdom and it stands apart from the current offerings available. Because we can offer the product in an ETF wrapper means that the fees to our clients are low relative to most offerings they have available to them and there is a tremendous tax-advantage for long-term investors over mutual fund or other alternatives.

ETF Stream: Value has been having a hard time the past few years and many now think it's dead. Why do you think this is?Some have speculated that the value premium has disappeared due to changes in accounting practices. Do you think there is any truth to this view?