Invesco’s AT1 bond ETF is turning ‘light green’ after its index added ESG exclusion criteria to its screening process in a bid to meet investor demand.

The Invesco AT1 Capital Bond UCITS ETF (AT1D), which currently tracks the iBoxx USD Contingent Convertible Liquid Developed Market AT1 (8/5% Issuer Cap) index, will now exclude companies that are non-compliant with the United Nations Global Compact Principles.

This includes companies involved in controversial weapons, small arms, military contracting, oil sands, thermal coal, tobacco, cannabis and predatory lending.

AT1D, which currently houses $1.2bn assets under management (AUM), will be labelled Article 8 under the Sustainable Finance Disclosure Regulation (SFDR) following the changes.

The adjustments came after IHS Markit launched a consultation in June to better “reflect the expectations of investors to meet certain ESG standards in their index-driven investments”.

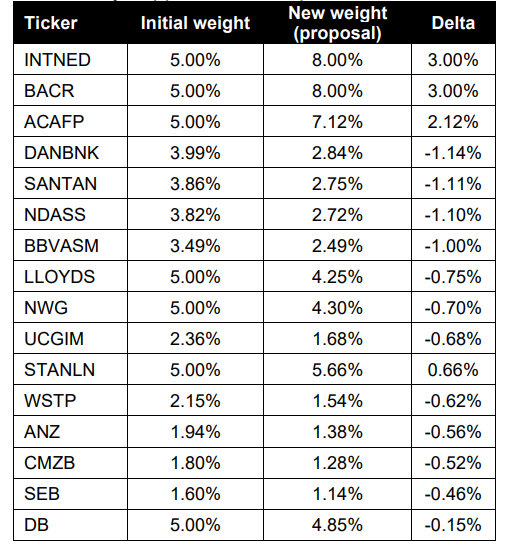

In another change to the index, IHS Markit will remove the 5% issuer cap applying the 8% issuer cap being applied more broadly.

The firm said this was to reduce the transaction costs of the ETF. The index will change its name to reflect the new issuer cap.

Source: IHS Markit

Currently, the index caps the five largest issuers at 8% with the remaining issuers being eligible to be capped at 5%. The capping takes effect when the index has over 17 constituents, presently it has 80.

IHS Market said the top five issuers – BNP Paribas, UBS, HSBC, Société Générale and Credit Suisse – which are already capped at 5%, will not be affected.

ADT1, which measures the performance of financial institutions’ AT1 convertible debt, has returned -8% year to date.

Related articles